- United States

- /

- Insurance

- /

- NYSE:HRTG

Should You Be Adding Heritage Insurance Holdings (NYSE:HRTG) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Heritage Insurance Holdings (NYSE:HRTG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Heritage Insurance Holdings with the means to add long-term value to shareholders.

Heritage Insurance Holdings' Improving Profits

Over the last three years, Heritage Insurance Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Heritage Insurance Holdings' EPS has grown from US$1.73 to US$2.07 over twelve months. There's little doubt shareholders would be happy with that 20% gain.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Heritage Insurance Holdings shareholders can take confidence from the fact that EBIT margins are up from 8.7% to 11%, and revenue is growing. That's great to see, on both counts.

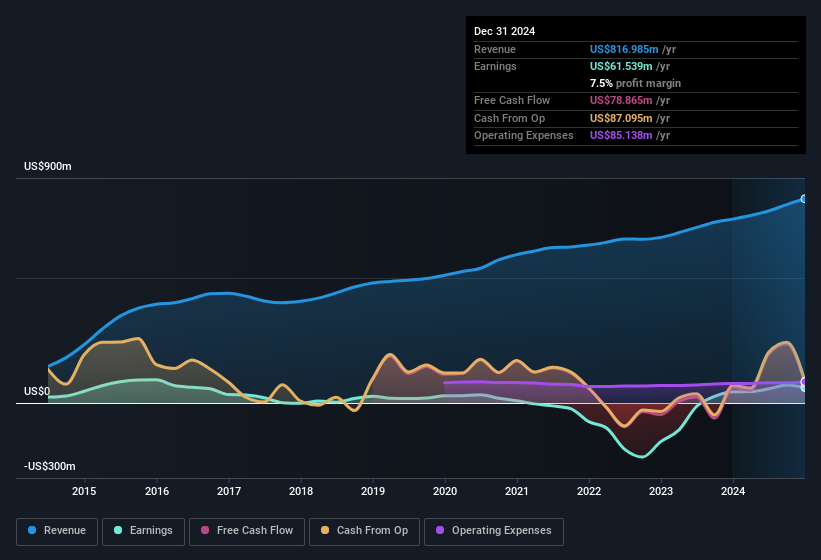

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

See our latest analysis for Heritage Insurance Holdings

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Heritage Insurance Holdings' forecast profits?

Are Heritage Insurance Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth US$169k) this was overshadowed by a mountain of buying, totalling US$1.0m in just one year. This adds to the interest in Heritage Insurance Holdings because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Independent Director Paul Whiting for US$418k worth of shares, at about US$8.35 per share.

Along with the insider buying, another encouraging sign for Heritage Insurance Holdings is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth US$146m. That equates to 26% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add Heritage Insurance Holdings To Your Watchlist?

One positive for Heritage Insurance Holdings is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Of course, just because Heritage Insurance Holdings is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Heritage Insurance Holdings is not the only stock with insider buying. Here's a list of small cap, undervalued companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Heritage Insurance Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Heritage Insurance Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HRTG

Heritage Insurance Holdings

Through its subsidiaries, provides personal and commercial residential insurance products.

Outstanding track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives