- United States

- /

- Insurance

- /

- NYSE:MCY

Even With A 26% Surge, Cautious Investors Are Not Rewarding Mercury General Corporation's (NYSE:MCY) Performance Completely

The Mercury General Corporation (NYSE:MCY) share price has done very well over the last month, posting an excellent gain of 26%. The last 30 days bring the annual gain to a very sharp 52%.

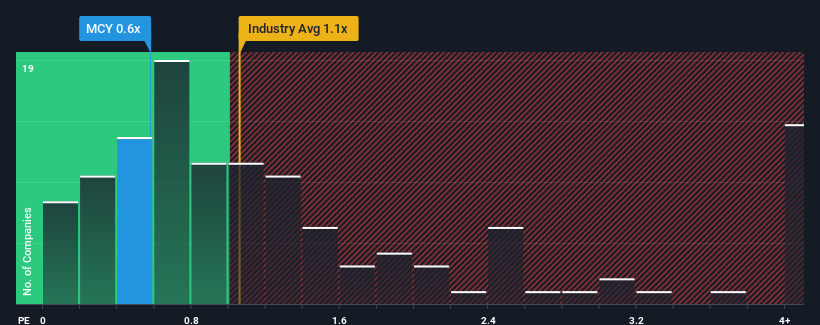

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Mercury General's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Insurance industry in the United States is also close to 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Mercury General

How Has Mercury General Performed Recently?

Mercury General certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mercury General.How Is Mercury General's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Mercury General's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. As a result, it also grew revenue by 22% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.8%, which is noticeably less attractive.

With this information, we find it interesting that Mercury General is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Mercury General's P/S?

Mercury General appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Mercury General's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Mercury General you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives