- United States

- /

- Insurance

- /

- NYSE:UNM

Unum Group (UNM): Valuation Check After $1 Billion Share Repurchase Announcement

Reviewed by Simply Wall St

Unum Group (UNM) just put a fresh $1 billion share repurchase program on the table, a move that signals management sees potential value in the stock and intends to continue returning cash to shareholders.

See our latest analysis for Unum Group.

That confidence is playing out against a steadier price backdrop, with the latest share price at $73.38 and a modestly negative 90 day share price return. At the same time, a powerful three year total shareholder return of around 102% suggests longer term momentum is still very much intact.

If this kind of capital return story appeals to you, it could be a good moment to see what else is out there and explore fast growing stocks with high insider ownership.

With analysts seeing upside to the current price and valuation metrics hinting at a discount, the key question now is whether Unum Group remains undervalued or if the market is already pricing in its future growth.

Most Popular Narrative: 21.2% Undervalued

Compared to Unum Group's last close at $73.38, the most widely followed narrative points to a notably higher fair value based on long term fundamentals.

The expanding focus among employers on employee and voluntary benefits, along with increasing awareness of supplemental products driven by a competitive labor market, is allowing Unum to cross sell more solutions and penetrate new market segments, underpinning premium and recurring revenue growth.

Curious how steady premium growth, shifting margins, and a richer earnings mix can still justify a higher future multiple than today, even after buybacks and derisking moves reshape the share count and profit base? Unlock the full playbook behind that valuation call.

Result: Fair Value of $93.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated benefit ratios and lingering long term care headwinds could pressure margins and capital, which may force investors to reassess that optimistic valuation path.

Find out about the key risks to this Unum Group narrative.

Another Angle on Valuation

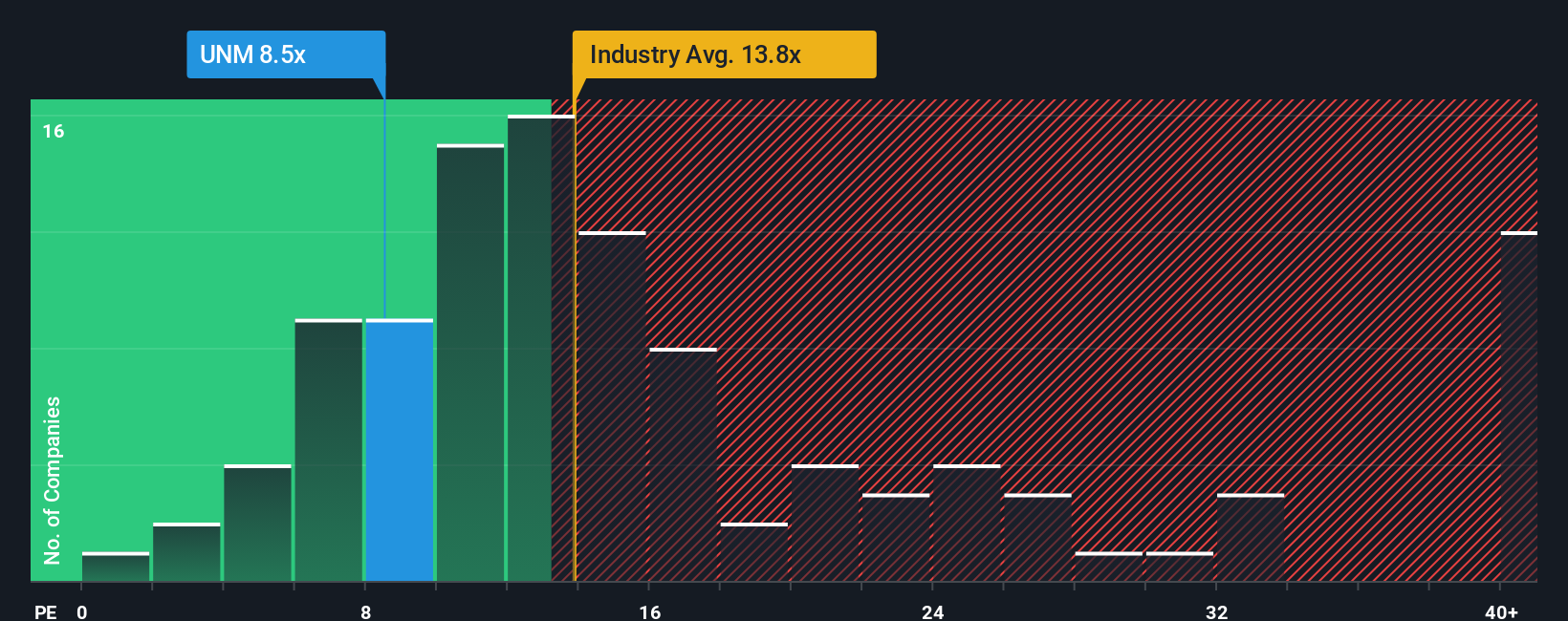

On earnings based metrics, Unum looks less clear cut. The shares trade at about 13.4 times earnings, richer than both the US insurance sector on 12.8 times and key peers on 9.2 times, yet still below a fair ratio of 18.8 times. This leaves investors to weigh potential upside against the risk of multiple compression.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unum Group Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Unum Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may want to explore your next potential opportunity by using the Simply Wall Street Screener to uncover focused ideas that match your strategy.

- Target income streams with these 15 dividend stocks with yields > 3% that can help strengthen your portfolio’s cash flow.

- Explore potential market mispricing by scanning these 895 undervalued stocks based on cash flows that may be trading below some estimates of intrinsic worth.

- Look for structural growth trends by focusing on these 27 AI penny stocks related to the adoption of intelligent technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNM

Unum Group

Provides financial protection benefit solutions in the United States, the United Kingdom, and Poland.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026