- United States

- /

- Insurance

- /

- NYSE:PGR

Progressive (PGR) Margin Improvement Reinforces Bullish Narratives Despite Forecast for Earnings Decline

Reviewed by Simply Wall St

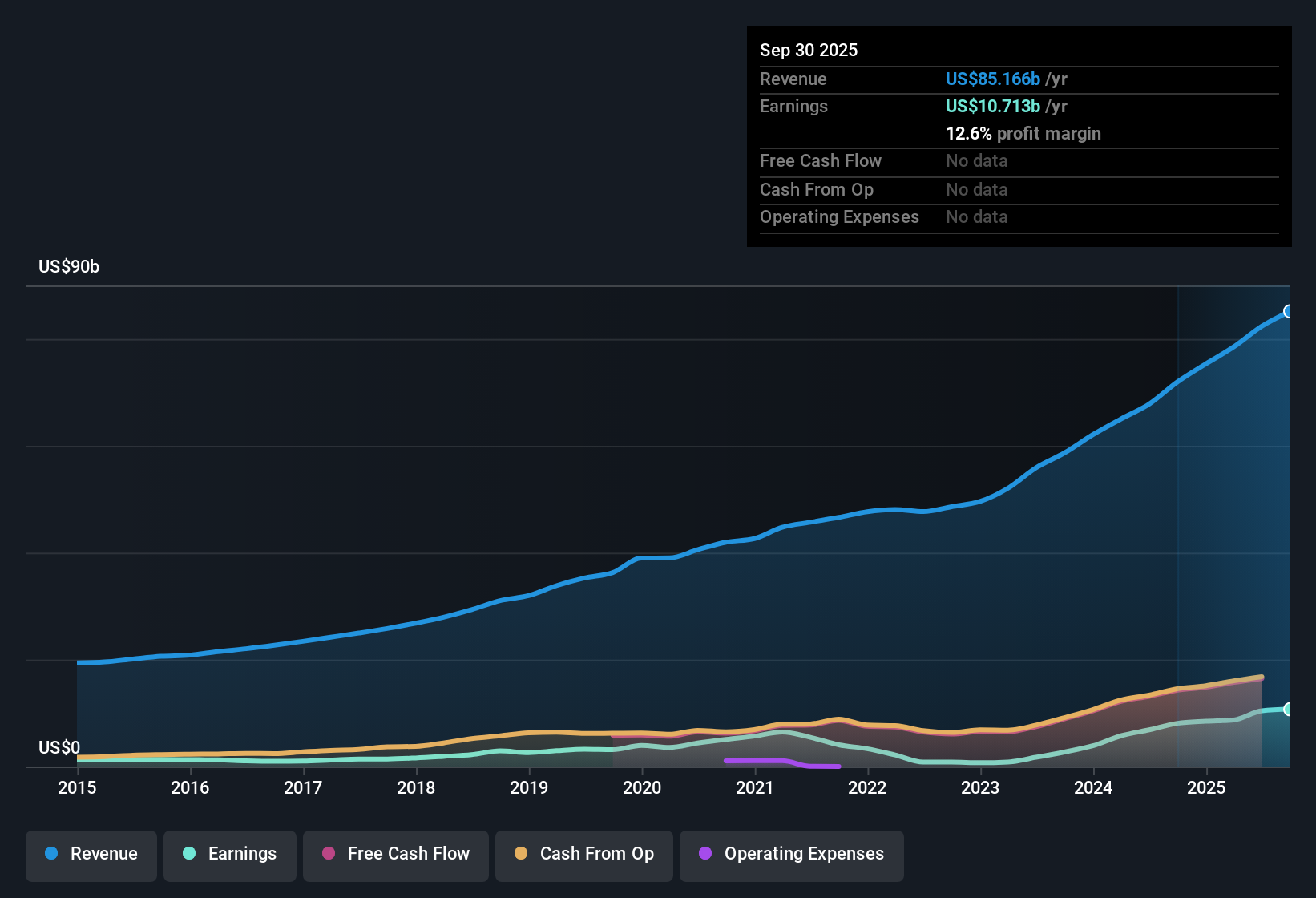

Progressive (PGR) posted net profit margins of 12.6%, up from 11.2% last year, with earnings growth reaching 32.5%, well ahead of its five-year average of 22.2% per year. Despite this period of strong and accelerating profits, forecasts call for earnings to dip at an annual rate of 4.8% over the next three years, while revenue is expected to rise at 7.6% per year, below the broader US market’s 10% pace. Investors are left weighing solid historical growth and improved margins against a more cautious outlook for future gains and income reliability.

See our full analysis for Progressive.Next, let’s see how these figures stack up against the wider narratives that shape market sentiment around Progressive. Some expectations could be confirmed, while others may face new questions.

See what the community is saying about Progressive

Profit Margin Forecast Narrows

- Analysts expect Progressive’s profit margins to shrink from 12.7% currently to 9.0% within three years, marking a significant decline in expected profitability versus prior trends.

- The consensus narrative points out the company's ongoing investments in data analytics and telematics, which have bolstered recent margins. However, rising claim costs and regulatory changes may erode this advantage.

- While advanced analytics have supported superior profitability until now, intensifying competition and cost inflation risk reducing future margins.

- Even with technological leadership, the consensus notes that evolving auto claims and stricter regulations could pressure results more than recent trends suggest.

- Bulls and bears alike will want to see if management can keep margins resilient as headwinds pick up, especially with forecasts indicating a nearly 400-basis-point squeeze. 📊 Read the full Progressive Consensus Narrative.

P/E Ratio Signals Relative Value, But Gap Grows Versus Peers

- Progressive is trading at a lower price-to-earnings ratio compared to the US insurance industry average but stands at a premium to its direct peer group by this same metric.

- The consensus narrative reflects on this valuation tension:

- Trading beneath sector averages enhances the perception of value. However, paying more than direct competitors could limit upside if growth falls short of expectations.

- Consensus analysts expect the price-to-earnings ratio to rise from 13.7x today to 21.5x by 2028, surpassing the current industry level (14.3x) and implying faith in future earnings stability, even as margin forecasts soften.

Analyst Price Target Outpaces Current Share Price

- The analyst consensus price target is $271.53, a roughly 20% premium over the latest share price of $226.50, despite projected declines in earnings through 2028.

- The consensus narrative highlights a disconnect between forecast weakness and optimism on valuation:

- Despite lower earnings expected in the next few years, analysts project that Progressive’s scale and technology will drive long-term market share gains and price recovery.

- This outlook depends on revenue reaching $106.0 billion and margins compressing only modestly, a view that could be tested if competitive and cost pressures intensify beyond today’s forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Progressive on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Share your perspective and shape your own narrative. It only takes a few minutes. Do it your way

A great starting point for your Progressive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Progressive faces compressing profit margins and rising valuation risks, with analyst forecasts calling for weaker earnings and less upside than sector peers.

If you want more consistent performance in your portfolio, check out stable growth stocks screener (2094 results) to discover companies that prioritize stable revenue and earnings growth in any market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives