- United States

- /

- Insurance

- /

- NYSE:UNM

Unum Group (UNM): Is the Insurer Still Undervalued After Its Recent Share Price Pullback?

Reviewed by Simply Wall St

Recent Performance and Investor Context

Unum Group (UNM) has been quietly grinding higher over the past month, even as short term moves have been a bit choppy, and that mix of steady fundamentals and modest volatility is exactly what makes the stock interesting right now.

See our latest analysis for Unum Group.

At around $74.30 per share, Unum’s recent pullback contrasts with a solid multi year run, with the 3 year total shareholder return near doubling and the 5 year total shareholder return even stronger. This suggests long term momentum is still firmly intact.

If Unum’s steady climb has you thinking about what else could compound quietly in the background, now is a good time to explore fast growing stocks with high insider ownership.

With earnings still growing faster than revenue, a sizeable discount to analyst targets, and a strong multi year track record, the key question is whether Unum remains undervalued or whether the market is already pricing in that future growth.

Most Popular Narrative Narrative: 20.2% Undervalued

With the narrative fair value sitting well above Unum Group’s last close, the valuation case leans on measured growth rather than aggressive assumptions.

The analysts are assuming Unum Group's revenue will grow by 4.0% annually over the next 3 years. Analysts assume that profit margins will shrink from 11.8% today to 10.8% in 3 years time.

Want to see how modest top line growth, thinner margins, and a higher future earnings multiple can still imply upside from here? The full narrative unpacks the step by step math behind that gap.

Result: Fair Value of $93.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent benefit ratio pressure and lingering long term care uncertainties could easily derail those margin assumptions and cap the upside implied by the narrative.

Find out about the key risks to this Unum Group narrative.

Another Angle on Valuation

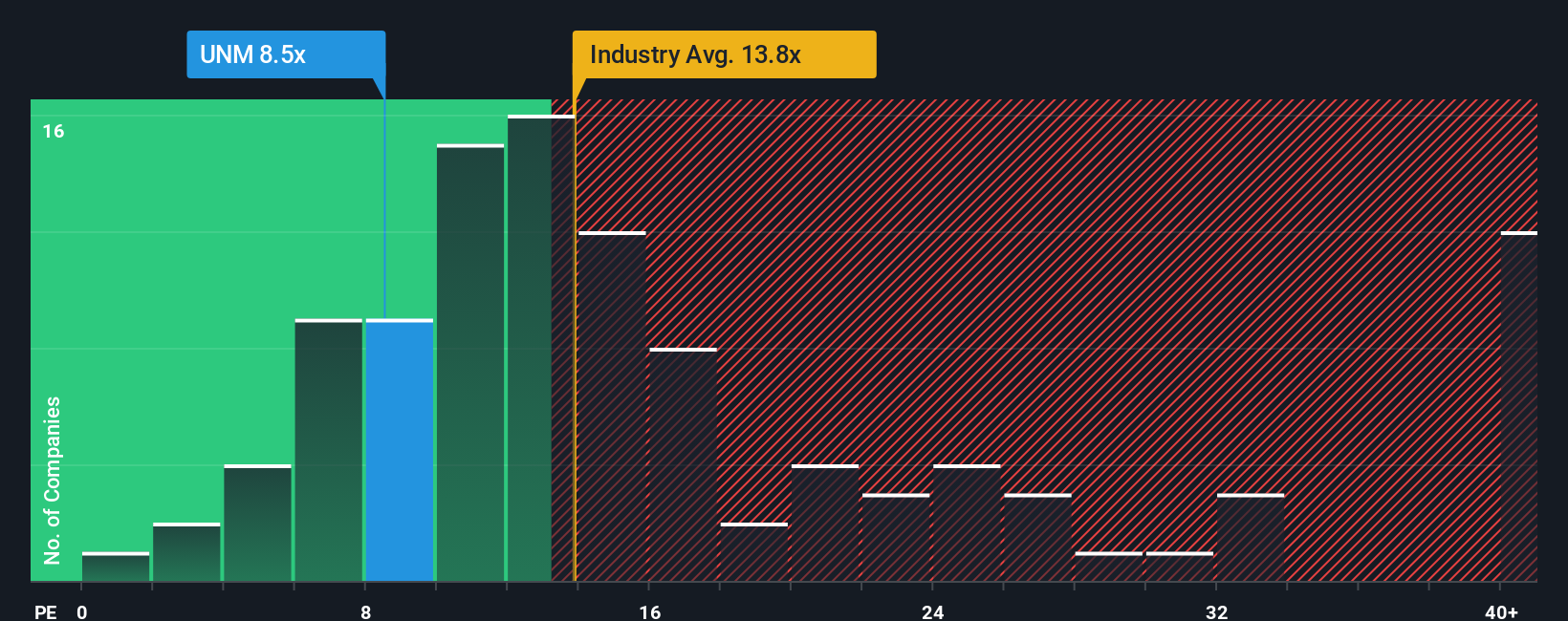

Step away from narratives and the market’s own numbers look more cautious. On a price to earnings basis, Unum trades at 13.6 times versus 9 times for close peers and 13.3 times for the wider US insurance group, even though our fair ratio suggests 18.8 times may be justified. That gap hints at upside, but also raises the risk that any earnings wobble could trigger a sharper de rating than the story implies. The question is: which signal do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unum Group Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom Unum story in minutes: Do it your way.

A great starting point for your Unum Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to uncover stocks that fit your exact strategy and risk profile.

- Capture potential income by scanning these 14 dividend stocks with yields > 3% to find ideas that may strengthen your portfolio’s cash flow and reduce reliance on capital gains alone.

- Position yourself ahead of major tech shifts by targeting these 24 AI penny stocks, where innovation and growth expectations are reshaping entire sectors.

- Strengthen your margin of safety by hunting through these 932 undervalued stocks based on cash flows that the market may still be underpricing based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNM

Unum Group

Provides financial protection benefit solutions in the United States, the United Kingdom, and Poland.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026