- United States

- /

- Insurance

- /

- NYSE:MET

MetLife (NYSE:MET) Shares Down 13% Over A Week As David Herzog Resigns From Board

Reviewed by Simply Wall St

MetLife (NYSE:MET) experienced a 13% decline in its share price over the past week, coinciding with significant executive changes as David L. Herzog announced his resignation from the board. Additionally, the issuance of $1 billion in subordinated debentures on March 13 may have heightened investor concerns regarding the company's financial strategy amid broader market volatility. The larger market also faced turmoil, with the S&P 500 and Nasdaq down 6% and 5.8%, respectively, as global trade tensions raised fears of economic slowdown. These external pressures likely contributed to MetLife's recent share performance alongside internal developments.

Buy, Hold or Sell MetLife? View our complete analysis and fair value estimate and you decide.

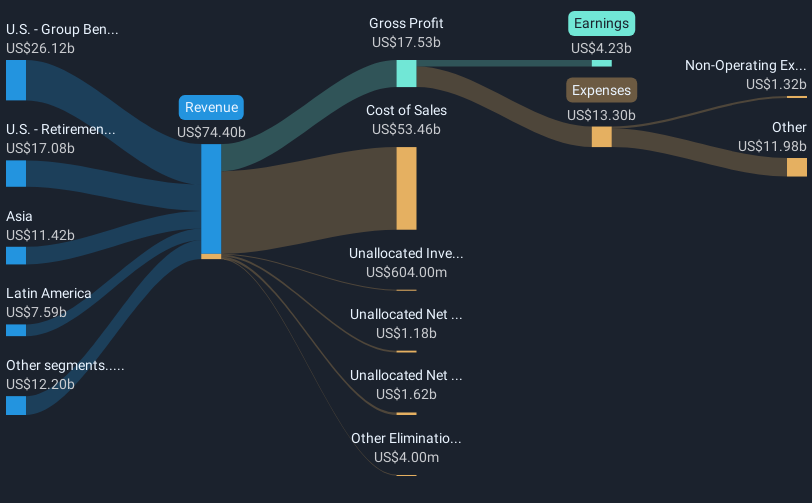

Over the past five years, MetLife delivered a total shareholder return of 130.94%, reflecting a period of substantial growth despite some headwinds. This dramatic growth contrasts with the past year's underperformance against the US market, where MetLife's earnings have excelled but revenue growth projections remain below the broader industry. Noteworthy strategic initiatives, such as the New Frontier strategy and the formation of Chariot Reinsurance Ltd., have been instrumental in expanding its global footprint and diversifying its revenue streams, most recently seen in their collaboration with General Atlantic.

Additionally, the company's commitment to disciplined capital management is evidenced by its share buyback programs, including the repurchase of over 10 million shares, which returns capital to shareholders, and the issuance of $1 billion in subordinated debentures for further financial maneuverability. Earnings announcements have consistently reinforced revenue strength, further solidifying investor confidence through declared dividends across multiple stock series.

Jump into the full analysis health report here for a deeper understanding of MetLife.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MET

MetLife

A financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives