- United States

- /

- Insurance

- /

- NYSE:STC

Stewart Information Services (STC): Evaluating Current Valuation Following Recent Share Price Swings

Reviewed by Kshitija Bhandaru

Stewart Information Services (STC) has seen its stock navigate both ups and downs over the past month, with its share price recently closing at $67.88. Investors are keeping an eye on its performance, especially given fluctuations in the insurance sector.

See our latest analysis for Stewart Information Services.

Zooming out, Stewart Information Services’ share price has put in a strong 90-day performance, gaining 19.4%. However, some momentum has faded recently with a one-month share price return of -8.85%. Over the past year, the total shareholder return has been modest at just above 1%. Those who have held for three to five years are seeing gains of over 70%. Overall, the stock has demonstrated its ability to rebound from near-term dips even as valuation concerns persist for some investors.

If sector shifts or recent swings have you curious, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With analysts setting a higher price target and ongoing discussions about valuation, the big question now is whether Stewart Information Services is trading below its true worth or if the market is already factoring in the company’s future growth prospects.

Most Popular Narrative: 10.6% Undervalued

With Stewart Information Services recently closing at $67.88 and the most-followed narrative placing fair value at $75.90, the narrative suggests there is significant upside if projections hold true. Investors should note how the narrative relies on sector and operational developments to support its higher fair value expectations.

The company is experiencing significant growth in its Title segment, specifically in commercial services and asset classes like retail and energy, which could positively impact revenue and pretax income. Strategic acquisitions in targeted Metropolitan Statistical Areas (MSAs) are anticipated to drive growth, increasing future revenue and earnings.

Curious how these forecasts add up to a much higher price than today's close? The explanation lies in aggressive revenue and profit margin projections, as well as a major shift in profit multiples. Want to see the bold assumptions that could deliver such a surprising valuation? Unlock all the details inside the full narrative now.

Result: Fair Value of $75.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high operating costs or continued stagnation in the housing market could challenge these optimistic projections and slow future gains for Stewart Information Services.

Find out about the key risks to this Stewart Information Services narrative.

Another View: Are Multiples Telling a Different Story?

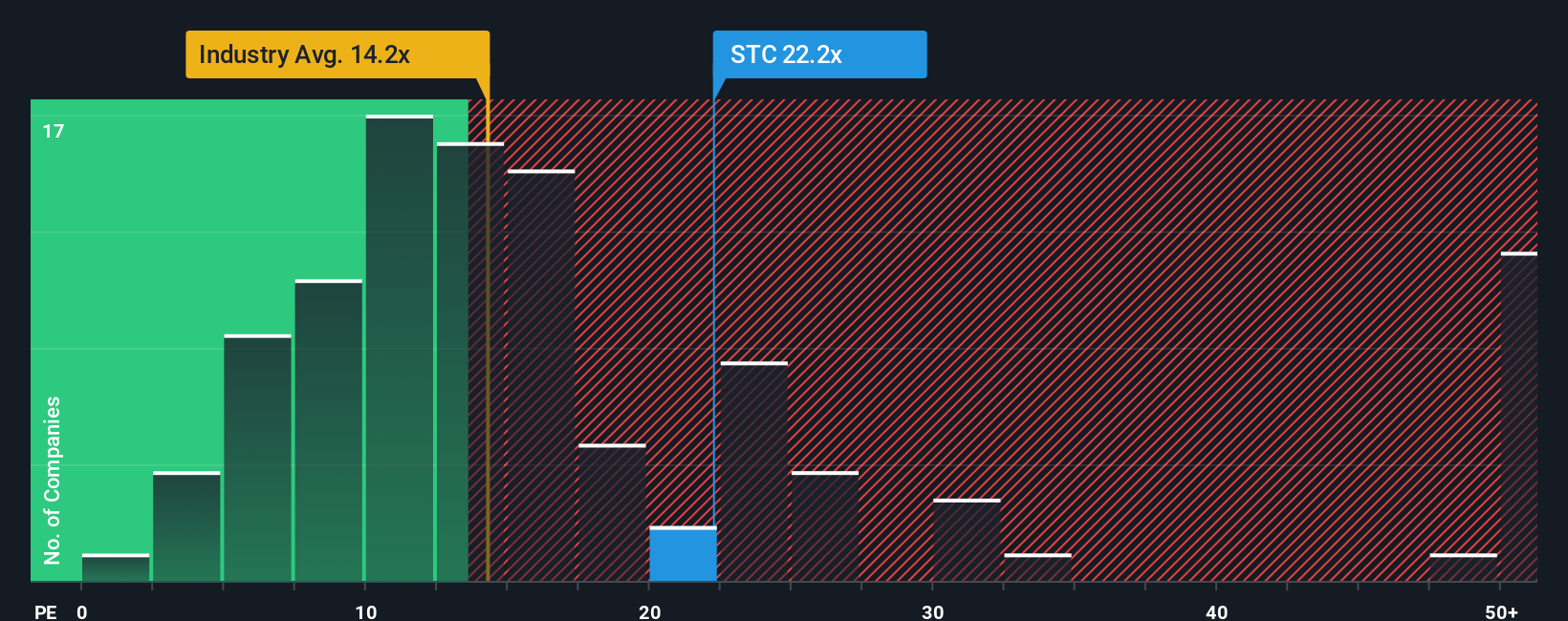

Looking from the market multiples angle, Stewart Information Services trades at a price-to-earnings ratio of 21.6x, which is markedly higher than both its peer average of 12x and the broader industry at 13.8x. This premium suggests the market is pricing in a lot of optimism and may amplify risk if future growth falls short. The fair ratio, calculated from market trends, could pull valuations lower if sentiment shifts. Is the current premium truly deserved, or does it signal caution for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stewart Information Services Narrative

If you have a different perspective or want to dig deeper into the data, you can put together your own view in just a few minutes. Do it your way

A great starting point for your Stewart Information Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The market never sleeps, and there are always fresh opportunities waiting. Don’t let the next big winner slip away. Equip yourself with powerful tools tailored for smart investors.

- Tap into fast-growing themes by checking out these 25 AI penny stocks, which are shaking up industries with advanced machine learning and automation.

- Spot hidden value and zero in on these 891 undervalued stocks based on cash flows, which are quietly trading well below their intrinsic worth.

- Grow your portfolio with regular income by exploring these 18 dividend stocks with yields > 3%, offering consistent yields over 3% and solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STC

Stewart Information Services

Through its subsidiaries, provides title insurance and real estate transaction related services in the United States and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives