- United States

- /

- Insurance

- /

- NYSE:PGR

Should Investors Revisit Progressive After Recent Claims Data and Three-Year 113% Share Surge?

Reviewed by Bailey Pemberton

Thinking about what to do with Progressive’s stock right now? You are definitely not alone. With so much buzz around insurance companies and a share price that has put up some eye-popping long-term returns, Progressive is on the radar of a lot of investors trying to figure out if it is time to buy, sell, or just hold tight.

Short-term, it has been a bit of a mixed bag. Over the last week, Progressive’s shares slipped 2.3%, while the past month brought a slightly larger dip of 3.3%. For 2024 as a whole, shares are basically flat, down just 0.3%. If you zoom out, the growth story becomes clear. Over the past three years, Progressive has risen 113.3%, and in the last five years, it is up an impressive 174.4%.

Mood shifts in the broader market and changing attitudes toward risk have played a role in these price moves. Progressive’s ability to weather storms and an industry-wide focus on profitability have kept many investors watching closely for signs of undervaluation or overheating.

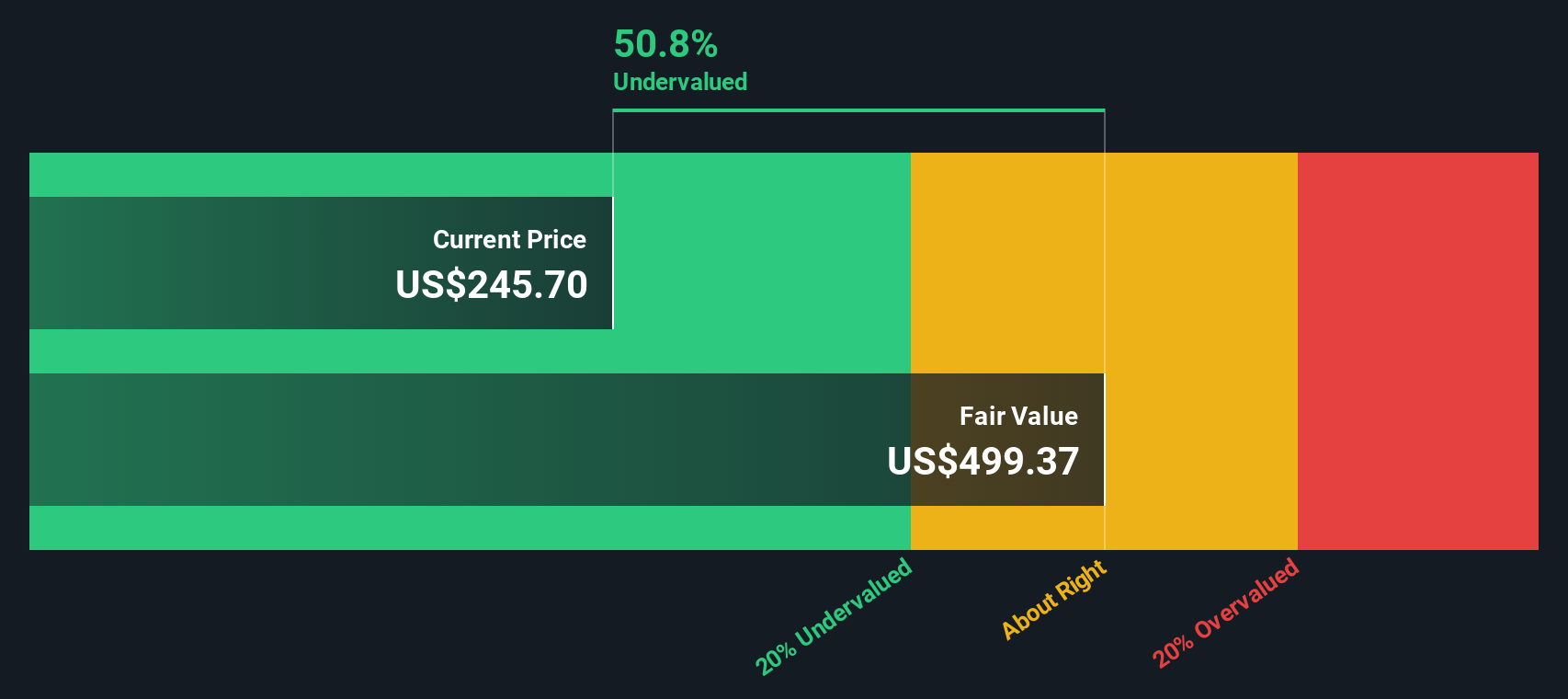

The question remains—is Progressive undervalued today, or are those long-term gains already fully factored in? Our valuation score, which tallies up 1 point for every out of 6 checks where a stock looks underpriced, comes in at a solid 3 for Progressive. That means the company is looking undervalued by half of the major measures we track.

Here is a breakdown of exactly what these valuation approaches are telling us about Progressive. There is also an even smarter way to judge value coming up at the end of the article.

Why Progressive is lagging behind its peers

Approach 1: Progressive Excess Returns Analysis

The Excess Returns valuation model focuses on how much value a company generates over and above the cost of capital, by measuring its returns on invested equity compared to what shareholders require. This approach is particularly relevant for financial firms like Progressive, where return on equity plays a central role in long-term performance.

According to the model, Progressive’s Book Value stands at $55.62 per share, with stable Earnings Per Share projected at $20.88, based on weighted Return on Equity estimates from 11 analysts. The company’s average Return on Equity is a robust 28.14%, while the Cost of Equity is estimated at $5.03 per share. The derived Excess Return, or the value generated beyond that required by investors, is a strong $15.86 per share. Looking ahead, the stable Book Value is forecast to rise to $74.20 per share according to the same analyst set.

This analysis calculates an intrinsic value that implies Progressive’s shares are trading at a 52.3% discount. This suggests the stock is substantially undervalued relative to its potential to earn above the required return for shareholders. The model’s result indicates a highly attractive valuation for long-term investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests Progressive is undervalued by 52.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Progressive Price vs Earnings

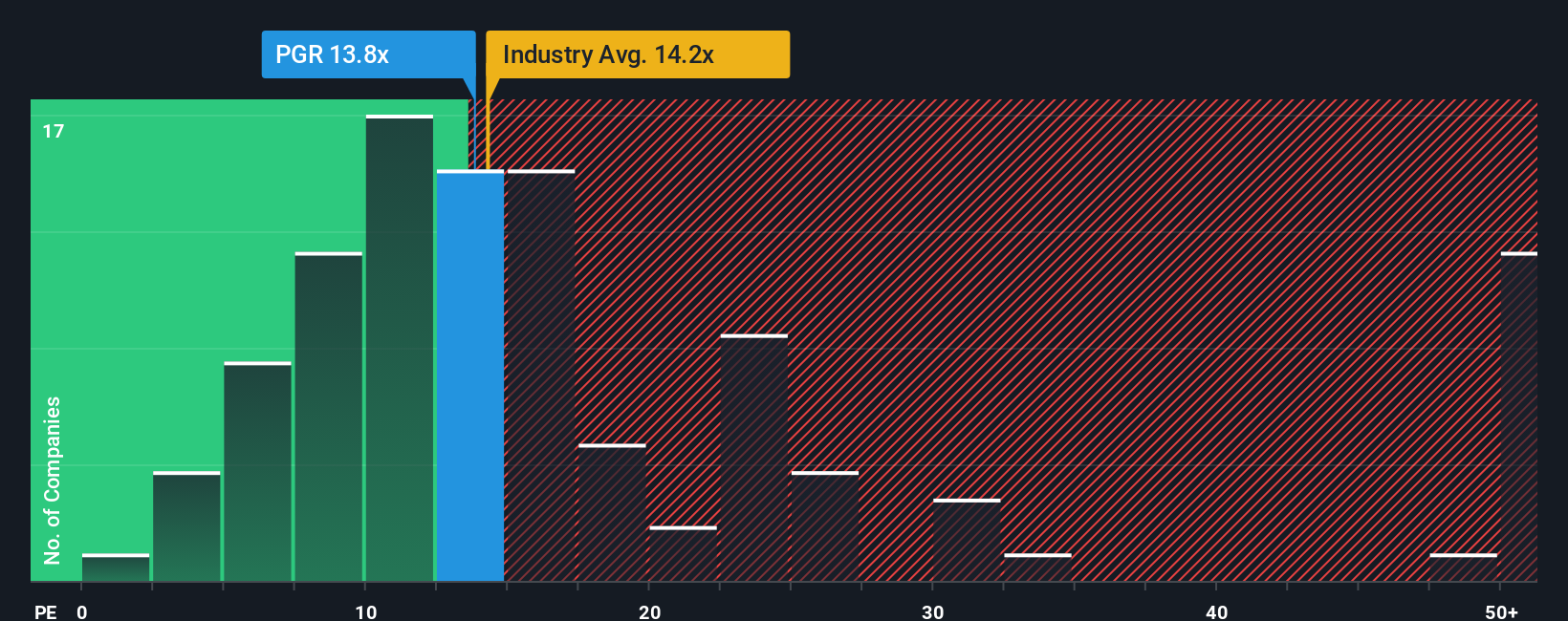

The Price-to-Earnings (PE) ratio is a widely used valuation tool, especially for profitable companies like Progressive. It helps investors understand how much the market is willing to pay for each dollar of current earnings. Since Progressive has consistent profitability, the PE ratio offers a straightforward way to compare its valuation against peers and industry norms.

A company’s "normal" or fair PE ratio is shaped by its expected earnings growth, the perceived stability or risk of those earnings, and how its profitability stacks up within its sector. Higher growth prospects and financial resilience usually warrant a higher PE, while greater risk can push it lower.

Currently, Progressive trades at a PE ratio of 13.5x. This is slightly below the Insurance industry average of 13.8x and above the average of its peers at 10.7x. Simply Wall St’s proprietary "Fair Ratio," which accounts for specific factors like Progressive’s earnings growth outlook, industry, profit margins, market cap, and unique risks, stands at 11.9x. The Fair Ratio is considered a better benchmark than industry or peer averages because it tailors the multiple to Progressive’s actual business profile, not just broad market trends.

With the current PE sitting modestly above the Fair Ratio, Progressive’s valuation through this lens looks a little rich, but not dramatically so.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Progressive Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In simple terms, a Narrative is the story you believe about a company based on your own perspective about where its business is headed. This understanding then drives your expectations for future revenue, earnings, and margins. On Simply Wall St’s platform, Narratives allow you to connect your outlook for Progressive to tangible forecasts and a calculated fair value, making it much easier to see if you think the stock is a buy, hold, or sell at current prices.

Narratives are an accessible and intuitive tool found on the Community page, where millions of investors share and compare their own views on companies like Progressive. By using Narratives, you can keep your valuation up to date as new company news or results come out, since forecasts and fair values update dynamically as information changes. For example, some investors see Progressive’s technological innovations and industry leadership propelling revenue toward $150 billion by 2034 and assign a fair value far above current prices. More cautious investors, on the other hand, anticipate slower margin growth and use lower future revenue estimates, arriving at a much more conservative fair value.

Do you think there's more to the story for Progressive? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives