- United States

- /

- Insurance

- /

- NYSE:PRI

Primerica (PRI): Evaluating Whether Recent Share Price Weakness Signals a Valuation Opportunity

Reviewed by Simply Wall St

Primerica (PRI) has quietly lagged the broader market this year, even as its core term-life and investment products keep generating steady revenue and earnings growth. That disconnect is exactly what makes the stock interesting now.

See our latest analysis for Primerica.

The steady business performance has not stopped sentiment from cooling. The share price at $252.84 translates into a weaker year to date share price return, while the three and five year total shareholder returns still point to strong long term compounding. This suggests that momentum has faded in the near term, but the longer narrative remains constructive.

If Primerica’s tempered momentum has you rethinking where growth might come from next, it could be worth exploring fast growing stocks with high insider ownership as a fresh set of ideas.

With earnings still climbing and the share price now sitting at a discount to analyst targets, investors face a key question: Is Primerica undervalued after its recent pullback, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 16.3% Undervalued

With Primerica closing at $252.84 against a narrative fair value of $302, the current share price implies the market is not fully embracing the long term earnings path baked into that estimate.

Analysts expect earnings to reach $775.3 million (and earnings per share of $26.02) by about September 2028, up from $707.5 million today.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, up from 12.4x today.

If you want to see what is powering that higher earnings base and richer multiple, yet still below sector norms, in a slow growing insurer, explore the full narrative to unpack the revenue runway, margin trajectory, and share count assumptions that are embedded in that fair value.

Result: Fair Value of $302 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost of living pressures and weaker productivity across Primerica’s sales force could slow policy growth and undermine the earnings and valuation narrative.

Find out about the key risks to this Primerica narrative.

Another Angle on Valuation

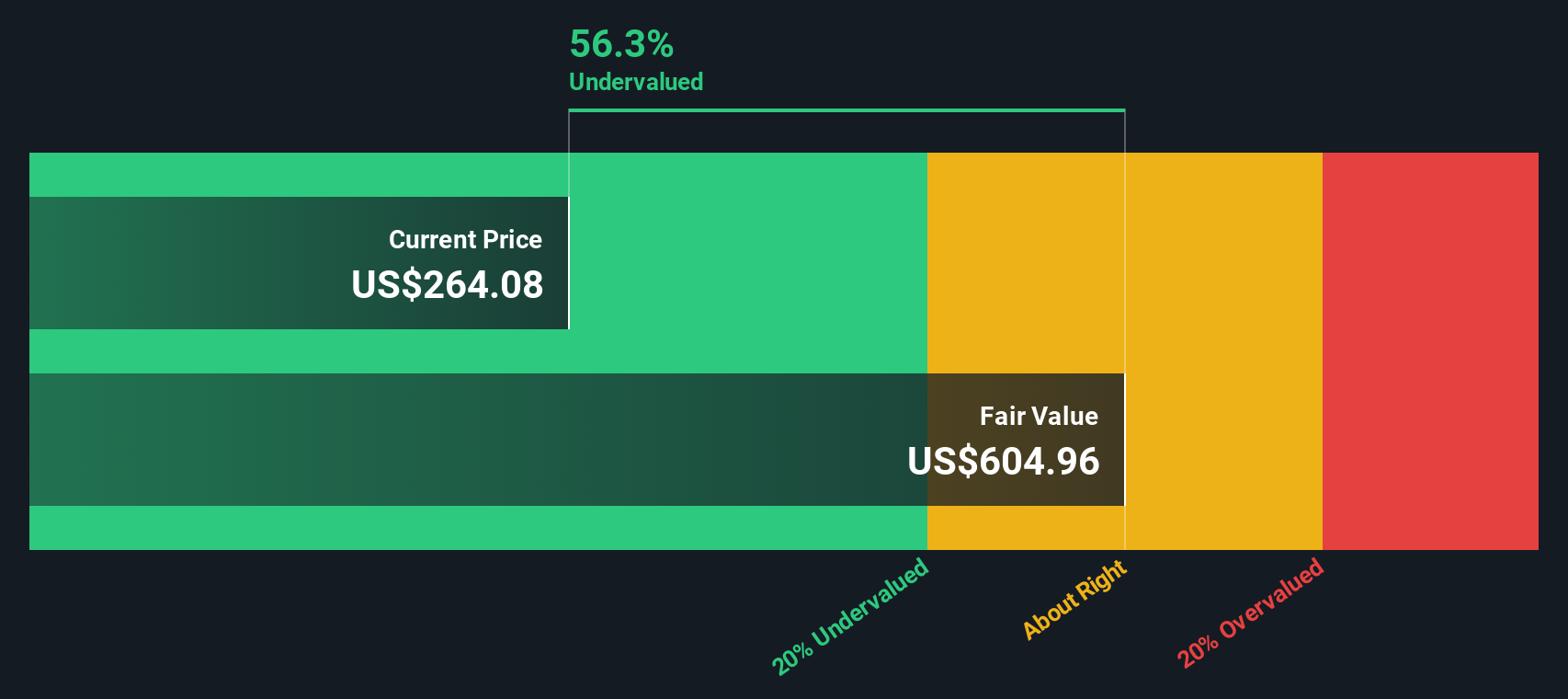

While the narrative fair value pegs Primerica at a moderate 16.3% discount, our DCF model is far more optimistic. It suggests the shares trade roughly 59% below fair value at $619.1. Is the market deeply mispricing long term cash flows, or is the model too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Primerica Narrative

If you see the story unfolding differently, or prefer to dive into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Primerica research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with Primerica, you may overlook standout opportunities the Simply Wall Street Screener flags every day, so put it to work and stay ahead.

- Capitalize on mispriced quality by scanning these 899 undervalued stocks based on cash flows that the market has yet to fully recognize.

- Harness structural tailwinds in medicine by targeting these 30 healthcare AI stocks shaping the next decade of healthcare innovation.

- Ride early-stage momentum by focusing on these 3588 penny stocks with strong financials where improving fundamentals can quickly transform sentiment and returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRI

Primerica

Provides financial products and services to middle-income households in the United States and Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026