- United States

- /

- Insurance

- /

- NYSE:WRB

W. R. Berkley (NYSE:WRB) Announces Dividend Increase And Special Cash Dividend

Reviewed by Simply Wall St

W. R. Berkley (NYSE:WRB) recently announced an increase in its regular cash dividend and a special cash dividend, both effective from June 30, 2025, which could have positively impacted its share price. The company experienced a 17% share price increase over the last quarter, during which dividends might have reinforced investor confidence. However, the broader market trends show a general upward movement, with indices like the S&P 500 nearing record highs. Consequently, Berkley's price move aligns with these market trends, suggesting that its corporate announcements supported but did not significantly deviate from the broader market movements.

We've identified 1 risk for W. R. Berkley that you should be aware of.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

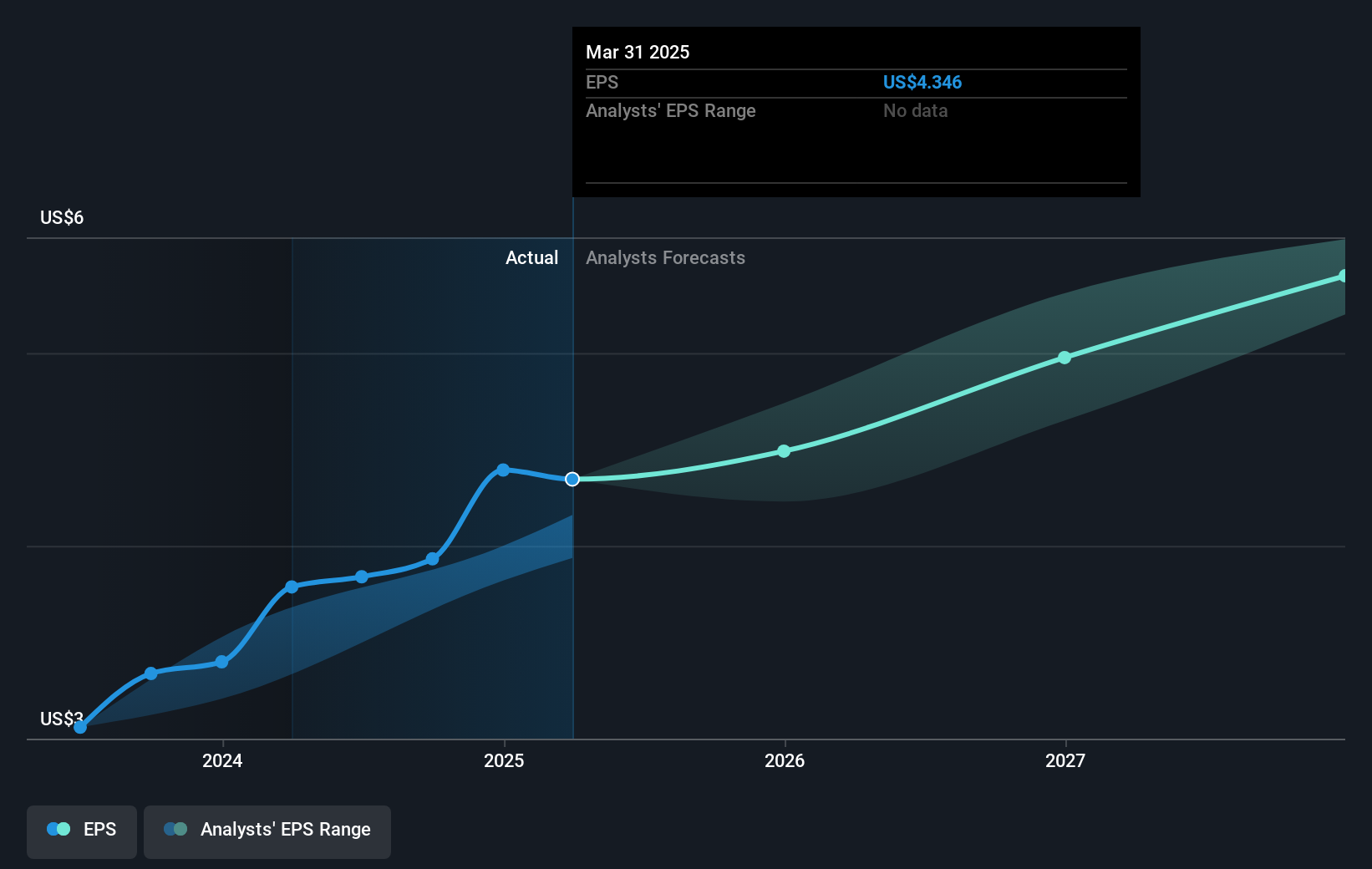

W. R. Berkley's announcement of dividend increases might positively reinforce its earnings and revenue, suggesting potential stability in future cash flows. This aligns with analysts' forecasts that project incremental growth in both revenue and profit margins over the next few years. Though share price saw a 17% increase over the last quarter, it's important to note that this movement is within the broader trend of a robust market, which the S&P 500 mirrors by nearing record highs.

Over the past five years, including dividends, the company achieved a total return of 208.64%. This is quite significant compared to its 1-year return, which surpassed both the U.S. Insurance industry average of 15.4% and the general market's 12.8% increase over the same duration. In terms of valuation, with a current share price of US$72.66, it slightly exceeds the consensus price target of US$67.83. This suggests that analysts view the stock as closely aligned with their fair value estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial line writer worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)