- United States

- /

- Metals and Mining

- /

- NasdaqGS:CENX

Century Aluminum (CENX): Evaluating Valuation Following Upward Earnings Revisions and Expansion Plans

Reviewed by Kshitija Bhandaru

Century Aluminum (CENX) is attracting attention after upward revisions to its full-year earnings estimates, which signals strengthening business momentum. Company moves such as expanding Mt. Holly and working on a new U.S. smelter are also contributing to the story.

See our latest analysis for Century Aluminum.

Backed by a wave of positive news from its expansion plans and ongoing earnings momentum, Century Aluminum’s share price has been trending higher and is now close to its 52-week high. Over the past year, the company delivered a 0.87% total shareholder return. Shorter-term price gains have been steady, reflecting growing optimism around its strategic moves and strengthening fundamentals.

If you’re watching momentum build in materials stocks like this, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With Century Aluminum’s momentum and recent gains capturing headlines, the core question for investors now becomes: are shares still undervalued based on fundamentals, or has the market already priced in the company’s future growth?

Most Popular Narrative: 3% Overvalued

Century Aluminum's most widely followed narrative points to a fair value of $29, which is slightly above the last closing price of $29.87. This suggests the current market price may be running just ahead of what future fundamentals alone might support, prompting closer scrutiny of growth projections.

"The expansion and restart of Mt. Holly, along with progress on a new U.S. smelter, positions Century Aluminum to meaningfully increase U.S. primary aluminum production. This allows the company to capture rising domestic demand driven by reshoring of supply chains and incentivized by government tariffs and trade protections, supporting future revenue growth and improved fixed cost absorption, thus enhancing net margins."

Curious to know the boldest assumptions backing up this narrative? Hint: rapid production restarts and ambitious profit expansion set the stage for a valuation rarely seen in this sector. You’ll want to uncover the key targets driving this calculation before the next move is priced in.

Result: Fair Value of $29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volatility in aluminum prices or a change in U.S. tariffs could quickly undermine these positive expectations for Century Aluminum’s growth.

Find out about the key risks to this Century Aluminum narrative.

Another View: DCF Model Signals Undervaluation

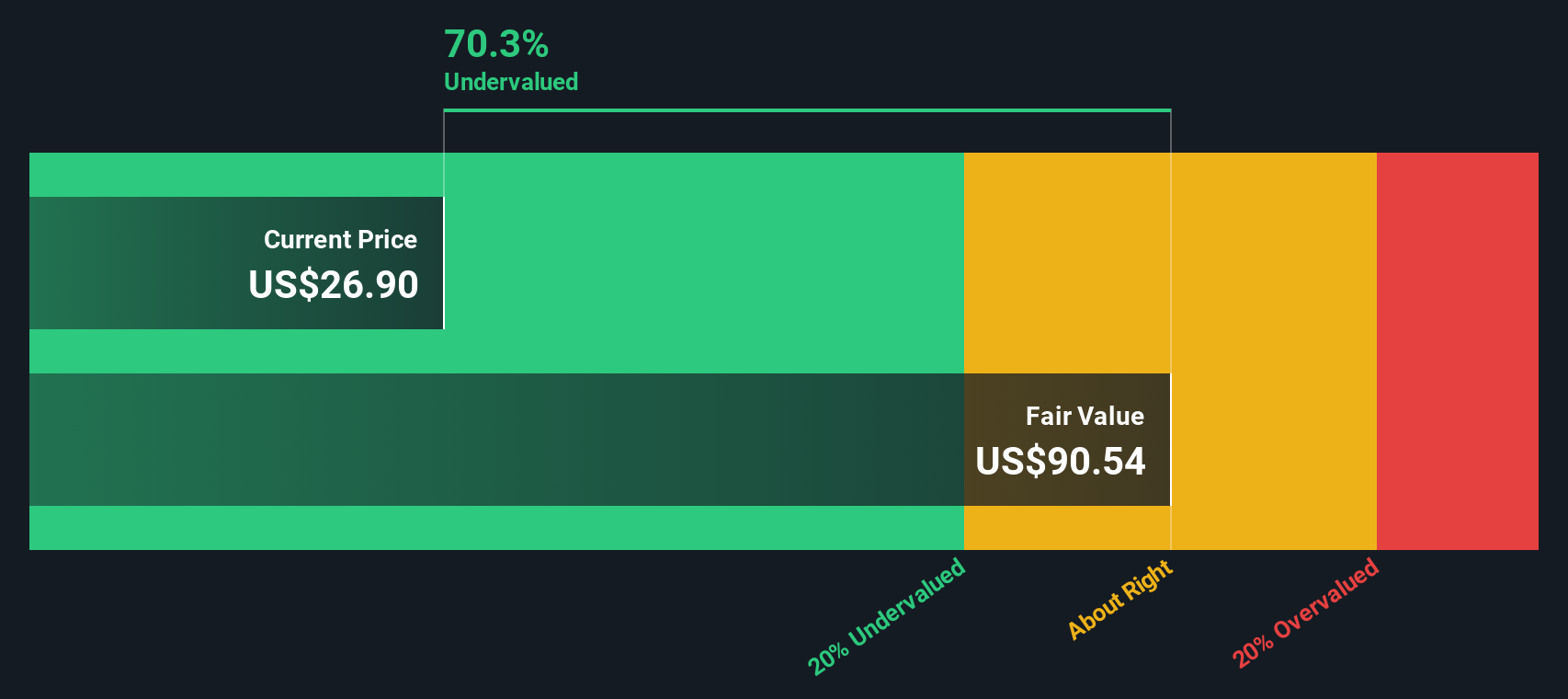

While the most popular market narrative sees Century Aluminum as about 3% overvalued, our SWS DCF model presents a sharply different story. It values shares at $89.81, so the stock is trading nearly 67% below its estimated fair value. Does this gap reflect real risk, or is the market missing the upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Century Aluminum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Century Aluminum Narrative

If you see things differently, or want to dig into the numbers yourself, you can craft your own perspective in just minutes. Do it your way

A great starting point for your Century Aluminum research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Ready to take your portfolio further? Don’t miss your chance to capitalize on unique opportunities you can uncover right now with these powerful tools from Simply Wall Street:

- Strengthen your income potential and unlock reliable payouts by starting with these 19 dividend stocks with yields > 3% featuring the most attractive yields available.

- Position yourself ahead of innovation by tapping into these 24 AI penny stocks that are transforming industries with artificial intelligence.

- Gain the edge with undervalued gems by checking out these 896 undervalued stocks based on cash flows that could be primed for growth based on their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CENX

Century Aluminum

Produces and sells standard-grade and value-added primary aluminum products in the United States and Iceland.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives