- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Does Linde's (LIN) Insider Buying Reinforce Its Long‑Term Growth Story Or Raise New Questions?

Reviewed by Sasha Jovanovic

- In recent days, Linde has attracted renewed attention as multiple banks reiterated positive views on its long-term growth model, underpinned by a project backlog of over US$7.10 billion and continued shareholder returns via dividends and buybacks, following a period of softer industrial demand.

- An interesting development is the uptick in insider share purchases, including by CEO Sanjiv Lamba, which many investors interpret as a concrete signal of management’s confidence in Linde’s future earnings resilience and growth plans.

- Next, we’ll examine how this insider buying and reaffirmed confidence in Linde’s project backlog could reshape its existing investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

Linde Investment Narrative Recap

To own Linde, you need to believe its long-term gas infrastructure and project backlog can more than offset bouts of softer industrial demand and regional economic weakness. The recent analyst reaffirmations and insider buying mainly reinforce this thesis, but they do not materially change the near term catalyst of executing its US$7.1 billion sale of gas backlog or the key risk that prolonged industrial softness, especially in Europe and Asia-Pacific, could keep base volumes under pressure.

The most relevant recent announcement here is Linde’s confirmation of a US$7.1 billion sale of gas project backlog that several banks expect to start ramping in 2026. This pipeline, alongside its ongoing dividends and share repurchases, is central to the current growth narrative because it provides visibility on future earnings while investors weigh near term volume headwinds, pricing pressure in some product lines and the pace of the global energy transition.

Yet investors should also pay close attention to how prolonged industrial weakness in Europe could erode Linde’s network density and...

Read the full narrative on Linde (it's free!)

Linde's narrative projects $38.9 billion revenue and $9.1 billion earnings by 2028. This requires 5.4% yearly revenue growth and a roughly $2.4 billion earnings increase from $6.7 billion today.

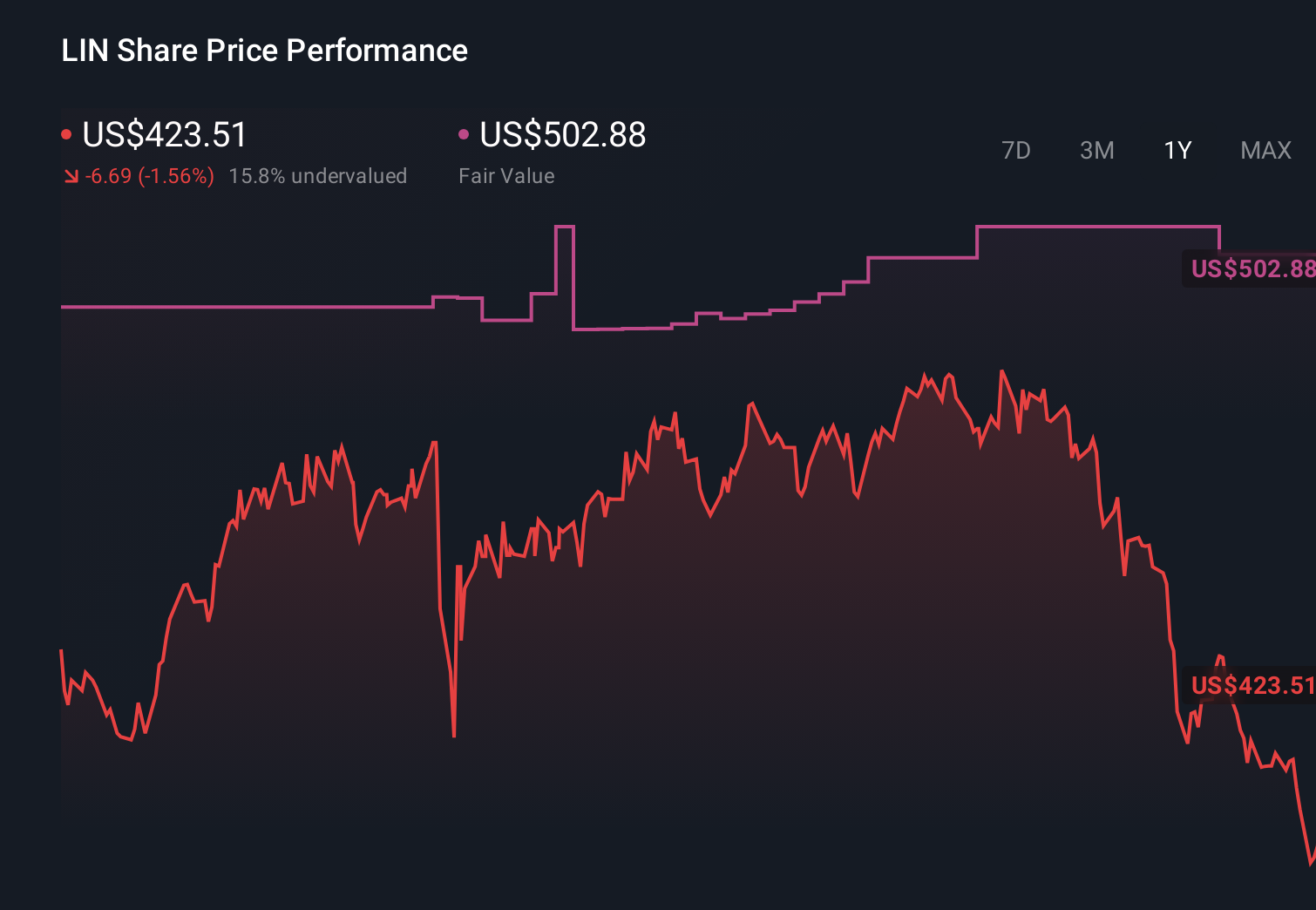

Uncover how Linde's forecasts yield a $502.88 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community currently estimate Linde’s fair value between US$302 and US$503, reflecting a wide spread of views. You are weighing those opinions against the same core question analysts are watching most closely: whether Linde’s large sale of gas project backlog can offset the risk that ongoing global industrial softness and slower energy transition projects might pressure future volumes and profitability.

Explore 8 other fair value estimates on Linde - why the stock might be worth 29% less than the current price!

Build Your Own Linde Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Linde research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Linde research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Linde's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)