- United States

- /

- Metals and Mining

- /

- NasdaqGS:CENX

Century Aluminum Company (NASDAQ:CENX) Shares Fly 32% But Investors Aren't Buying For Growth

Century Aluminum Company (NASDAQ:CENX) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

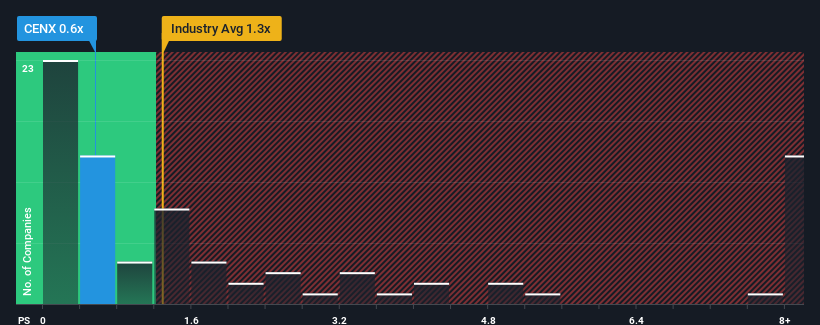

Even after such a large jump in price, Century Aluminum may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Metals and Mining industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Century Aluminum

What Does Century Aluminum's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Century Aluminum has been very sluggish. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Century Aluminum's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Century Aluminum?

Century Aluminum's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. Still, the latest three year period has seen an excellent 36% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 7.1% per year as estimated by the dual analysts watching the company. With the industry predicted to deliver 401% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Century Aluminum's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Century Aluminum's P/S Mean For Investors?

Despite Century Aluminum's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Century Aluminum's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Century Aluminum that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CENX

Century Aluminum

Produces and sells standard-grade and value-added primary aluminum products in the United States and Iceland.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives