- United States

- /

- Insurance

- /

- NYSE:WDH

Clover Health Investments And 2 Other Penny Stocks With Promising Financials

Reviewed by Simply Wall St

As the U.S. markets kick off a holiday-shortened trading week with significant gains, optimism is building around the potential for a Federal Reserve interest rate cut in December. In such an environment, investors often look to diversify their portfolios by exploring various investment opportunities, including penny stocks. Although the term 'penny stock' might seem outdated, it still represents smaller or emerging companies that can offer substantial value when backed by strong financials. Let's explore several penny stocks that combine balance sheet strength with potential for growth, providing investors a chance to uncover hidden value in promising companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.75 | $379.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.815 | $658.23M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.745 | $588.08M | ✅ 4 ⚠️ 2 View Analysis > |

| FinVolution Group (FINV) | $4.95 | $1.2B | ✅ 3 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.97 | $246.41M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.2293 | $27.72M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.47 | $568.6M | ✅ 5 ⚠️ 0 View Analysis > |

| Nephros (NEPH) | $4.93 | $51.75M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.80 | $6.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.775 | $85.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 357 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Clover Health Investments (CLOV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market cap of approximately $1.18 billion.

Operations: The company generates revenue primarily from its Insurance segment, which amounted to $1.77 billion.

Market Cap: $1.18B

Clover Health Investments, Corp. has a market cap of US$1.18 billion and primarily generates revenue from its Insurance segment, reporting US$1.77 billion in revenue. Despite being unprofitable with a net loss of US$24.38 million for Q3 2025, the company raised its full-year guidance for Insurance revenue to between US$1.85 billion and US$1.88 billion, indicating growth potential in its Medicare Advantage offerings. The company is debt-free and has sufficient cash runway for over a year based on current free cash flow trends, though it remains volatile with higher-than-average stock price fluctuations.

- Click to explore a detailed breakdown of our findings in Clover Health Investments' financial health report.

- Assess Clover Health Investments' future earnings estimates with our detailed growth reports.

SmartRent (SMRT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SmartRent, Inc. is an enterprise real estate technology company offering management software and applications to rental property stakeholders globally, with a market cap of $274.34 million.

Operations: The company's revenue is primarily derived from its Electronic Security Devices segment, totaling $151.22 million.

Market Cap: $274.34M

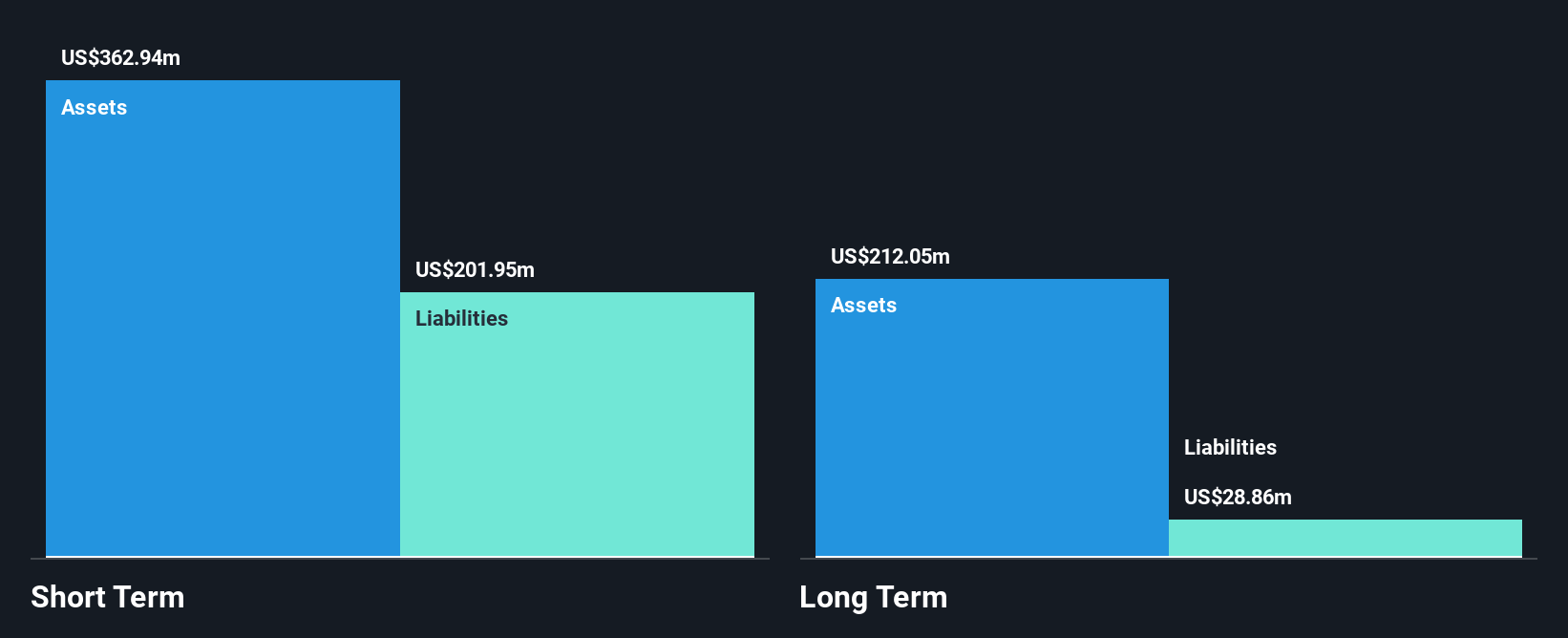

SmartRent, Inc., with a market cap of US$274.34 million, is debt-free and has sufficient short-term assets to cover both its short and long-term liabilities. Despite being unprofitable, it reported third-quarter revenue of US$36.2 million and reduced its net loss compared to the previous year. Recent leadership changes include the appointment of Sangeeth Ponathil as CIO to drive technology strategy amid ongoing executive transitions. The company trades significantly below estimated fair value but faces challenges in profitability and management experience, with an average tenure under two years for both management and board members.

- Unlock comprehensive insights into our analysis of SmartRent stock in this financial health report.

- Learn about SmartRent's future growth trajectory here.

Waterdrop (WDH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Waterdrop Inc. operates as an online insurance brokerage in China, connecting users with insurance products, and has a market cap of $658.23 million.

Operations: The company's revenue is primarily derived from its insurance segment, which generated CN¥2.78 billion, followed by its crowd funding segment with CN¥153.68 million.

Market Cap: $658.23M

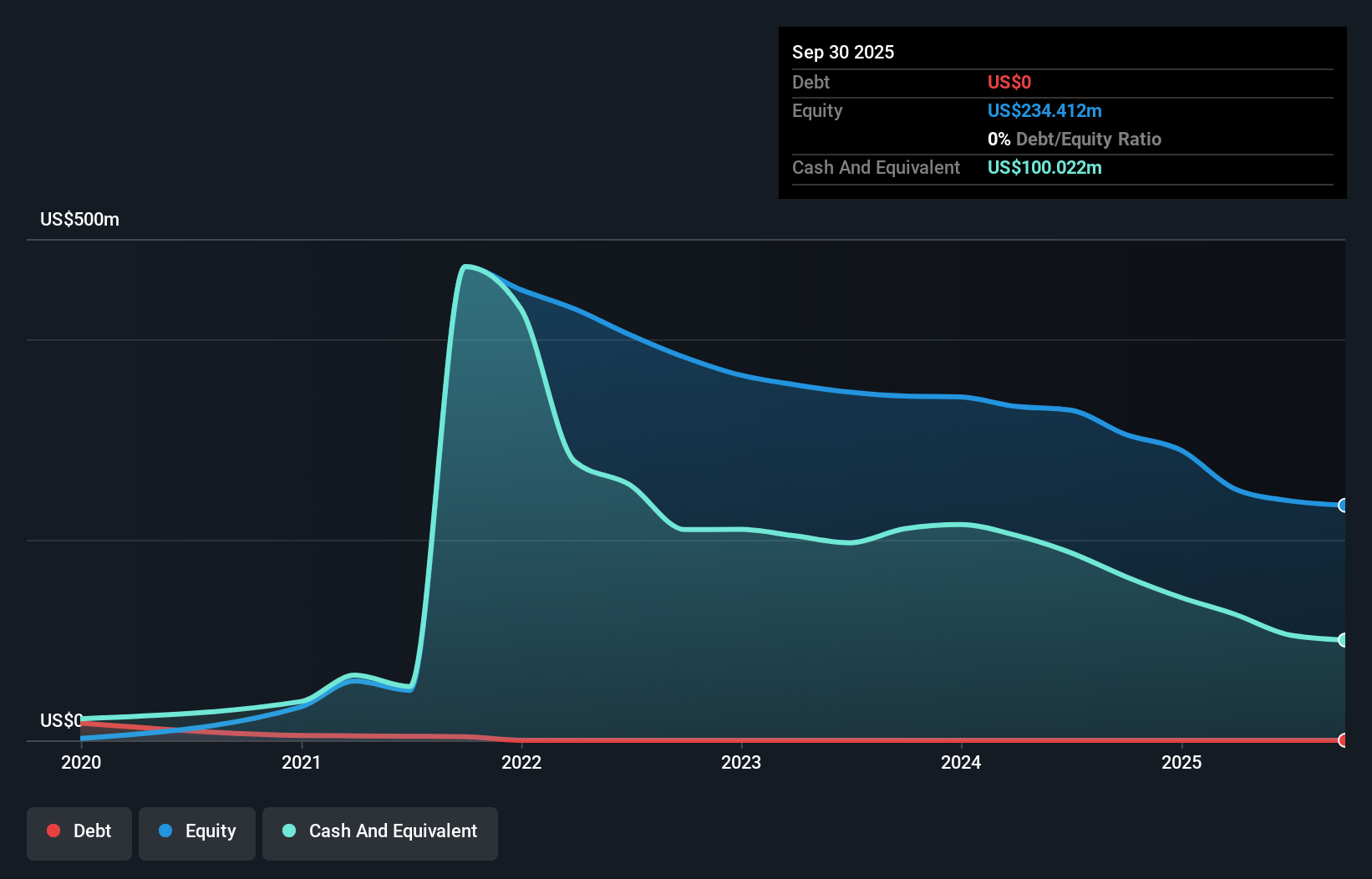

Waterdrop Inc., with a market cap of $658.23 million, is an online insurance brokerage in China showing robust financial health. The company reported significant revenue growth, with CN¥837.96 million for the second quarter and net income rising to CN¥140.16 million from CN¥88.29 million year-over-year, reflecting improved profit margins and high-quality earnings. Waterdrop's strong cash position allows it to cover debt effectively, supporting a share repurchase program of up to $50 million funded by existing cash reserves until September 2026, alongside paying semi-annual dividends of US$0.024 per share in November 2025.

- Click here to discover the nuances of Waterdrop with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Waterdrop's future.

Turning Ideas Into Actions

- Explore the 357 names from our US Penny Stocks screener here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waterdrop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WDH

Waterdrop

Through its subsidiaries, provides online insurance brokerage services to match and connect users with related insurance products underwritten by insurance companies in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success