- United States

- /

- Life Sciences

- /

- NasdaqGS:ABCL

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the U.S. stock market navigates a holiday-shortened week with notable gains in major indices, investors are paying close attention to broader economic signals and corporate developments. For those interested in exploring opportunities beyond the mainstream, penny stocks—despite their somewhat antiquated name—remain an intriguing area of investment. These stocks often represent smaller or newer companies that, when underpinned by strong financials, can offer potential for substantial returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $99.16M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.21 | $1.91B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.8849 | $6.46M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.95 | $227.01M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $7.76M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.36 | $45.54M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.74 | $142.05M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.26 | $17.19M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.80 | $70.15M | ★★★★★☆ |

Click here to see the full list of 742 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

AbCellera Biologics (NasdaqGS:ABCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AbCellera Biologics Inc. operates as a company focused on antibody drug discovery and development, with a market cap of approximately $841.79 million.

Operations: The company's revenue segment includes $32.96 million from the discovery and development of antibodies.

Market Cap: $841.79M

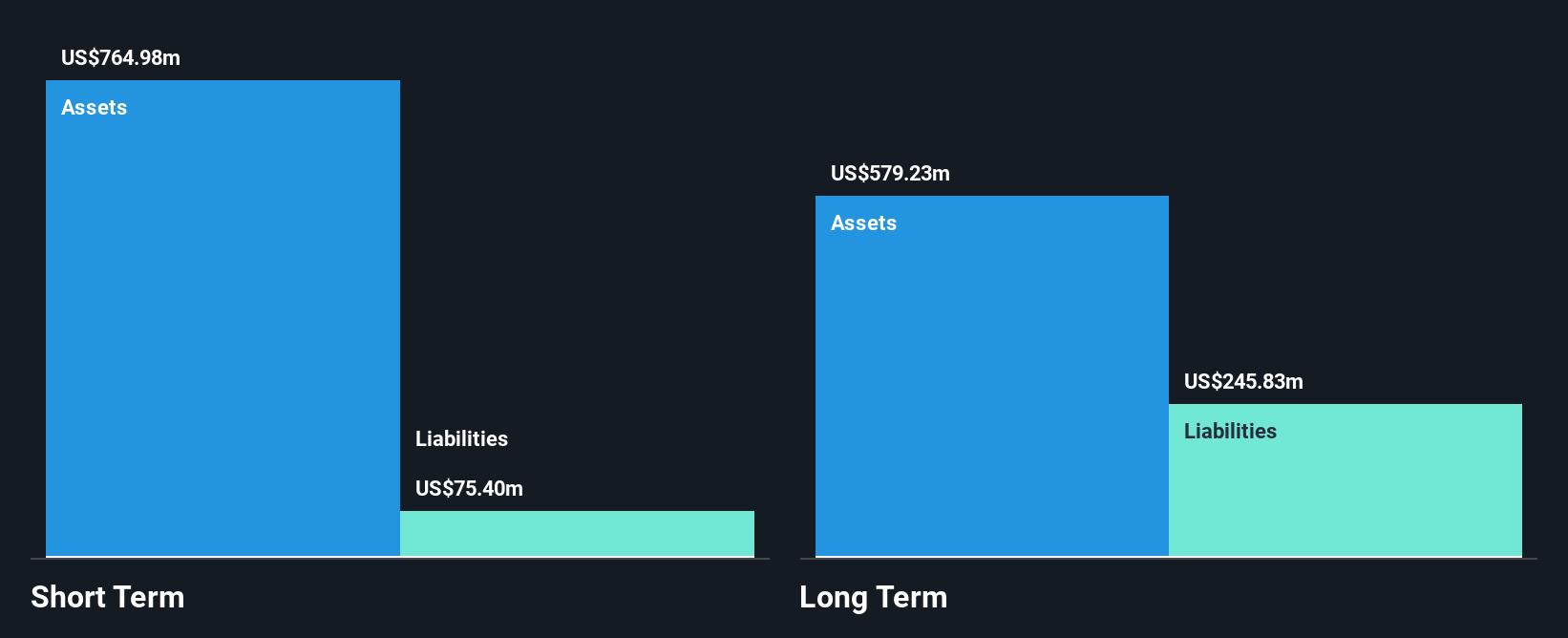

AbCellera Biologics, with a market cap of US$841.79 million, remains an intriguing penny stock due to its focus on antibody drug discovery. Despite being unprofitable and experiencing increased losses over the past five years, the company benefits from a robust balance sheet with short-term assets of US$742.9 million significantly surpassing both short-term and long-term liabilities. The absence of debt reduces financial risk, and no recent shareholder dilution is evident. However, revenue growth is modest at 16.47% annually while earnings are expected to decline by 10.7% per year over the next three years, indicating potential challenges ahead.

- Get an in-depth perspective on AbCellera Biologics' performance by reading our balance sheet health report here.

- Gain insights into AbCellera Biologics' outlook and expected performance with our report on the company's earnings estimates.

SES AI (NYSE:SES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SES AI Corporation develops and produces high-performance Lithium-metal rechargeable batteries for electric vehicles, electric vehicle take-off and landing, and other applications, with a market cap of approximately $149 million.

Operations: Currently, there are no reported revenue segments for SES AI Corporation.

Market Cap: $148.99M

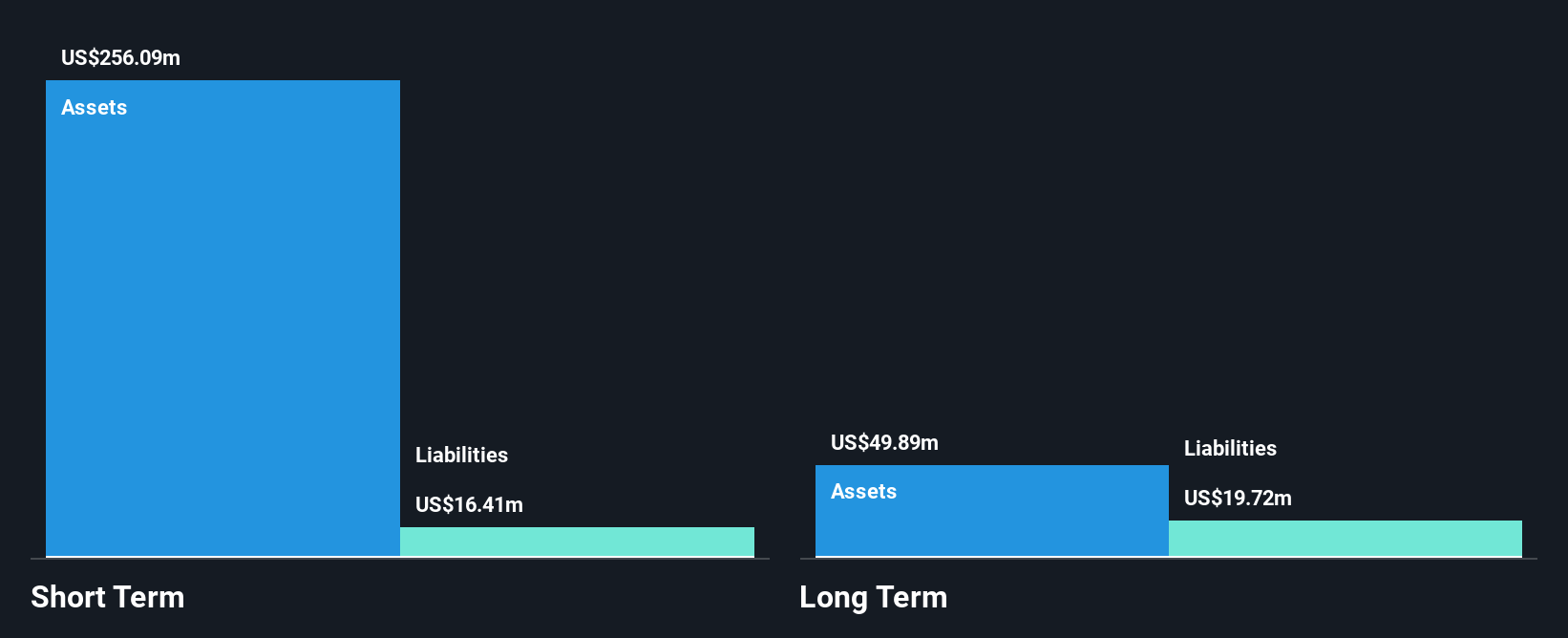

SES AI Corporation, with a market cap of US$149 million, is a pre-revenue company focused on lithium-metal battery technology. The firm recently faced delisting risks due to its stock price falling below US$1.00 on the NYSE but remains active in strategic partnerships, notably signing its first commercial agreement for AI-driven electrolyte development. Despite high volatility and increased losses, SES benefits from being debt-free and having short-term assets of US$291.5 million that exceed liabilities. However, shareholder dilution has occurred, and earnings are forecast to decline by 17.4% annually over the next three years.

- Dive into the specifics of SES AI here with our thorough balance sheet health report.

- Learn about SES AI's future growth trajectory here.

Waterdrop (NYSE:WDH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Waterdrop Inc., with a market cap of $398.46 million, operates through its subsidiaries to offer online insurance brokerage services that connect users with insurance products underwritten by companies in the People’s Republic of China.

Operations: The company's revenue is primarily derived from its insurance segment, which generated CN¥2.37 billion, complemented by CN¥242.53 million from crowdfunding activities.

Market Cap: $398.46M

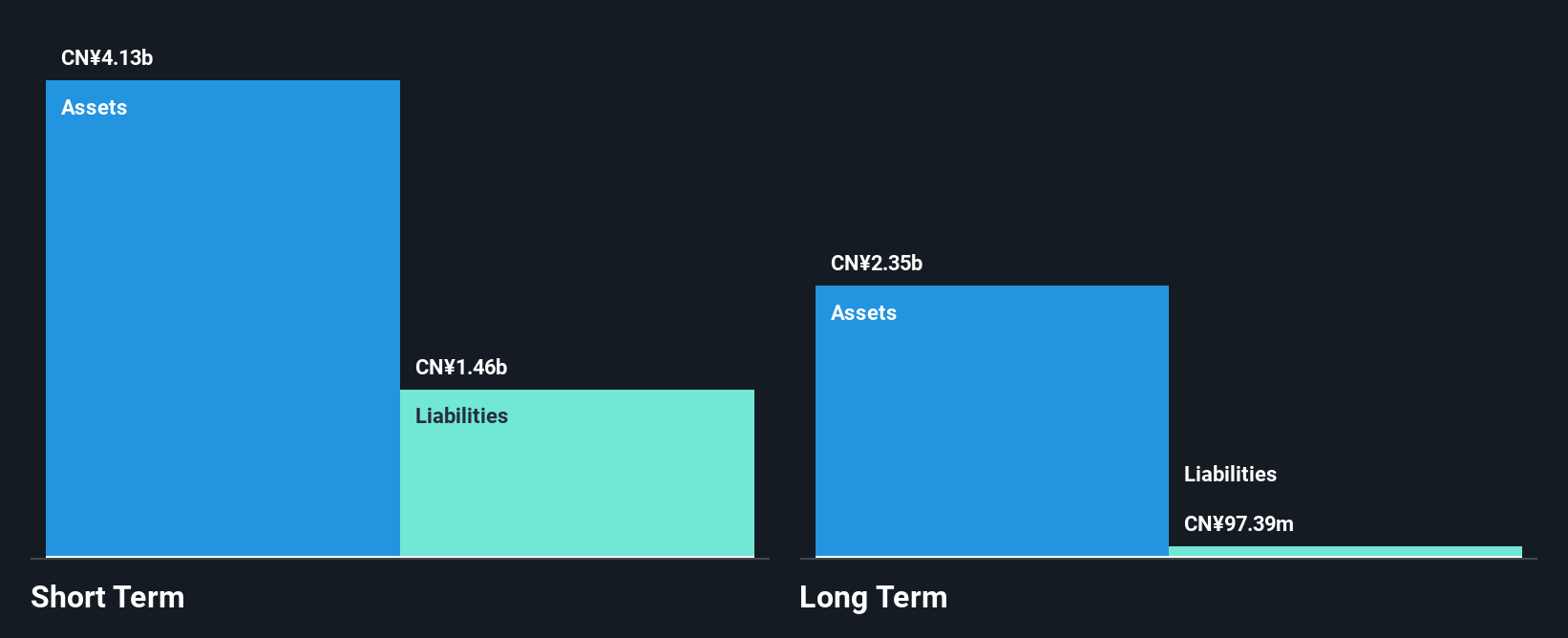

Waterdrop Inc., with a market cap of CN¥398.46 million, shows promising financial health as its short-term assets (CN¥4.4 billion) surpass both short and long-term liabilities, and it maintains more cash than debt. The company's earnings have grown significantly, with net income for the third quarter reaching CN¥92.81 million compared to CN¥36.74 million the previous year, reflecting improved profit margins from 8.8% to 11.7%. Despite low return on equity at 6.7%, Waterdrop trades at a favorable price-to-earnings ratio of 10.3x against the US market average, offering potential value for investors in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Waterdrop.

- Examine Waterdrop's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Embark on your investment journey to our 742 US Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABCL

AbCellera Biologics

AbCellera Biologics Inc. builds an engine for antibody drug discovery and development.

Flawless balance sheet with concerning outlook.