- United States

- /

- Insurance

- /

- NYSE:KMPR

Could Kemper's (KMPR) Revenue Growth Mask Deeper Profit Challenges Ahead?

Reviewed by Simply Wall St

- Kemper reported its most recent quarterly results, showing revenue growth of 8.4% year on year but missing analyst estimates on both earnings per share and book value per share.

- This underperformance compared to expectations drew investor attention to the company's earnings trajectory despite revenue growth, highlighting pressures in profitability and asset values.

- We'll assess how this revenue growth alongside weaker profitability numbers could affect the long-term investment narrative for Kemper.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kemper Investment Narrative Recap

Being a Kemper shareholder means believing in the long-term growth of specialty auto and life insurance, underpinned by operational efficiency and underserved market strengths. The recent revenue growth is encouraging, but softer earnings and book value may dampen near-term optimism as profitability and asset quality remain the top catalyst and the biggest risk, respectively, a situation that calls for attention but does not fundamentally shift the broad investment narrative at this point.

Among recent company announcements, the affirmation of a quarterly dividend at US$0.32 per share stands out, reinforcing Kemper's focus on returning value to shareholders even amid quarterly earnings volatility. This indicates a commitment to shareholder rewards regardless of short-term fluctuations, supporting confidence in the company’s capital allocation priorities as a complementary factor to revenue trends.

In contrast, it’s critical for investors to recognize the lingering uncertainty around adverse reserve development, as the earnings headline tells only part of the story...

Read the full narrative on Kemper (it's free!)

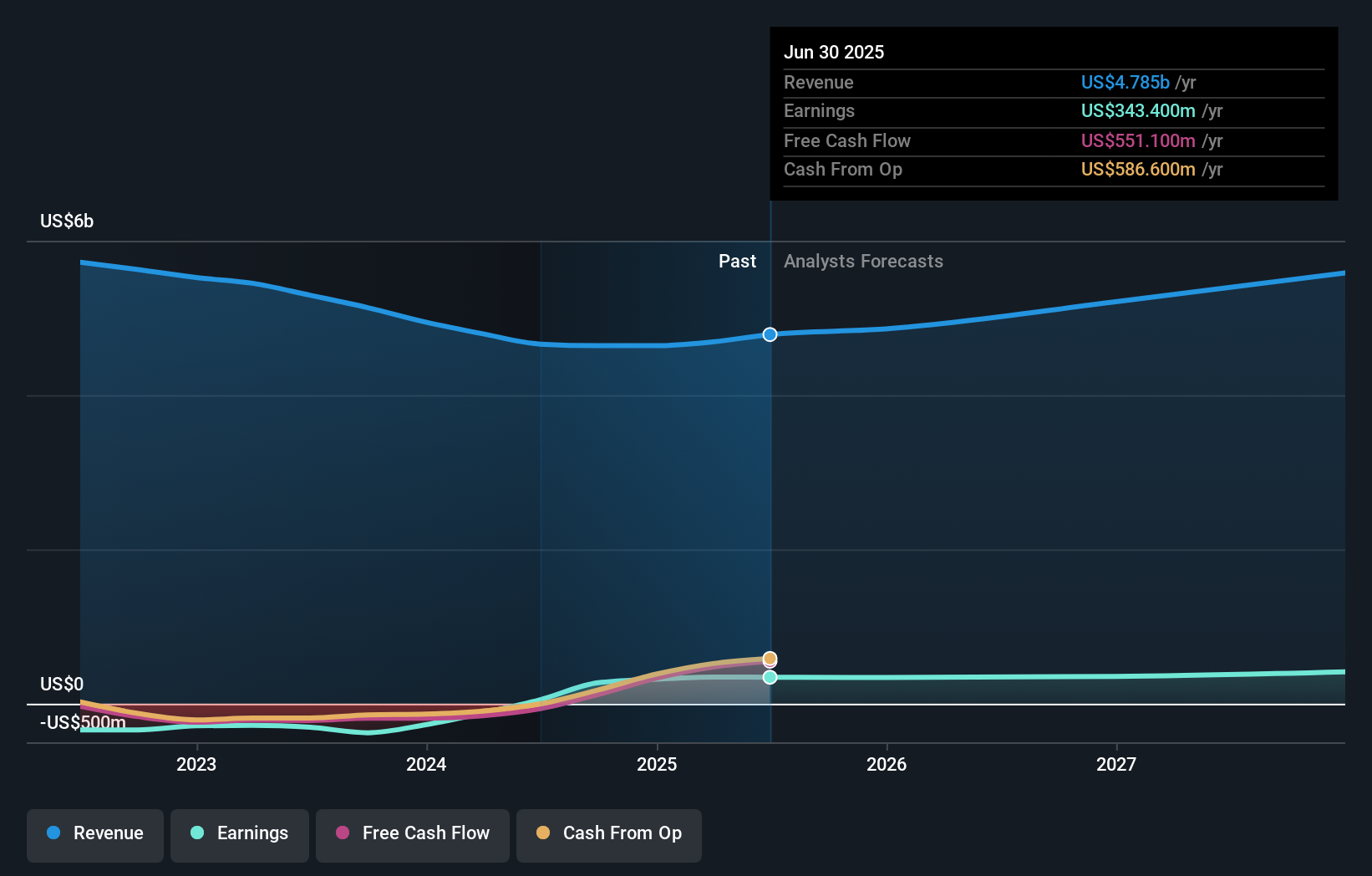

Kemper's outlook anticipates $5.7 billion in revenue and $406.9 million in earnings by 2028. This is based on a forecast of 6.2% annual revenue growth and an earnings increase of $63.5 million from the current earnings of $343.4 million.

Uncover how Kemper's forecasts yield a $67.60 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Kemper’s fair value between US$67.60 and US$121.12, based on two independent approaches. With ongoing pressure on profitability and asset values, your view on industry risks may significantly shape your outlook, explore these viewpoints and see where you stand among other investors.

Explore 2 other fair value estimates on Kemper - why the stock might be worth over 2x more than the current price!

Build Your Own Kemper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kemper research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Kemper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kemper's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kemper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMPR

Kemper

An insurance holding company, provides insurance products in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives