- United States

- /

- Insurance

- /

- NYSE:WTM

Can White Mountains (WTM) Justify Its Premium Valuation Amid Renewed Investor Attention?

Reviewed by Sasha Jovanovic

- In recent days, White Mountains Insurance Group experienced a significant upward move, catching increased investor attention against a backdrop of relatively muted year-to-date share performance.

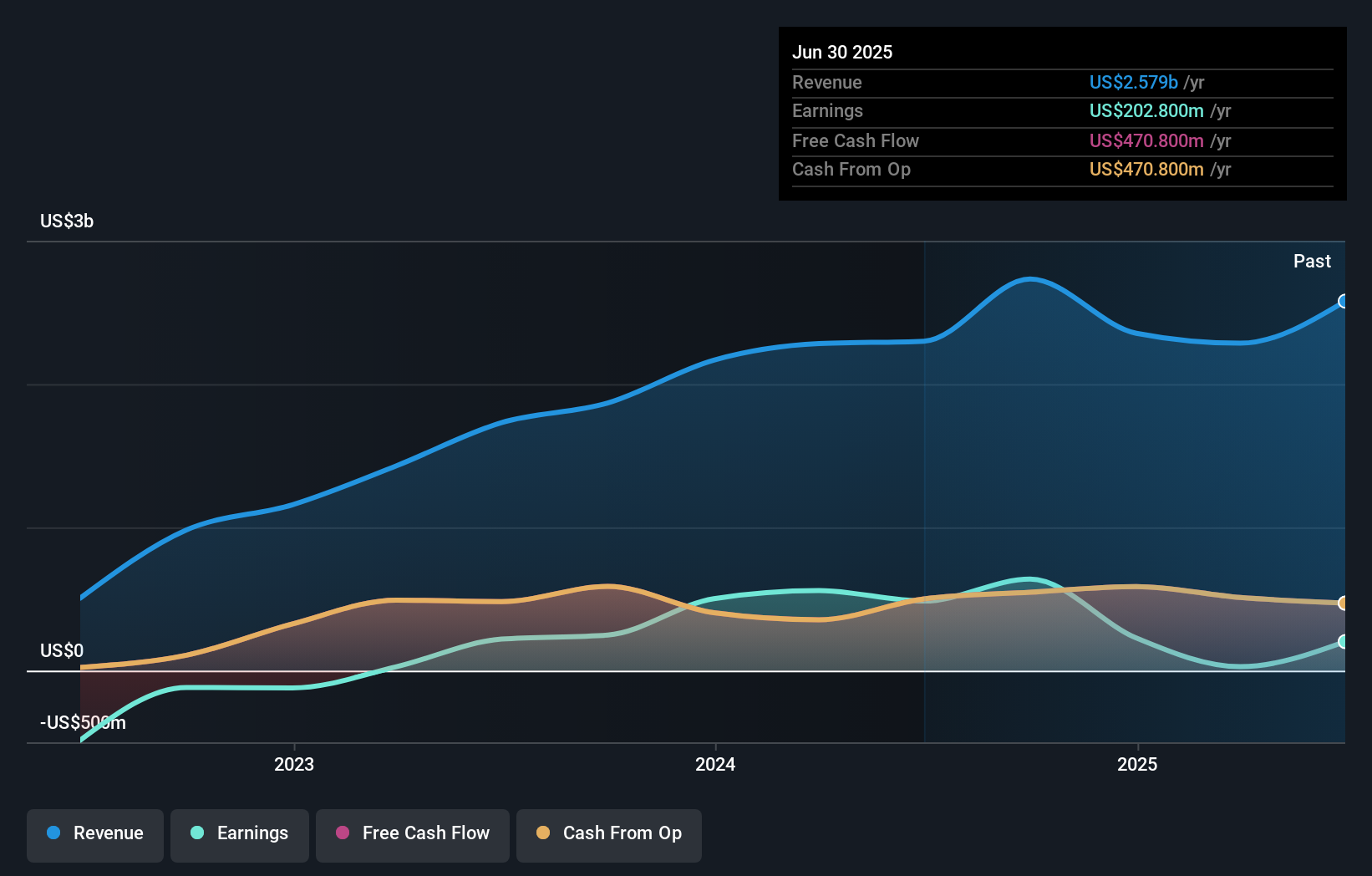

- Investor discussions have intensified around the company's elevated price-to-earnings ratio, which exceeds industry averages and signals differing views about potential future growth.

- We'll consider how the company's valuation premium may be shaping the evolving investment narrative for White Mountains Insurance Group.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is White Mountains Insurance Group's Investment Narrative?

For anyone considering White Mountains Insurance Group as a potential holding, the core thesis is usually built around confidence in the group's ability to grow earnings, maintain disciplined underwriting, and successfully manage its diversified portfolio even through transitions. This week’s share price surge, coming against a backdrop of flat year-to-date returns and an above-average P/E ratio, may prompt some investors to revisit their convictions about both risk and reward. The immediate question is whether this rally acts as a meaningful catalyst or simply amplifies ongoing debates about valuation. While the price momentum reflects market enthusiasm, there’s no clear fundamental change in the company’s short-term growth outlook or risk profile from recent news, at least for now. With executive succession set for 2026 and recent earnings still reflecting the aftershocks of significant one-off losses, the main risks, transitional leadership, margin pressure, and premium valuation, remain in play, even as short-lived momentum stokes renewed interest.

But with the C-suite transition looming, leadership certainty is something investors should keep on their radar. White Mountains Insurance Group's shares are on the way up, but they could be overextended by 37%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on White Mountains Insurance Group - why the stock might be worth as much as $1581!

Build Your Own White Mountains Insurance Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your White Mountains Insurance Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free White Mountains Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate White Mountains Insurance Group's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if White Mountains Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTM

White Mountains Insurance Group

Through its subsidiaries, provides insurance and other financial services in the United States.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives