- United States

- /

- Insurance

- /

- NYSE:MET

MetLife (MET) Valuation After $10 Billion Reinsurance Deal and Strong Q3 Results

Reviewed by Simply Wall St

MetLife (MET) has been back on investors radar after finalizing a $10 billion reinsurance deal with Talcott Resolution and posting a strong third quarter, with net income and pension risk transfer activity both climbing.

See our latest analysis for MetLife.

Those capital moves have not yet translated into headline grabbing gains, with the 1 year total shareholder return down 6.6 percent and the share price about 5 percent lower year to date. However, a solid 3 year total shareholder return of roughly 14 percent suggests the longer term trend is still constructive rather than broken.

If MetLife’s repositioning has you rethinking the sector, this could be a good moment to compare it with other major insurers and broader healthcare stocks to see what else fits your portfolio thesis.

With earnings growth strong and a sizeable discount to analyst targets, yet a richer valuation than some peers, investors now face a key question: is MetLife genuinely undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 16.7% Undervalued

With MetLife last closing at $77.51 against a narrative fair value of $93, the valuation gap turns on how durable its growth and margin story really is.

Strong, sustained premium and sales growth in high potential international markets (Asia, Latin America, EMEA) positions MetLife to capitalize on growing middle class wealth and increased insurance penetration, supporting robust long term revenue and top line growth.

Curious how steady but unspectacular top line growth can still justify a higher fair value? The narrative leans on richer margins, rising earnings power, and a lower future multiple than today. Want to see how those moving parts add up to that price tag?

Result: Fair Value of $93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering pressure on investment yields and credit risks in commercial mortgage loans could quickly undermine the margin and earnings assumptions behind this undervaluation narrative.

Find out about the key risks to this MetLife narrative.

Another Angle On Valuation

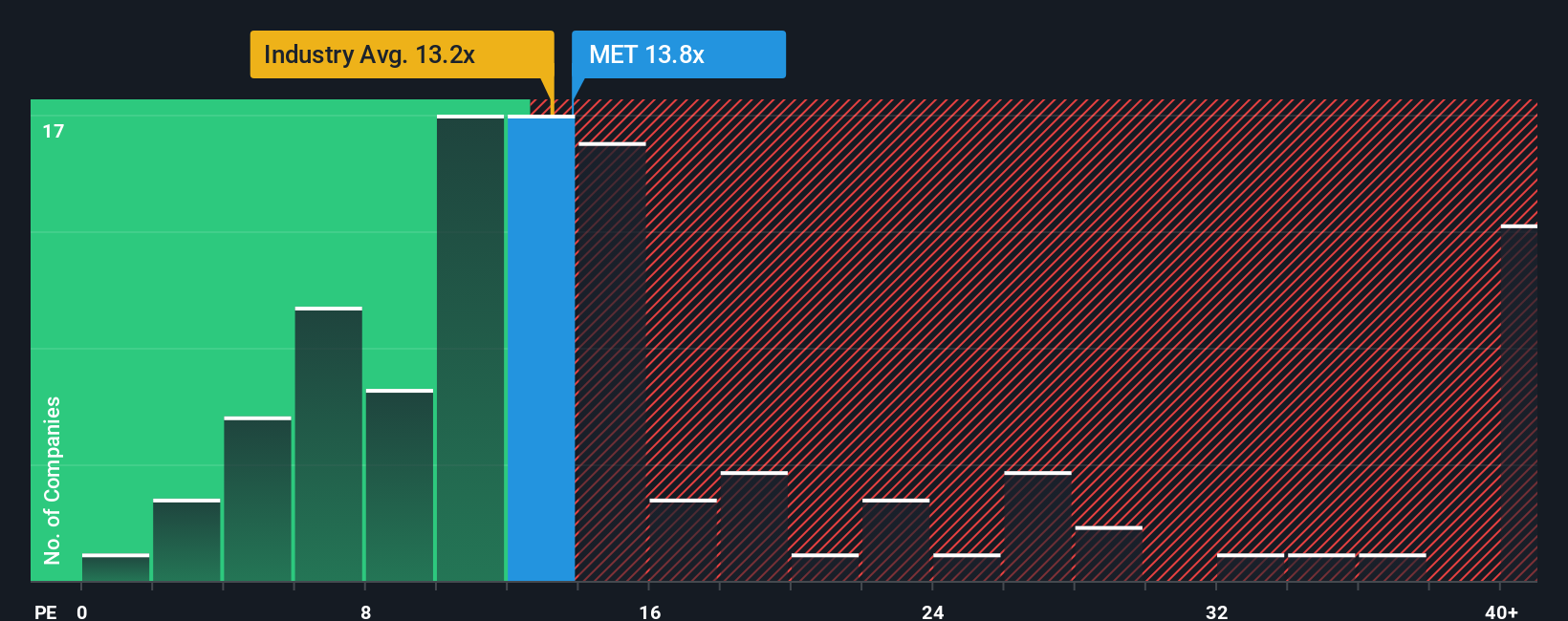

On earnings, the story looks less generous. MetLife trades on a 14.1x price to earnings ratio versus 13.1x for the US insurance industry and 13.5x for peers, even though its fair ratio is closer to 17x. That premium today narrows the margin of safety if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MetLife Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your MetLife research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single insurer. Put Simply Wall Street’s powerful screener to work and line up your next round of high conviction opportunities today.

- Capture income potential by targeting stable payers with growing cash flows through these 14 dividend stocks with yields > 3% that can strengthen your portfolio’s yield without stretching for risk.

- Position ahead of structural technology shifts by scanning these 25 AI penny stocks poised to benefit from the adoption of automation, data analytics, and machine intelligence.

- Secure asymmetric upside by filtering for mispriced opportunities using these 920 undervalued stocks based on cash flows, so you are early when the market reprices quality cash generators.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MET

MetLife

A financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026