- United States

- /

- Chemicals

- /

- NasdaqCM:BON

Bon Natural Life Limited's (NASDAQ:BON) Shares Not Telling The Full Story

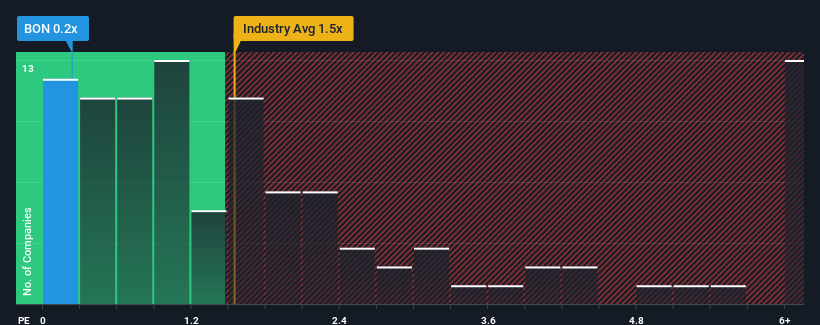

When close to half the companies operating in the Chemicals industry in the United States have price-to-sales ratios (or "P/S") above 1.5x, you may consider Bon Natural Life Limited (NASDAQ:BON) as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Bon Natural Life

How Bon Natural Life Has Been Performing

As an illustration, revenue has deteriorated at Bon Natural Life over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bon Natural Life's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Bon Natural Life?

Bon Natural Life's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 1.3% decrease to the company's top line. Still, the latest three year period has seen an excellent 62% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is only predicted to deliver 6.4% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Bon Natural Life's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Bon Natural Life's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Bon Natural Life revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for Bon Natural Life (1 shouldn't be ignored!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bon Natural Life might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BON

Bon Natural Life

Engages in the research and development, manufacture, and sale of functional active ingredients extracted from natural herb plants in the People’s Republic of China and internationally.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives