- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Is Kaiser Aluminum (KALU) Undervalued After Recent Share Price Momentum?

Reviewed by Kshitija Bhandaru

Kaiser Aluminum (KALU) shares have seen some movement lately, catching the attention of investors focused on the materials sector. The company has shown steady growth over the past year. Its recent trajectory invites a closer look at what is driving interest now.

See our latest analysis for Kaiser Aluminum.

Kaiser Aluminum’s share price has gained momentum in 2024, rising 13.85% year-to-date and helping fuel a robust 1-year total shareholder return of 15.88%. Even with some recent volatility, long-term shareholders have seen a solid 51.83% return over the past five years. This suggests steady value creation and renewed confidence in the company’s outlook.

If the materials sector has you thinking about where the next wave of opportunity could emerge, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

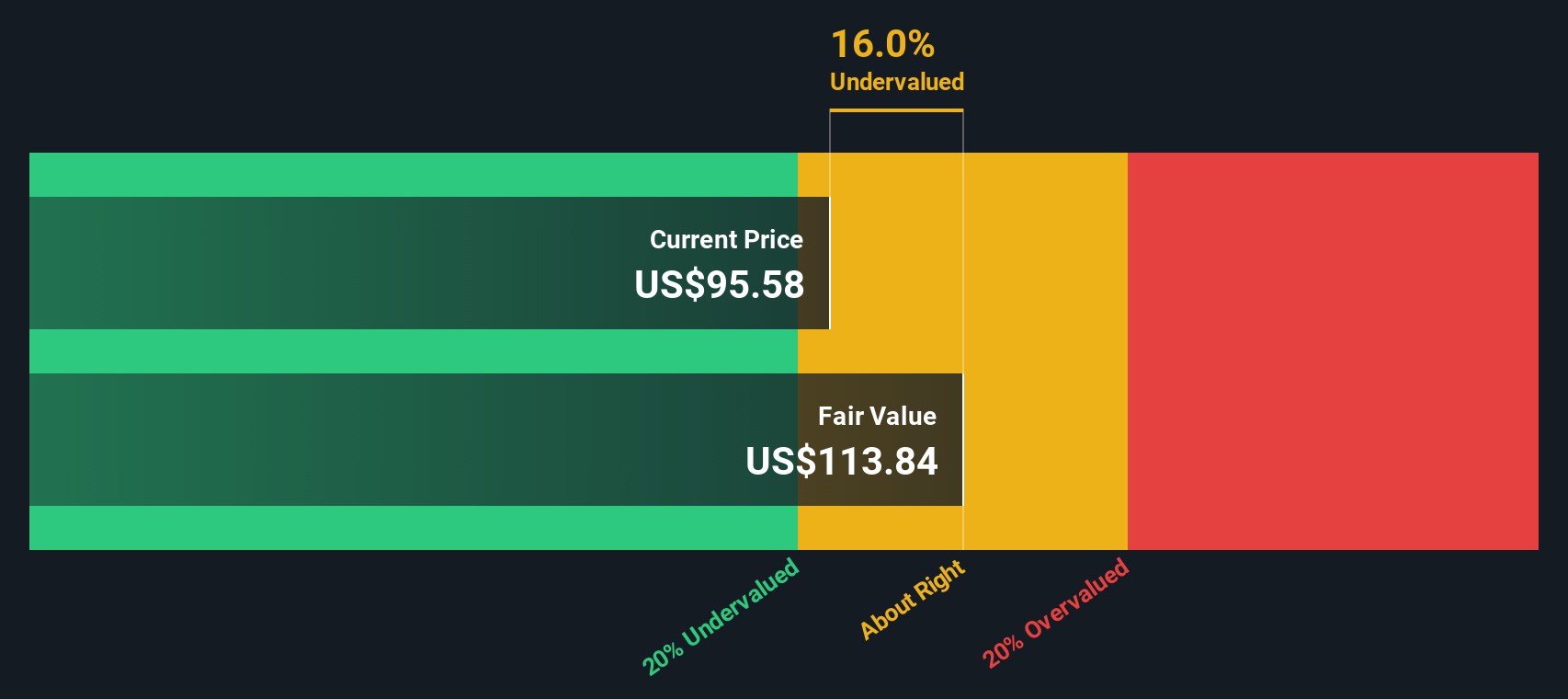

With shares climbing and long-term returns outpacing the sector, the question remains: is Kaiser Aluminum trading at a bargain relative to its value, or is the market already accounting for the company’s future growth prospects?

Price-to-Earnings of 23.5x: Is it justified?

Kaiser Aluminum is trading at a price-to-earnings (P/E) ratio of 23.5x, which positions the stock attractively compared to both industry peers and the broader market. With the most recent close at $80, investors may find the valuation compelling if strong growth can be sustained.

The P/E ratio represents how much investors are willing to pay per dollar of current earnings. In the metals and mining sector, this ratio can often reflect expectations around future profitability, cyclical demand shifts, and the company's ability to maintain margins through volatile periods.

Kaiser's P/E of 23.5x is lower than the US Metals and Mining industry average of 25.7x and also sits below the peer group average of 29.7x. In addition, regression analysis suggests the fair price-to-earnings ratio for Kaiser Aluminum should be around 25.7x. This positions the current valuation as potentially conservative if earnings growth continues along its recent trajectory.

Explore the SWS fair ratio for Kaiser Aluminum

Result: Price-to-Earnings of 23.5x (UNDERVALUED)

However, slowing revenue growth or unexpected shifts in cyclical demand could challenge current market optimism and put pressure on Kaiser Aluminum’s valuation in the future.

Find out about the key risks to this Kaiser Aluminum narrative.

Another View: Discounted Cash Flow Tells a Deeper Story

Taking a step back from earnings ratios, the SWS DCF model estimates Kaiser Aluminum’s fair value at $123.83 per share. This is about 35% above the current market price. While multiples suggest value, this approach hints the market may be missing the company’s true long-term cash generation potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kaiser Aluminum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kaiser Aluminum Narrative

Keep in mind, if you have your own perspective or enjoy digging into the numbers yourself, you can craft your own Kaiser Aluminum narrative in just a few minutes with Do it your way.

A great starting point for your Kaiser Aluminum research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep winning by acting early, not waiting for the perfect moment. The best opportunities are often in places where few others are looking. Don’t miss your next winner.

- Get ahead with steady income by checking out these 18 dividend stocks with yields > 3% delivering yields above 3% for reliable cash flow potential.

- Step into tomorrow’s breakthroughs and fuel your watchlist with these 24 AI penny stocks that could shape industries through artificial intelligence.

- Uncover hidden bargains poised for growth when you evaluate these 872 undervalued stocks based on cash flows based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives