- United States

- /

- Metals and Mining

- /

- NasdaqGS:METC

Ramaco Resources, Inc. (NASDAQ:METC) Stocks Shoot Up 31% But Its P/S Still Looks Reasonable

Ramaco Resources, Inc. (NASDAQ:METC) shares have continued their recent momentum with a 31% gain in the last month alone. The annual gain comes to 113% following the latest surge, making investors sit up and take notice.

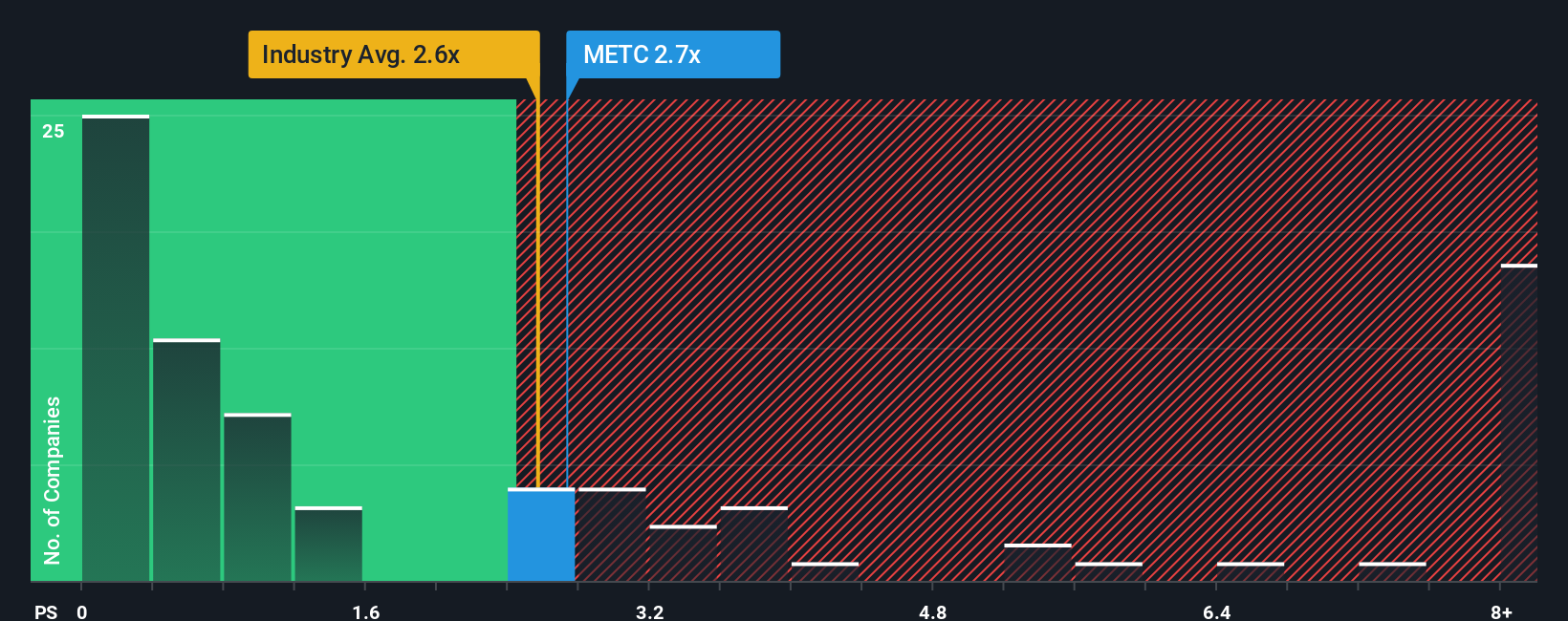

Even after such a large jump in price, it's still not a stretch to say that Ramaco Resources' price-to-sales (or "P/S") ratio of 2.7x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in the United States, where the median P/S ratio is around 2.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Ramaco Resources

What Does Ramaco Resources' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Ramaco Resources' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ramaco Resources.Do Revenue Forecasts Match The P/S Ratio?

Ramaco Resources' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 37% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the three analysts watching the company. That's shaping up to be similar to the 13% each year growth forecast for the broader industry.

With this information, we can see why Ramaco Resources is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Ramaco Resources' P/S Mean For Investors?

Ramaco Resources appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Ramaco Resources' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Metals and Mining industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Ramaco Resources (at least 1 which makes us a bit uncomfortable), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:METC

Ramaco Resources

Engages in the development, operation, and sale of metallurgical coal.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.