- United States

- /

- Insurance

- /

- NYSE:WRB

W. R. Berkley (NYSE:WRB) Launches Berkley Embedded Solutions With Stephanie Lloyd As President

Reviewed by Simply Wall St

W. R. Berkley (NYSE:WRB) has seen a notable development with the formation of Berkley Embedded Solutions, a new initiative aimed at integrating modern technology with digital-first insurance products. This venture, led by experienced executive Stephanie Lloyd, aligns with the company's ongoing growth strategy, potentially influencing their stock performance. Over the past month, W. R. Berkley's share price rose 7.2%, which stands out against a broader market decline of 1.3% within the same timeframe. The announcement coincided with the ex-dividend date for a quarterly cash dividend, marking a period of positive investor sentiment. In contrast to turbulent market conditions, including declines in major indices like the Dow and Nasdaq, W. R. Berkley’s price movement is distinct and may reflect investor optimism around its strategic expansions and leadership changes. While the general market faced economic concerns, W. R. Berkley maintained an upward trajectory amidst these challenges.

Dig deeper into the specifics of W. R. Berkley here with our thorough analysis report.

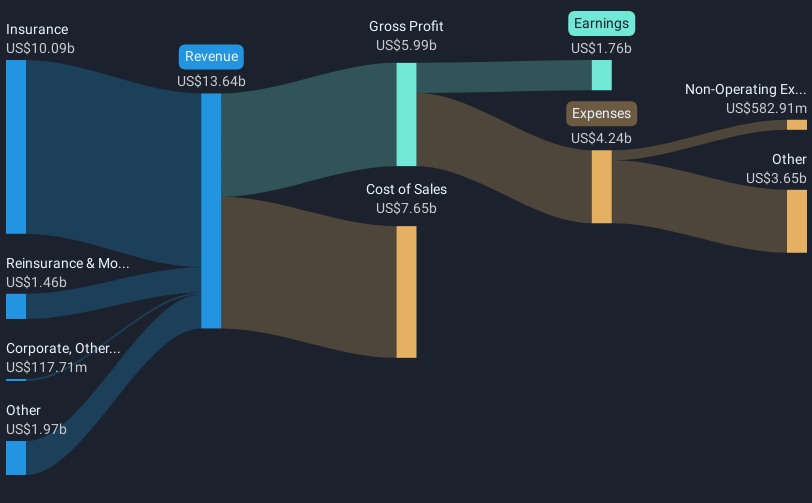

Over the last five years, W. R. Berkley has delivered a total return of 160.26%, a testament to its solid growth strategy. One contributing factor has been the significant earnings growth, averaging 23% annually, which offers insight into the company's robust financial management. Earnings growth has also accelerated recently, with a 27.1% increase in the past year, surpassing both its historical average and the insurance industry growth rate. This performance reflects well on the company, even as it underperformed the broader US market and insurance industry over the past year.

Significant business expansions, such as the formation of Berkley Embedded Solutions, highlight its adaptive approach to market demands. Additionally, consistent dividend payments, including a special dividend declared in December 2024, have contributed to overall shareholder returns. Meanwhile, strategic buybacks, such as the US$67.42 million repurchase program completed by the end of 2024, have further strengthened investor appeal by enhancing earnings per share.

- Discover whether W. R. Berkley is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the potential risks impacting W. R. Berkley's growth trajectory—explore our risk evaluation report.

- Have a stake in W. R. Berkley? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial lines writers worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives