- United States

- /

- Metals and Mining

- /

- NasdaqGS:AUGO

Why Aura Minerals (AUGO) Is Up 7.5% After Achieving Commercial Production at Borborema Mine

Reviewed by Sasha Jovanovic

- Goldman Sachs and Bank of America Securities recently initiated coverage on Aura Minerals, each assigning positive outlooks, following Aura's announcement of commercial production at the Borborema gold mine in Brazil, which is now operating at over 80% capacity with strong gold recoveries.

- This marks a key operational milestone for Aura Minerals as it underscores the company's ability to ramp up production and gain increased attention from major financial institutions.

- We'll explore how achieving commercial production at Borborema enhances Aura Minerals' investment narrative and long-term growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Aura Minerals' Investment Narrative?

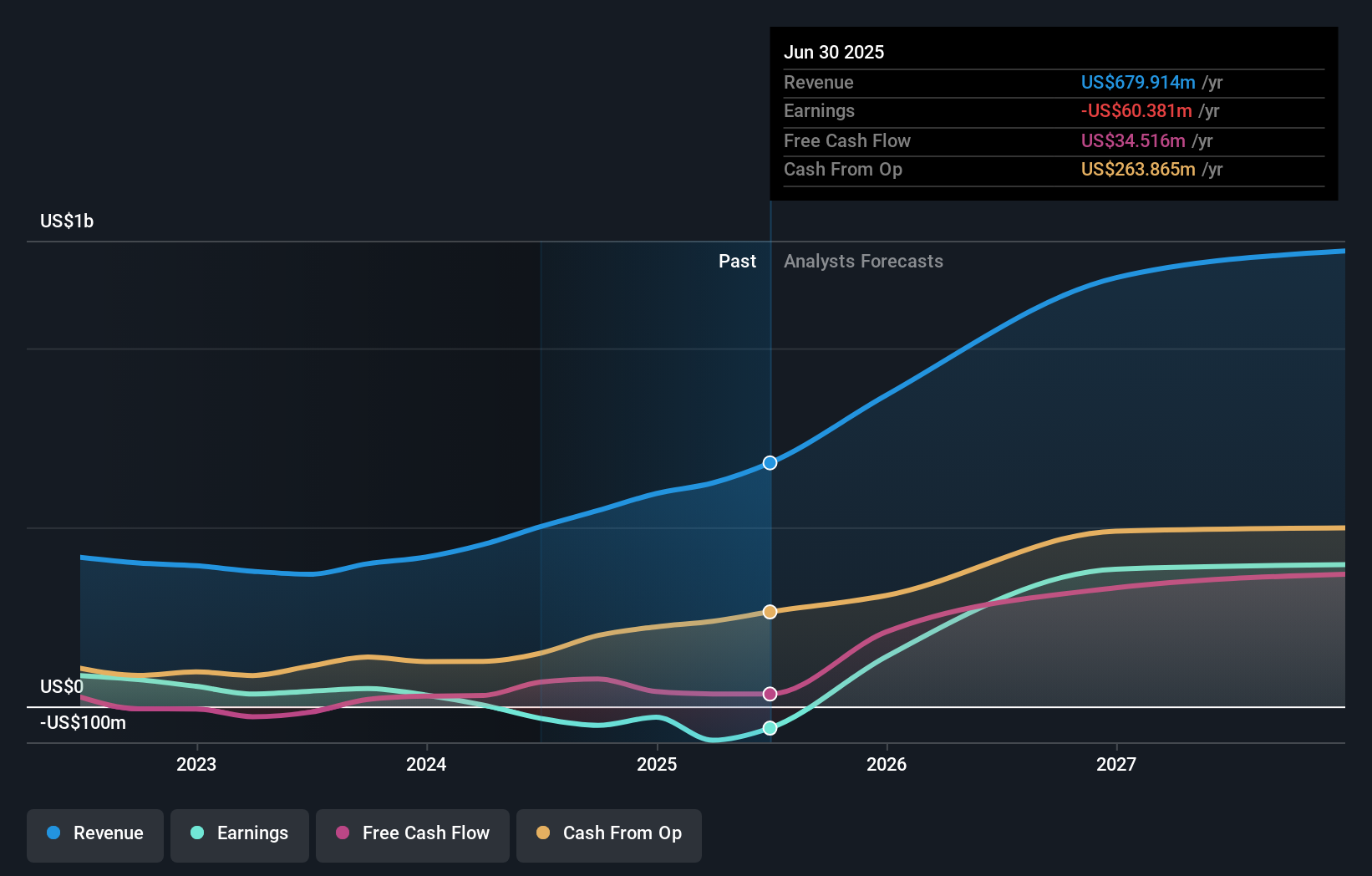

Aura Minerals’ journey this year has revolved around delivering on production at its key assets and being recognized by both analysts and major financial institutions. With commercial production at Borborema now a reality, and both Goldman Sachs and Bank of America initiating coverage with upbeat outlooks, this development could prove pivotal for near-term catalysts, shifting the focus from project ramp-up risks to operational execution and the prospect for rapidly scaling revenues and earnings. The Borborema milestone has the potential to significantly de-risk the Aura story in the eyes of investors, as sustained performance will likely influence future guidance, support dividend continuity, and reinforce the company’s recent index inclusions. That said, balance sheet leverage and the ability to convert new output into meaningful profits remain clear watchpoints. The recent news reinforces Aura’s operational relevance but sets a higher bar for delivery moving forward.

However, risks tied to profitability sustainability are still ones investors should keep front of mind.

Exploring Other Perspectives

Explore another fair value estimate on Aura Minerals - why the stock might be worth over 3x more than the current price!

Build Your Own Aura Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aura Minerals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aura Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aura Minerals' overall financial health at a glance.

No Opportunity In Aura Minerals?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUGO

Aura Minerals

A gold and copper production company, focuses on the development and operation of gold and base metal projects in the Americas.

High growth potential and fair value.

Market Insights

Community Narratives