- United States

- /

- Insurance

- /

- NYSE:MET

Will MetLife's (MET) New Cancer Support Offering Reinforce Its Employee Benefits Leadership?

Reviewed by Simply Wall St

- MetLife recently introduced a new Cancer Support benefit, expanding its Critical Illness Insurance to offer personalized care and expert guidance through a collaboration with Private Health Management.

- This initiative addresses the projected rise in cancer cases and significant related financial hardships, enhancing the support and resources available to employees facing a cancer diagnosis.

- We'll examine how MetLife's enhanced cancer support offering could influence analyst expectations for its employee benefits business and future growth.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

MetLife Investment Narrative Recap

Owning MetLife stock means believing in the company's ability to generate resilient earnings from a diverse global insurance and employee benefits platform, while navigating investment margin pressures and evolving digital competition. The launch of the new Cancer Support benefit expands MetLife’s employee benefits offerings and could help reinforce competitive positioning, but is unlikely to materially affect the most significant short-term earnings catalyst, sustained premium growth in key global markets, or offset major risks tied to investment margin compression and reserve volatility.

Among recent company announcements, MetLife’s partnership with Sprout.ai to further automate claims processing aligns most closely with efforts to strengthen core operating efficiency, supporting the same benefits segment impacted by the new cancer initiative. Efficiency gains here remain an important lever as the company seeks to deliver profitable growth amid pressure on investment income.

However, what investors should also be aware of is that despite new product offerings, ongoing low or volatile interest rates remain a...

Read the full narrative on MetLife (it's free!)

MetLife's narrative projects $83.8 billion in revenue and $6.3 billion in earnings by 2028. This requires 4.7% yearly revenue growth and a $2.2 billion increase in earnings from the current $4.1 billion.

Uncover how MetLife's forecasts yield a $91.86 fair value, a 14% upside to its current price.

Exploring Other Perspectives

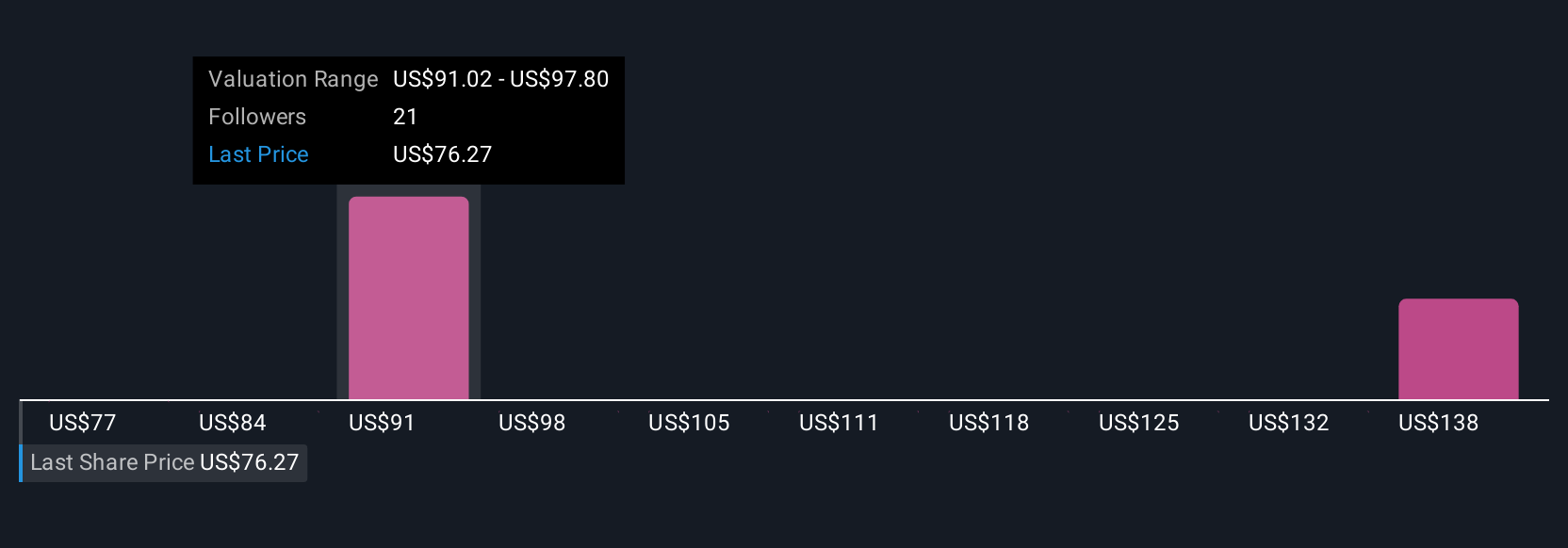

Three fair value estimates from the Simply Wall St Community range from US$77.46 to US$111.95 per share. While opinions cover a broad span, potential compression of investment margins continues to be a widely acknowledged headwind for the company’s outlook, prompting a need to weigh contrasting viewpoints on future performance.

Explore 3 other fair value estimates on MetLife - why the stock might be worth just $77.46!

Build Your Own MetLife Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MetLife research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MetLife research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MetLife's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MET

MetLife

A financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives