- United States

- /

- Insurance

- /

- NYSE:PRU

Prudential Financial (PRU): Evaluating Valuation After Recent Fixed-Income Offerings and Debt Issuance

Reviewed by Simply Wall St

Most Popular Narrative: 8.5% Undervalued

According to the most widely followed narrative, Prudential Financial appears to be trading below its estimated fair value, with a notable discount suggesting future upside if projections hold true.

“The ongoing shift from public to private retirement savings, along with recent and future retirement reforms, is increasing reliance on annuities and asset management products. These are core segments for Prudential and support fee-based revenue and earnings growth opportunities. Expansion into high-growth international markets, such as the continued buildout and success in Brazil and product innovation in Asia, enables Prudential to benefit from the expanding global middle class. This enhances top-line growth and future premium volume.”

Curious how Prudential’s bold transformation and ambitious international expansion might shape the next decade? This narrative hinges on game-changing profit targets and margin shifts that could put the company in a whole new league. Want to see what really drives that double-digit upside? Prepare to be surprised by what’s baked into this fair value estimate.

Result: Fair Value of $115.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing competition and regulatory changes could disrupt Prudential’s earnings momentum and challenge its current valuation story.

Find out about the key risks to this Prudential Financial narrative.Another View: What Do Market Ratios Say?

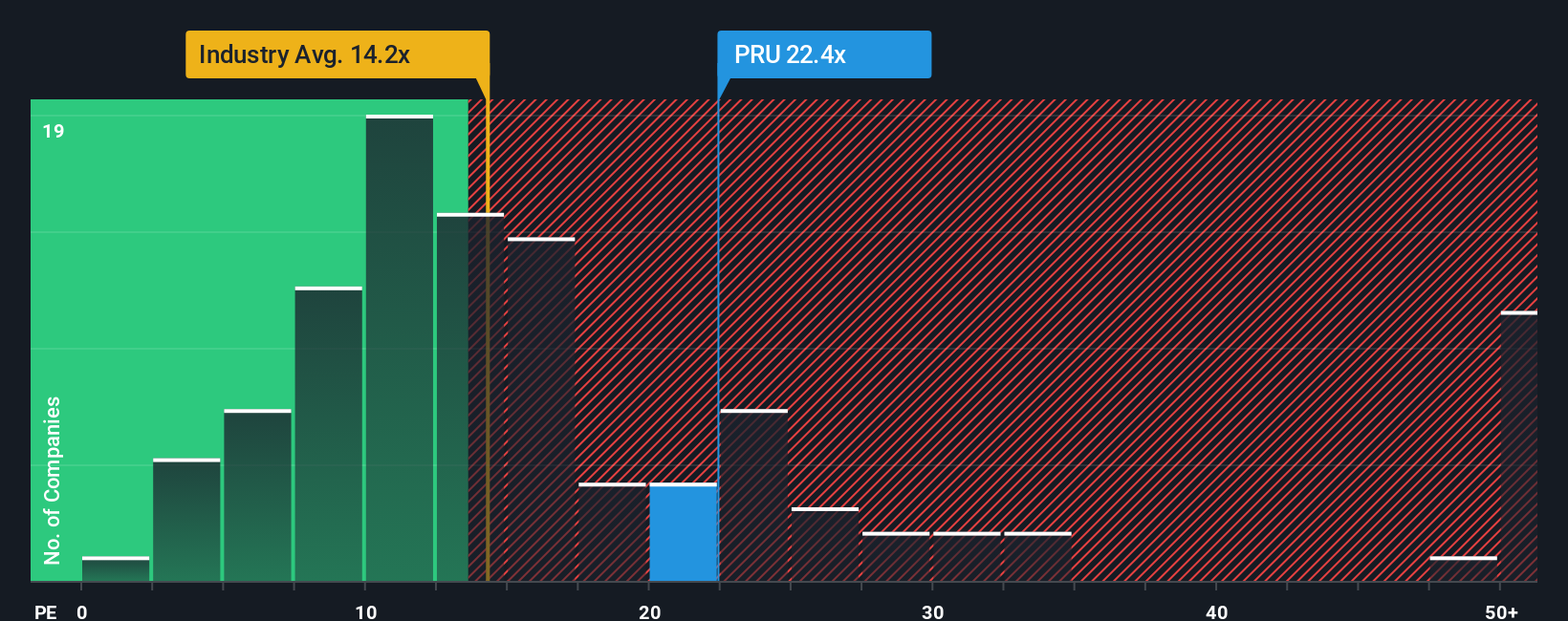

Taking a step back from analyst forecasts, a look at market ratios suggests Prudential may not be as cheap as it looks. Compared to the US Insurance industry, its share price appears relatively expensive. This raises the question of whether the market is pricing in more risk or uncertainty than the fundamentals show.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prudential Financial Narrative

If you see things differently or want a hands-on look at the data, you can craft your own story and perspective in just a few minutes: Do it your way.

A great starting point for your Prudential Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Smart Investment Move?

Countless unique opportunities are waiting just beyond the obvious picks. Supercharge your portfolio with smart ideas you might otherwise miss. Let Simply Wall Street’s powerful screener help you spot leaders in the making.

- Target reliable income streams and amplify your cash flow by checking out dividend stocks with yields > 3% offering yields above 3%.

- Snap up emerging tech winners and ride the AI wave with our selection of AI penny stocks that are powering tomorrow’s innovation.

- Capitalize on undervalued opportunities and spot stocks trading well below their potential through our expertly curated undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PRU

Prudential Financial

Provides insurance, investment management, and other financial products and services in the United States, Japan and internationally.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in