- United States

- /

- Insurance

- /

- NYSE:PGR

Progressive (NYSE:PGR) Teams With DC For In-App Safety Feature Highlight At Superman Premiere

Reviewed by Simply Wall St

Progressive (NYSE:PGR) recently announced a collaboration with DC and Warner Bros. to promote its Accident Response feature at the Superman film premiere. This marketing initiative aligns with the company's broader promotional strategy, yet the price moved 3% over the last quarter. Additionally, the decline could have been influenced by the broader market and trade uncertainties, with the Dow flat due to tariff news. Progressive's active dividend strategy and share buyback efforts may have provided some underpinning stability, but these efforts coincided with broader market volatility, reflecting mixed investor sentiment.

The collaboration with DC and Warner Bros. to promote Progressive's Accident Response feature is a step toward enhancing brand visibility. This initiative aligns with the company's strategy to leverage partnerships, potentially contributing to revenue streams by attracting new policyholders. However, despite potential long-term benefits from increased brand recognition, market uncertainties, particularly tariffs, may temper short-term gains in revenue and earnings forecasts.

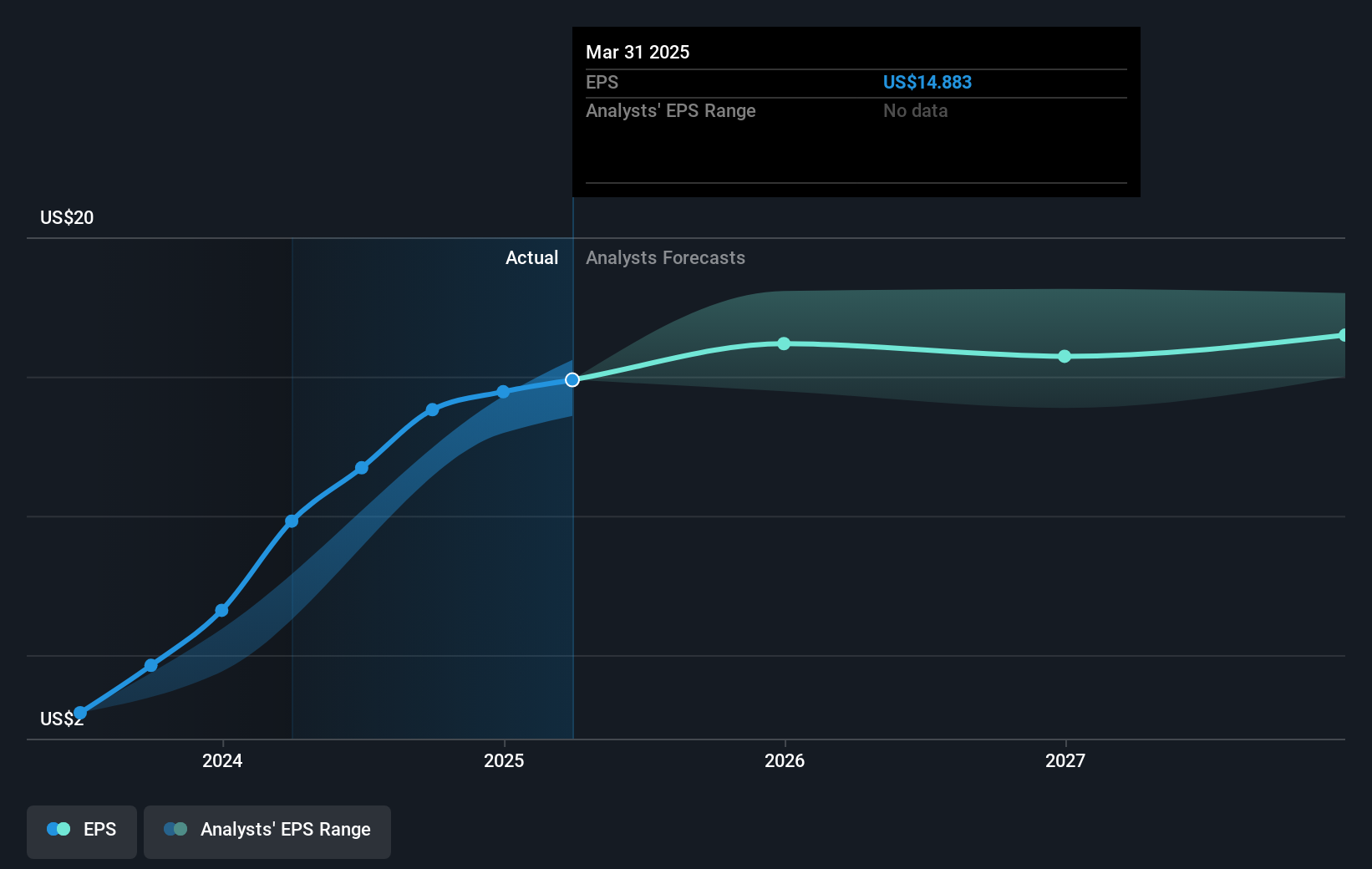

Over the past five years, Progressive's total return, including both share price and dividends, was 248.52%. This significant growth over half a decade highlights the company's consistent value creation for shareholders. In comparison, for the recent year, Progressive has outperformed both the US Insurance industry and the US market, as it achieved higher returns than the 14.5% and 12.5% garnered by the industry and market, respectively.

Current share performance shows a moderate discount to the consensus price target of US$288.57, with the share price at US$283.66, reflecting a 1.7% discount. This suggests analysts believe Progressive is fairly valued, considering the expected revenue growth of 8.2% per year is slightly below the projected industry average of 8.7%. The ongoing market volatility might keep share valuation in check, although the additional branding efforts could help mitigate competitive pressures over the longer term.

The valuation report we've compiled suggests that Progressive's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives