- United States

- /

- Banks

- /

- NYSE:OFG

US Market's Undiscovered Gems And 2 Other Promising Small Caps

Reviewed by Simply Wall St

As major indices like the S&P 500, Dow, and Nasdaq reach record highs driven by a surge in technology stocks, the small-cap Russell 2000 index has also achieved its first record close since November 2021. Amid this buoyant market environment, investors are increasingly looking to identify promising opportunities within the small-cap sector, where undiscovered gems can offer significant growth potential. In this context, a good stock often combines strong fundamentals with innovative business strategies that align well with current economic trends and market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tri-County Financial Group | 82.51% | 3.15% | -17.04% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

SUI Group Holdings (SUIG)

Simply Wall St Value Rating: ★★★★★★

Overview: SUI Group Holdings Limited is a principal investment firm focusing on investments in debt and equity securities of public and private companies to support their operational needs, with a market cap of $333.52 million.

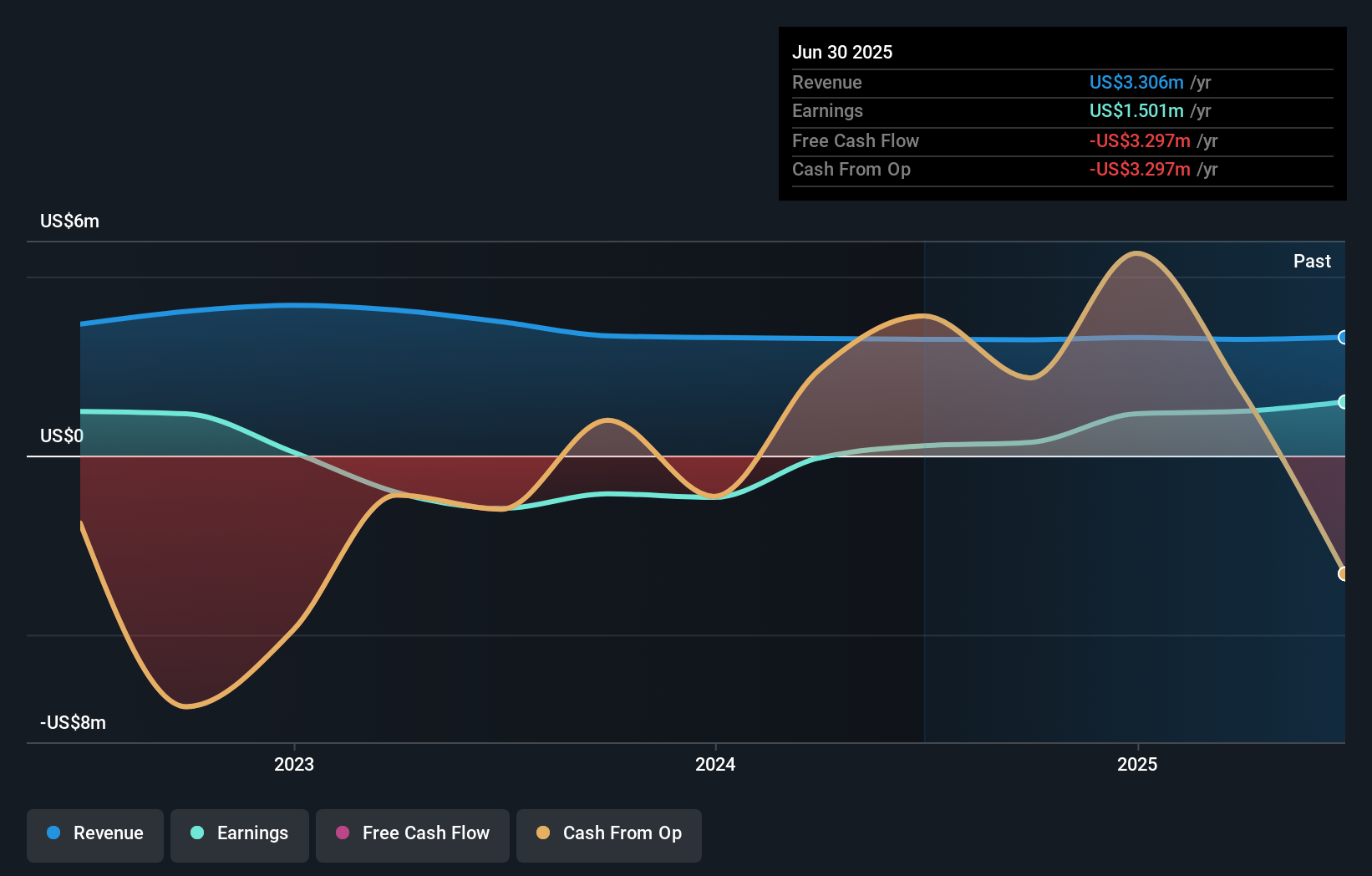

Operations: SUI Group Holdings generates revenue primarily through its financial services segment, specifically from closed-end funds, amounting to $3.31 million. The company's market cap stands at $333.52 million.

SUI Group Holdings, a small-cap entity, has shown remarkable earnings growth of 442.3% over the past year, significantly outpacing the Diversified Financial industry’s 7.5%. Despite its profitability and debt-free status, SUIG's share price has been highly volatile recently. The company announced a substantial $50 million share repurchase program in September 2025, indicating confidence in its valuation amidst recent shareholder dilution. However, with revenues at just US$3M and high levels of non-cash earnings reported, potential investors should weigh these factors carefully when considering this dynamic yet complex investment opportunity.

Heritage Insurance Holdings (HRTG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Heritage Insurance Holdings, Inc. operates through its subsidiaries to offer personal and commercial residential insurance products, with a market capitalization of $729.36 million.

Operations: HRTG generates revenue primarily from its residential property insurance segment, totaling $841.67 million. The company's financial performance is influenced by factors affecting the insurance industry, including claims and underwriting expenses.

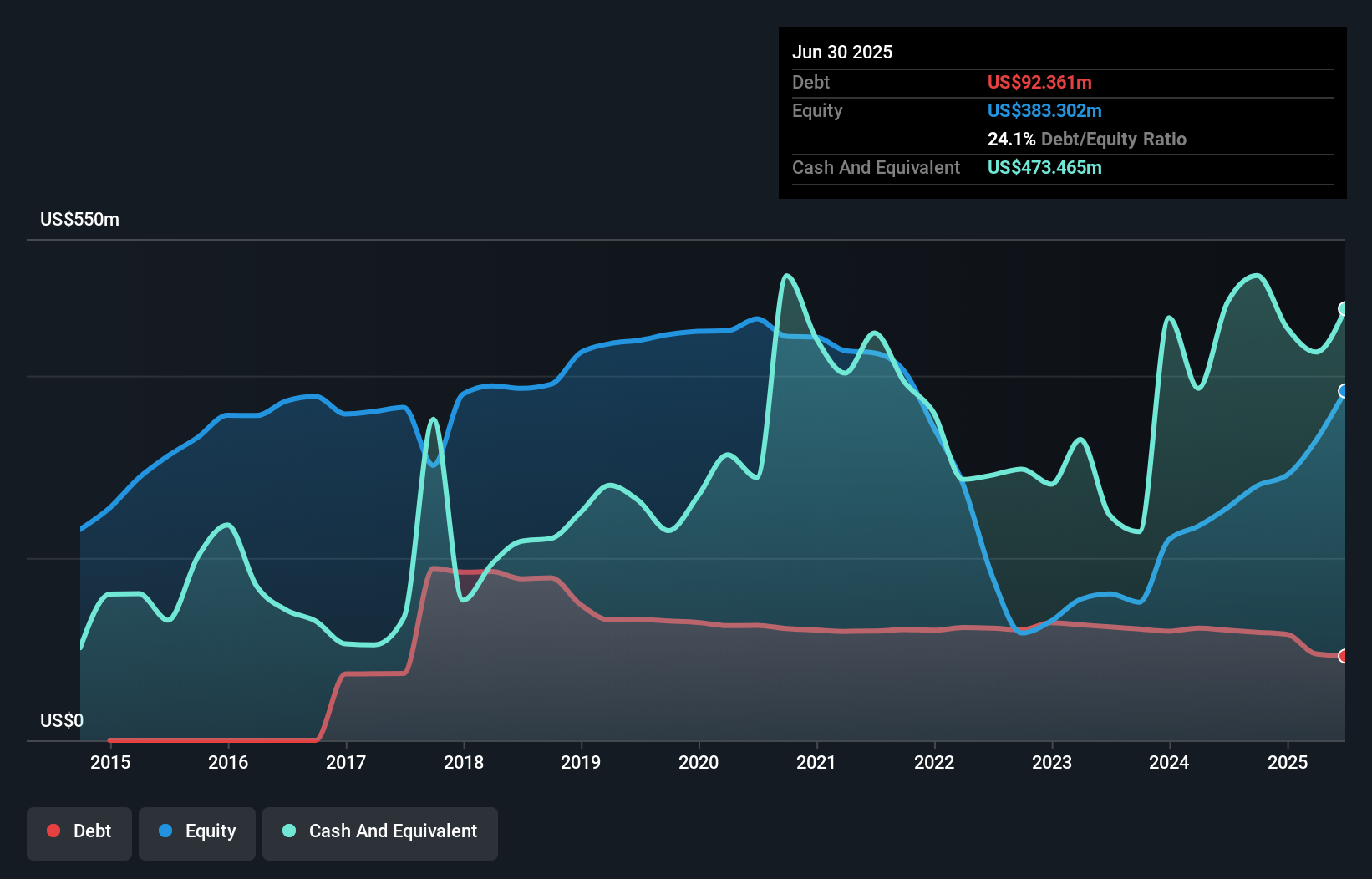

Heritage Insurance Holdings, a smaller player in the insurance sector, is making waves with its impressive 88.9% earnings growth over the past year, outpacing the industry average of 6%. The company's debt management appears robust, as it holds more cash than total debt and has reduced its debt-to-equity ratio from 27.3% to 24.1% over five years. With interest payments well covered by EBIT at a multiple of 15.6x and trading at a notable discount to fair value estimates (66.1%), Heritage seems positioned for potential upside despite challenges like exposure to catastrophe-prone regions and competitive pressures.

OFG Bancorp (OFG)

Simply Wall St Value Rating: ★★★★★★

Overview: OFG Bancorp is a financial holding company offering diverse banking and financial services in the United States, with a market cap of $1.95 billion.

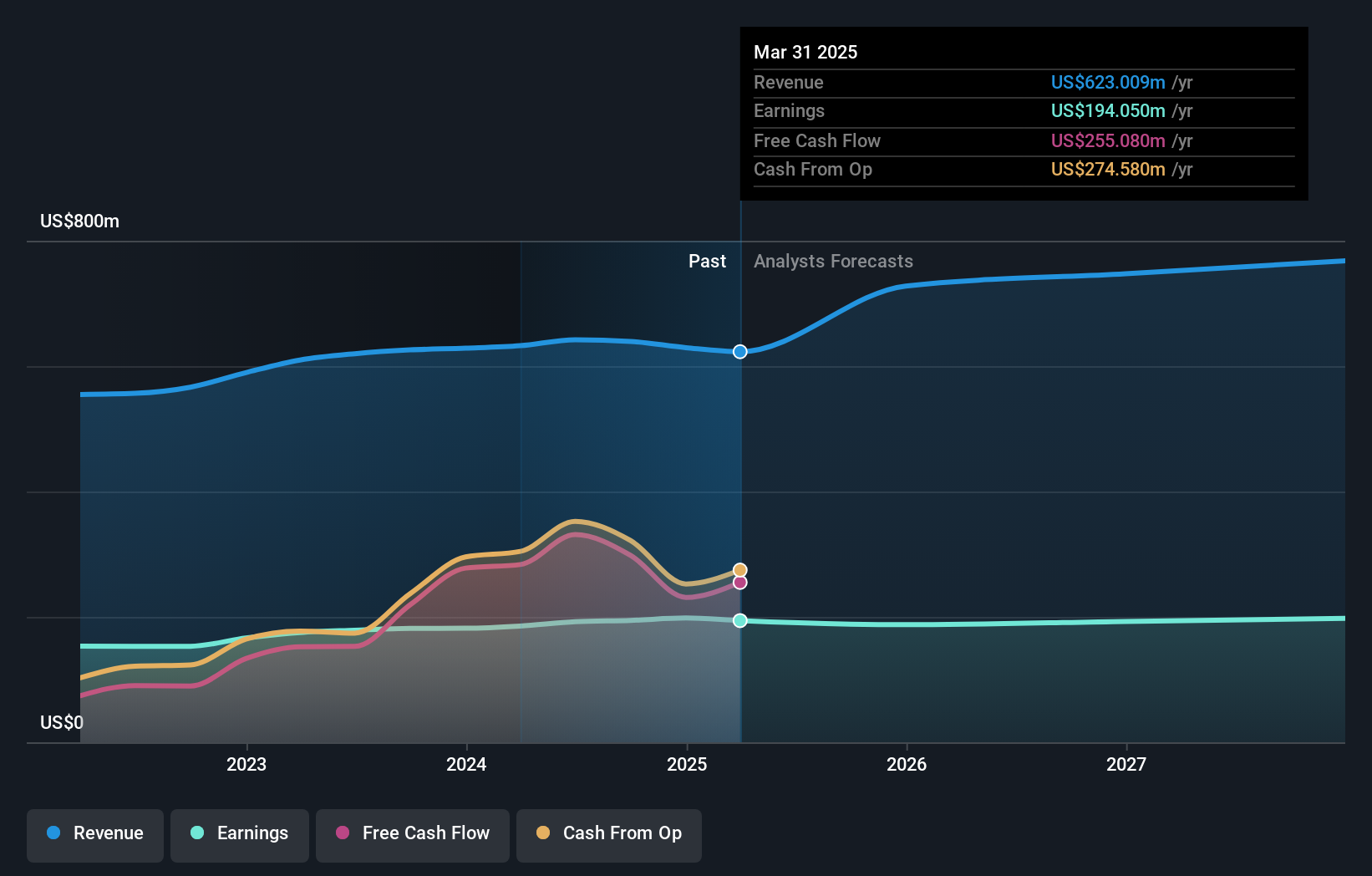

Operations: OFG Bancorp generates revenue primarily from its Banking segment, contributing $467.80 million, followed by Treasury at $114.33 million and Wealth Management at $37.34 million.

OFG Bancorp, with assets totaling US$12.2 billion and equity of US$1.3 billion, stands out for its robust financial health and strategic focus on digital banking expansion. The company has a solid allowance for bad loans at 1.2% of total loans, indicating prudent risk management. With 93% of liabilities sourced from low-risk customer deposits, OFG is well-positioned to weather economic fluctuations in Puerto Rico where it operates significantly. Trading at nearly 60% below estimated fair value, the bank offers potential upside; however, competition and technological investments remain challenges as it navigates future growth opportunities in the region.

Where To Now?

- Click this link to deep-dive into the 281 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OFG

OFG Bancorp

A financial holding company, provides a range of banking and financial services in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives