- United States

- /

- Insurance

- /

- NYSE:LMND

Brokers Are Upgrading Their Views On Lemonade, Inc. (NYSE:LMND) With These New Forecasts

Celebrations may be in order for Lemonade, Inc. (NYSE:LMND) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance. Investors have been pretty optimistic on Lemonade too, with the stock up 30% to US$28.66 over the past week. Could this upgrade be enough to drive the stock even higher?

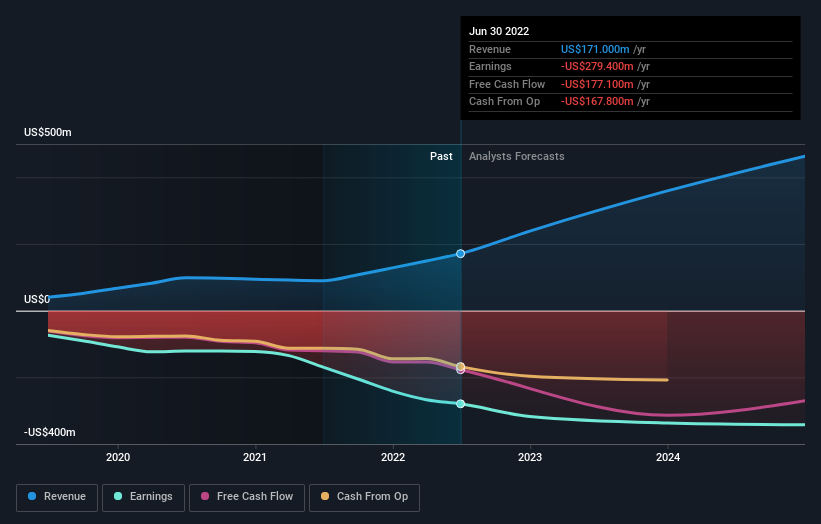

Following the upgrade, the current consensus from Lemonade's six analysts is for revenues of US$240m in 2022 which - if met - would reflect a sizeable 40% increase on its sales over the past 12 months. Losses are supposed to balloon 20% to US$4.87 per share. Yet before this consensus update, the analysts had been forecasting revenues of US$215m and losses of US$5.43 per share in 2022. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

See our latest analysis for Lemonade

The consensus price target rose 11% to US$25.44, with the analysts encouraged by the higher revenue and lower forecast losses for this year. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Lemonade at US$40.00 per share, while the most bearish prices it at US$14.00. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analysts are definitely expecting Lemonade's growth to accelerate, with the forecast 96% annualised growth to the end of 2022 ranking favourably alongside historical growth of 35% per annum over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 5.0% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Lemonade to grow faster than the wider industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting Lemonade is moving incrementally towards profitability. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Lemonade could be worth investigating further.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 5 potential warning signs with Lemonade, including a short cash runway. For more information, you can click through to our platform to learn more about this and the 3 other warning signs we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LMND

Lemonade

Provides various insurance products in the United States, Europe, and the United Kingdom.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026