- United States

- /

- Insurance

- /

- NYSE:SPNT

SiriusPoint (SPNT): Exploring Valuation Perspectives Following Recent Steady Performance

Reviewed by Kshitija Bhandaru

SiriusPoint (SPNT) has maintained a steady profile as investors assess recent trends in the insurance sector. The company’s stock movement over the past month has been relatively muted. This has encouraged a closer look at its fundamentals and performance.

See our latest analysis for SiriusPoint.

SiriusPoint’s share price has charted a measured path recently, but the bigger picture tells the real story. Its 17.2% year-to-date share price return shows meaningful progress, and the 1-year total shareholder return of 35.5% highlights strong ongoing momentum. Over three and five years, those total returns climb to 269% and 130.6% respectively, reinforcing that long-term investors have been well rewarded as market sentiment has improved around the company’s fundamentals.

If you’re interested in broadening your watchlist, now’s an ideal time to discover fast growing stocks with high insider ownership.

With shares still trading well below analyst price targets, SiriusPoint draws attention. Is the stock trading at a discount with more room to run, or is the current price already factoring in the company’s improved outlook?

Most Popular Narrative: 32.9% Undervalued

At a last close of $18.45, the most widely followed narrative assigns SiriusPoint a fair value of $27.50. This places the stock well below what analysts expect based on growth and improving margins.

SiriusPoint is well-positioned to benefit from rising global demand for reinsurance capacity and specialized insurance solutions amid increasing climate-driven catastrophes and the globalization of complex risks. This supports forward premium growth and higher rates, which should lift revenues and gross written premiums over time.

What is driving this sharp uptick in value? The narrative hinges on SiriusPoint’s ability to dramatically grow both revenue and profit margins over the next few years. Want to see exactly which bold projections back up this price jump? Don’t miss the key figures and underlying logic in the full narrative.

Result: Fair Value of $27.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note that SiriusPoint's growth could falter if new MGA partnerships underperform or if market competition intensifies, which could impact revenue and margins.

Find out about the key risks to this SiriusPoint narrative.

Another View: Multiples Tell a Different Story

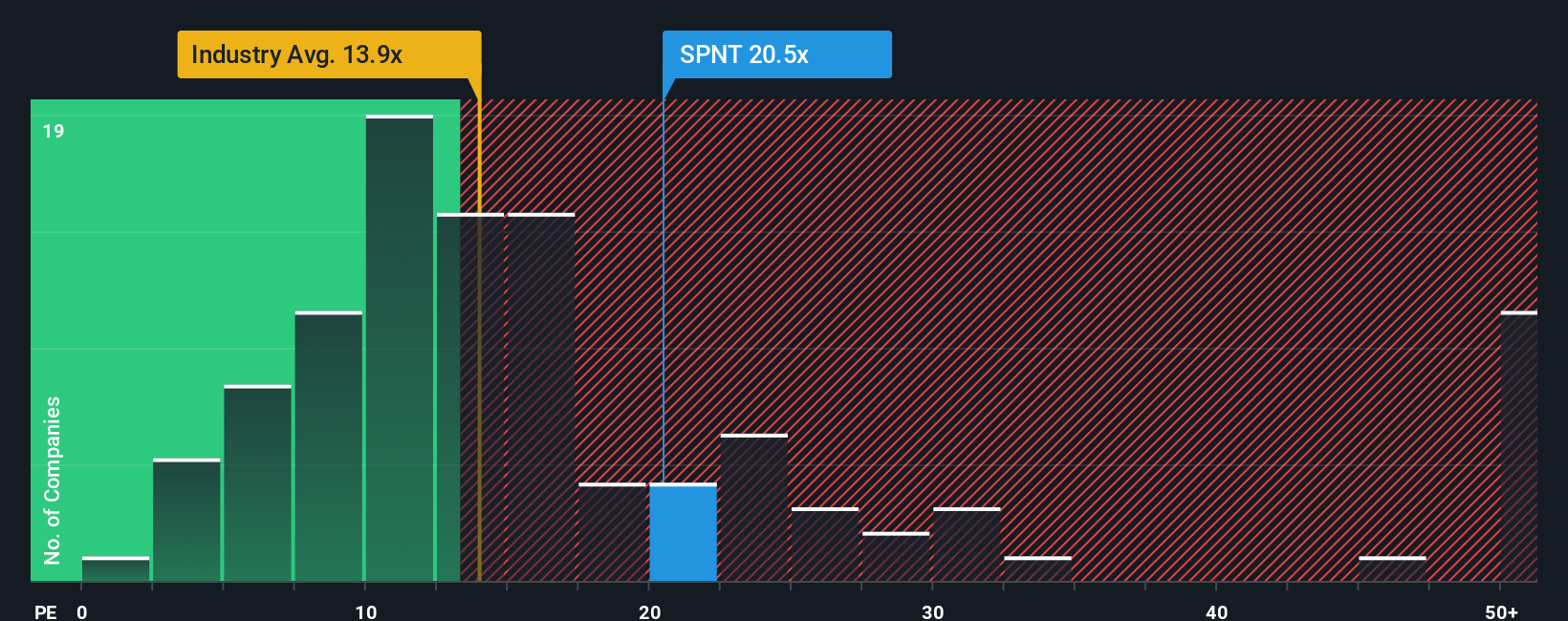

While the narrative valuation points to SiriusPoint being undervalued, our look at its price-to-earnings ratio raises questions. At 20.4x earnings, SiriusPoint is trading well above both the peer average (13.1x) and the US Insurance industry average (13.9x). This gap suggests the market is pricing in a lot of optimism, and there could be downside risk if growth stalls. For context, the fair ratio sits at 34.3x as a distant long-term benchmark. Which perspective will prove more accurate as events unfold?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SiriusPoint Narrative

Not convinced by the current outlook, or want to dig a bit deeper? You can quickly assemble your own view based on the latest data. Give it a try in just a few minutes with Do it your way.

A great starting point for your SiriusPoint research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investing universe with opportunities you won’t want to miss. The Simply Wall St Screener surfaces market movers and hidden gems across different themes for every kind of investor.

- Escape the ordinary and seize rapid-growth potential with these 3580 penny stocks with strong financials, which are at the forefront of innovation and strong financial performance.

- Lock in consistent returns by targeting these 19 dividend stocks with yields > 3% that offer reliable yields above 3% for income-focused portfolios.

- Tap into high-impact breakthroughs by selecting these 33 healthcare AI stocks, which is revolutionizing the future of healthcare with cutting-edge AI solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPNT

SiriusPoint

Provides multi-line reinsurance and insurance products and services worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives