- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Linde (LIN): Assessing Valuation as New Tennessee Facility Expands Regional Growth Reach

Reviewed by Kshitija Bhandaru

Linde (LIN) has brought a new air separation unit online in eastern Tennessee, supplying liquid oxygen, nitrogen and argon to a wider customer base across the Interstate 75 corridor. This operational move positions the company to support ongoing growth in the region and offers insights into its evolving footprint.

See our latest analysis for Linde.

Linde’s expansion in Tennessee comes as the stock rides a wave of medium-term momentum. While the YTD share price return stands at 10.9%, the one-year total shareholder return is down 3.2%. This suggests that longer-term holders have seen outsized gains, but recent performance has tempered. Notably, the solid three- and five-year total shareholder returns of nearly 68% and 111% highlight the company’s robust track record and resilience, even as short-term price movements have cooled a bit this quarter.

If this operational update has you thinking about what's next in the broader market, take a moment to discover fast growing stocks with high insider ownership

But with Linde’s fundamentals and recent expansion in mind, does this moment mark a genuine buying opportunity? Or has the market already factored in the company’s future growth potential?

Most Popular Narrative: 10.1% Undervalued

With Linde's consensus fair value set at $511, the latest closing price at $459.25 puts the stock at a notable discount according to the prevailing expert narrative. This gap has fueled talk that the company's future earnings power and strategic expansion could be more potent than the market currently reflects.

Strategic investments and customer commitments in rapidly expanding growth markets such as commercial space launches, electronics, and clean hydrogen (with almost $5 billion in new clean energy contracts) provide a runway for high-margin revenue streams and new project conversion that will structurally lift blended margins and earnings.

Curious about the math behind the optimism? This narrative leans heavily on bold projections for both earnings and profit margins, pointing toward a future margin profile few peers can match. Wonder what underpins analysts’ conviction and how assumptions about contract growth and margin expansion shape that headline price target? Dive into the details. These are the numbers that could change the game.

Result: Fair Value of $511 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic weakness in Europe and oversupply pressures in certain industrial gases could pose challenges to revenue growth and future profitability for Linde.

Find out about the key risks to this Linde narrative.

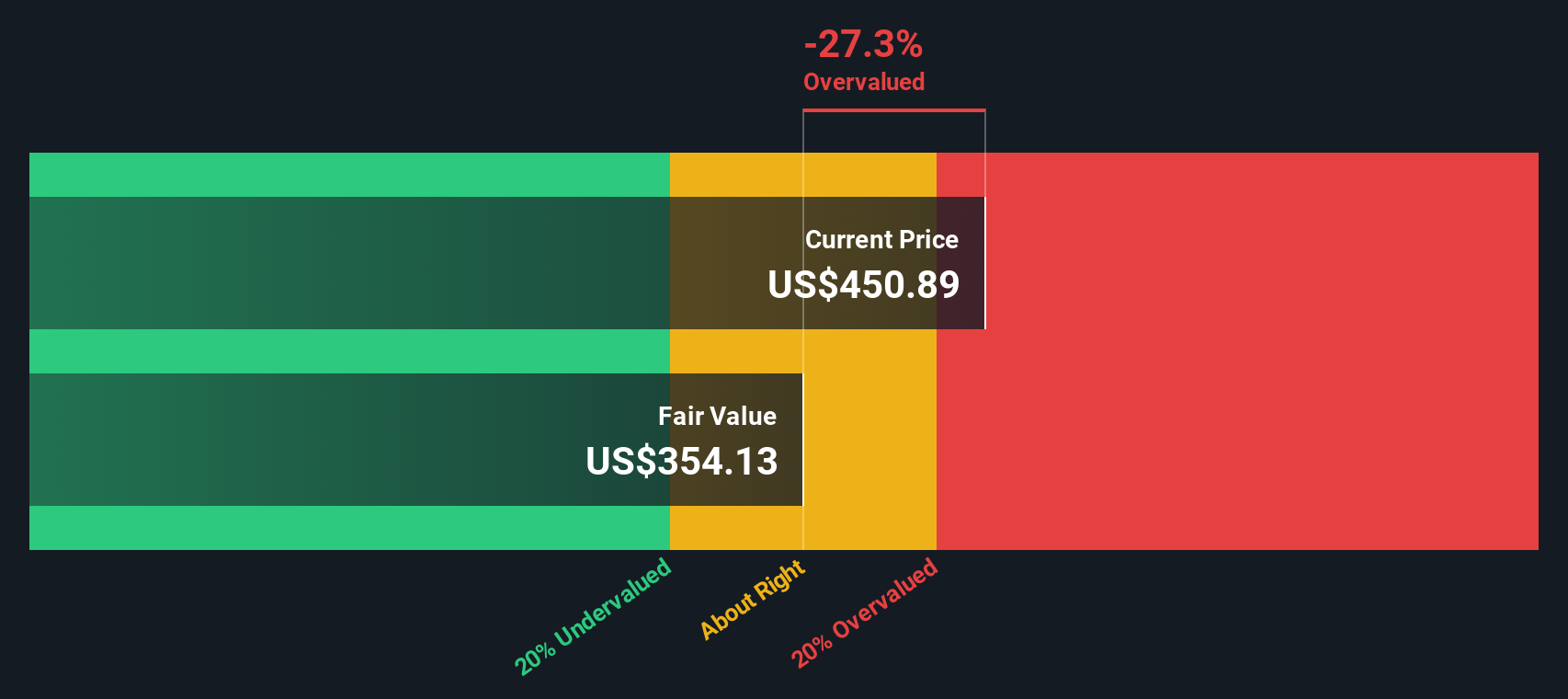

Another View: DCF Model Challenges the Consensus

While analysts set Linde’s fair value at $511 based on future earnings growth, our DCF model suggests a more cautious stance. According to this approach, the current share price of $459.25 actually sits above the estimated fair value of $354.48. This implies the stock may be overvalued if cash flows play out less optimistically.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Linde for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Linde Narrative

If you see the numbers differently or would rather draw your own conclusions, you can craft a personal take on Linde’s outlook in just a few minutes using our tools. Do it your way.

A great starting point for your Linde research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give your portfolio a fresh edge with unique stock picks you might have missed. The right screener can put powerful trends and hidden gems at your fingertips and help you act before the market catches on.

- Tap into higher yields by zeroing in on these 18 dividend stocks with yields > 3% to access reliable income potential and above-market payouts.

- Jump ahead of the curve with these 25 AI penny stocks that are shaping tomorrow’s technology and transforming entire industries with AI-driven innovation.

- Catch overlooked bargains by targeting these 877 undervalued stocks based on cash flows that are poised for future growth based on strong fundamentals and smart valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives