- United States

- /

- Insurance

- /

- NYSE:TRV

Are Mixed Analyst Views on Travelers (TRV) Signaling Uncertainty About Management's Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Travelers Companies announced its quarterly earnings for the period ended September 30, 2025, reporting revenue growth in line with analyst forecasts and ongoing attention due to mixed analyst opinions and recent insider share sales.

- Market sentiment toward the company remains divided, as some analysts have issued positive ratings while others highlight concerns amid increased insider selling activity.

- We'll explore how the anticipation surrounding Travelers' earnings and analyst sentiment update its investment narrative as shifting market expectations unfold.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Travelers Companies Investment Narrative Recap

To be a shareholder in Travelers Companies, you need to believe in the firm's ability to manage insurance risk through disciplined underwriting and innovation, despite sector headwinds like severe weather claims and competitive auto markets. The upcoming earnings news aligns with consensus forecasts, so it doesn’t materially change the focus on weather-driven catastrophe losses as the main short-term catalyst, while increased insider selling remains a key risk that is drawing attention from both analysts and the market.

Of the recent company announcements, the quarterly dividend increase to US$1.10 per share stands out. It signals management’s ongoing confidence in Travelers' earnings stability, even as market participants monitor climate-driven claims and pressure on combined ratios.

In contrast, investors should also be mindful of heightened insider selling, this is information that could signal…

Read the full narrative on Travelers Companies (it's free!)

Travelers Companies is expected to reach $49.1 billion in revenue and $5.0 billion in earnings by 2028. This outlook is based on a forecast annual revenue decline of 0.9% and a $0.2 billion decrease in earnings from the current $5.2 billion.

Uncover how Travelers Companies' forecasts yield a $293.65 fair value, a 9% upside to its current price.

Exploring Other Perspectives

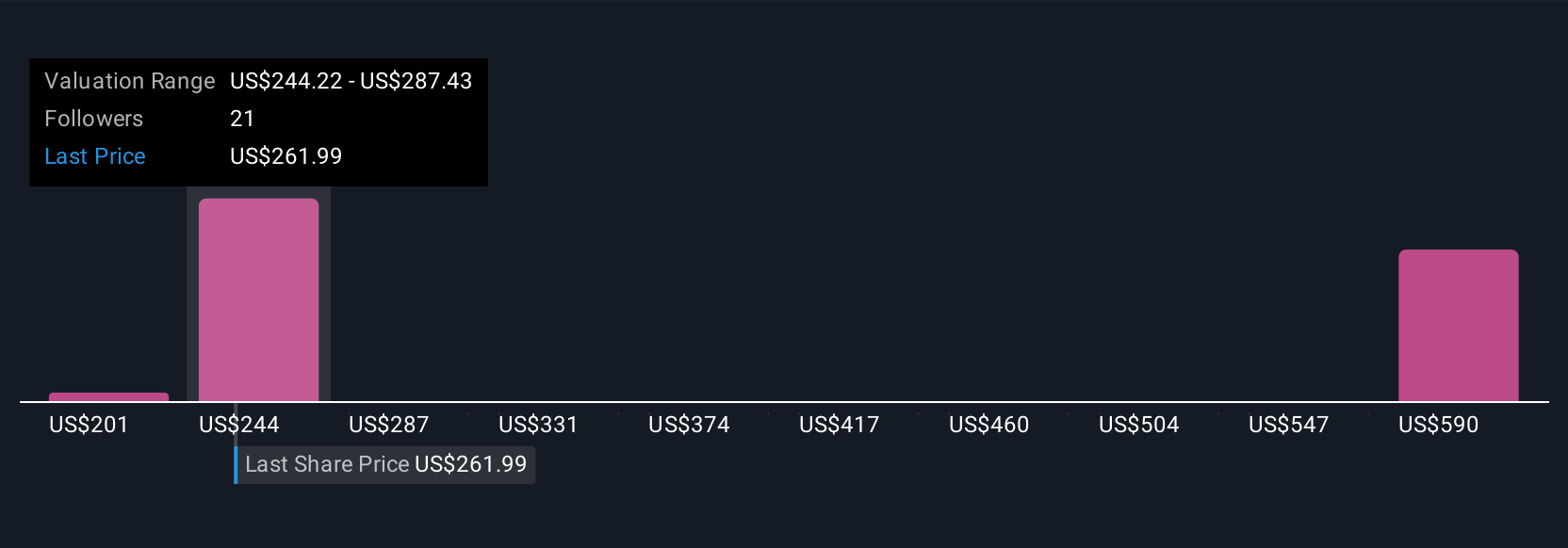

Four members of the Simply Wall St Community estimate Travelers' fair value between US$228.84 and US$592.96 per share, illustrating wide-ranging expectations. As you consider these varied outlooks, remember that catastrophe losses remain a significant risk to future profitability and long-term returns.

Explore 4 other fair value estimates on Travelers Companies - why the stock might be worth over 2x more than the current price!

Build Your Own Travelers Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travelers Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Travelers Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travelers Companies' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travelers Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRV

Travelers Companies

Through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives