- United States

- /

- Metals and Mining

- /

- NasdaqCM:HUDI

Insufficient Growth At Huadi International Group Co., Ltd. (NASDAQ:HUDI) Hampers Share Price

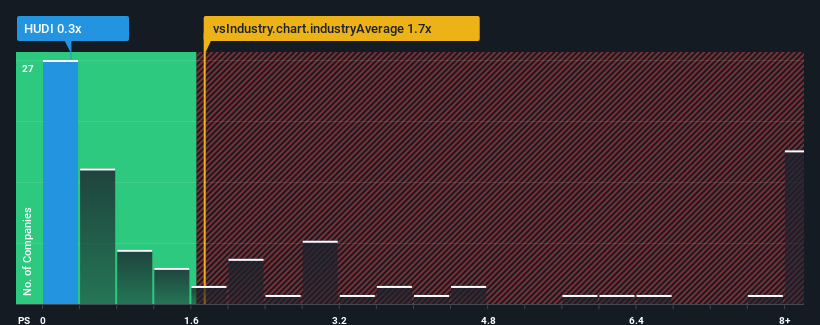

With a price-to-sales (or "P/S") ratio of 0.3x Huadi International Group Co., Ltd. (NASDAQ:HUDI) may be sending bullish signals at the moment, given that almost half of all the Metals and Mining companies in the United States have P/S ratios greater than 1.7x and even P/S higher than 6x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

We've discovered 3 warning signs about Huadi International Group. View them for free.Check out our latest analysis for Huadi International Group

How Huadi International Group Has Been Performing

As an illustration, revenue has deteriorated at Huadi International Group over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Huadi International Group's earnings, revenue and cash flow.How Is Huadi International Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Huadi International Group's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.7% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 8.8% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Huadi International Group's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Huadi International Group's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Huadi International Group confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for Huadi International Group (1 shouldn't be ignored!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Huadi International Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HUDI

Huadi International Group

Through its subsidiaries, develops, manufactures, markets, and sells stainless steel seamless pipes, tubes, and bars in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives