- United States

- /

- Insurance

- /

- NYSE:LMND

How Investors May Respond To Lemonade (LMND) Adding PayPal CMO to Board and Reaching $1B Premium Milestone

Reviewed by Sasha Jovanovic

- Lemonade announced in the past week that Geoff Seeley, Chief Marketing Officer at PayPal Holdings, has joined its Board of Directors, bringing decades of experience in global brand strategy and digital marketing.

- Shortly after, Lemonade reported reaching US$1 billion in in-force premium in just 8.5 years, making it the fastest insurer to achieve this scale, supported by strong quarterly results and ongoing momentum.

- We'll explore how Lemonade's record-breaking premium growth and board appointment could impact its investment outlook and future expansion plans.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Lemonade Investment Narrative Recap

Owning Lemonade stock means believing in its ability to disrupt insurance through rapid technology adoption, strong AI-driven underwriting, and bold expansion into new markets. While the addition of an accomplished digital marketer like Geoff Seeley brings valuable expertise, this board appointment alone does not materially affect the most important short-term catalyst, sustained revenue growth from accelerating in-force premium, nor does it ease the biggest current risk: persistent losses and uncertain path to profitability.

Lemonade’s announcement that it now exceeds US$1 billion in in-force premium, making it the fastest insurer to reach this milestone, directly ties to the ongoing momentum that investors have been watching as a key growth driver. The pace and scale of this growth amplifies both the rewards and execution risks tied to Lemonade’s expansion, especially as cost discipline and underwriting accuracy come under greater scrutiny at increasing scale.

However, investors should also be aware that if Lemonade’s customer acquisition costs begin outpacing customer lifetime value, this could...

Read the full narrative on Lemonade (it's free!)

Lemonade's narrative projects $1.8 billion revenue and $201.4 million earnings by 2028. This requires 44.9% yearly revenue growth and a $405.4 million increase in earnings from -$204.0 million.

Uncover how Lemonade's forecasts yield a $45.12 fair value, a 20% downside to its current price.

Exploring Other Perspectives

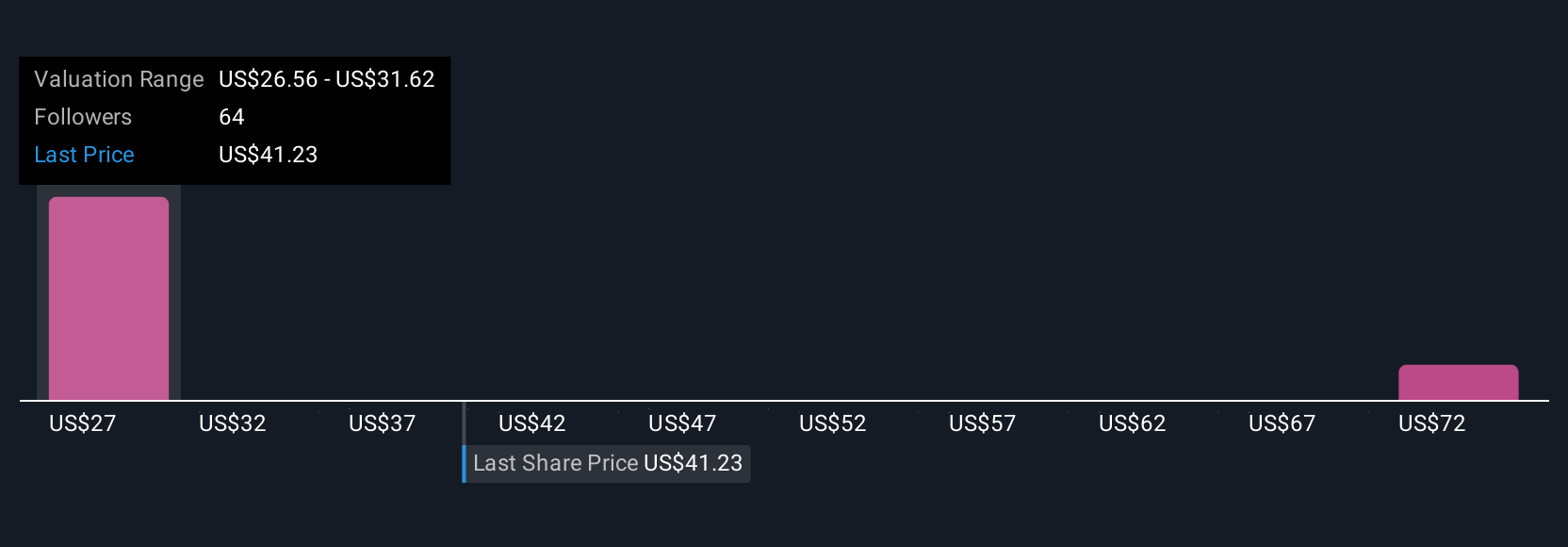

Simply Wall St Community members have shared 12 fair value estimates for Lemonade ranging from US$23.34 to US$77.14 per share. While many anticipate continued rapid revenue growth, your view on future operating losses could shape how you interpret this wide spectrum of price targets.

Explore 12 other fair value estimates on Lemonade - why the stock might be worth as much as 38% more than the current price!

Build Your Own Lemonade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lemonade research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lemonade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lemonade's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMND

Lemonade

Provides various insurance products in the United States, Europe, and the United Kingdom.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives