- United States

- /

- Chemicals

- /

- NasdaqGS:HWKN

Hawkins (HWKN): Margin Dip Challenges “Safe Haven” Narrative as Premium Valuation Persists

Reviewed by Simply Wall St

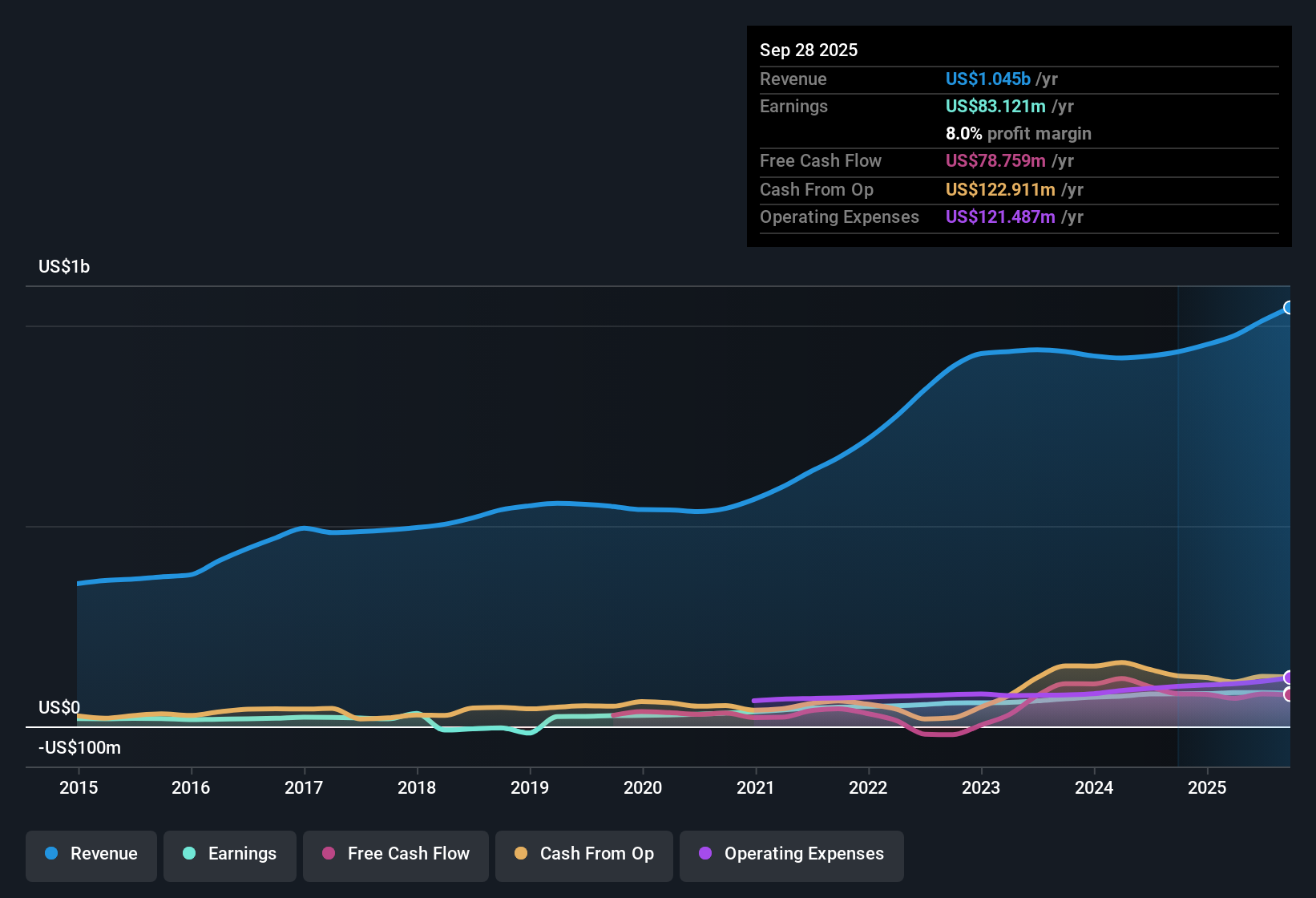

Hawkins (HWKN) saw earnings grow at an average of 17.1% per year over the past five years, but the most recent annual earnings growth slowed sharply to just 1.7%. Net profit margins also dipped to 8%, down from last year’s 8.7%. With revenue now forecast to rise 6.4% per year, which is slower than the broader U.S. market’s expected 10.3% growth, investors are weighing these more modest numbers alongside a Price-to-Earnings Ratio of 37.8x, higher than both its peer average (37.4x) and the industry average (26.7x).

See our full analysis for Hawkins.The next section puts these headline results up against the market's dominant narratives, highlighting where consensus views are confirmed and where the numbers pose a challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Growth Outlook Clears 12% Hurdle

- Earnings are forecast to grow by 11.96% per year, compared to the longer-term historical average of 17.1% annual growth over five years.

- What is interesting is that the market’s prevailing view sees Hawkins as a steady, resilient operator in specialty chemicals,

- Growth guidance is not as rapid as prior trends but remains above many defensive sector peers. This anchors the “safe haven” angle that investors favor in uncertain environments.

- A track record of operational consistency is frequently credited with keeping Hawkins top of mind for those seeking lower volatility holdings.

Margin Pressures Take a Bite

- Net profit margins slipped to 8%, notably down from the prior year’s 8.7%.

- The prevailing market perspective emphasizes Hawkins’ margin stability, yet the recent decline may challenge the confidence that earnings quality is immune to industry headwinds,

- While specialty chemicals companies as a group have faced cyclical pressures, Hawkins’ ability to keep margins above most industry names is seen as a sign of prudent management.

- The dip in margins, though modest, is a reminder that cost headwinds can impact even well-run, defensive businesses.

Premium Valuation Despite Slower Pace

- Shares trade at a Price-to-Earnings Ratio of 37.8x, above the peer average of 37.4x and well over the U.S. chemicals industry average of 26.7x. The current share price of $150.58 sits materially above the DCF fair value estimate of $132.59.

- Prevailing market analysis points to a blend of optimism and caution as investors debate paying up for Hawkins’ dependable growth,

- Some investors are willing to pay a premium multiple for Hawkins’ historic performance, despite the forecast growth lagging the broader U.S. market.

- However, the valuation gap versus both DCF fair value and industry peers suggests the market will demand continued resilience to justify the current price.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hawkins's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Hawkins maintains margin resilience and consistent growth, its premium valuation and slower earnings trajectory leave investors exposed if market optimism fades.

If you’re searching for stocks that trade at more attractive prices with stronger value upside, start your hunt with these 848 undervalued stocks based on cash flows to uncover opportunities that better balance growth and valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hawkins might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HWKN

Hawkins

Operates as a water treatment and specialty ingredients company in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)