- United States

- /

- Insurance

- /

- NYSE:HG

Leadership Shift and Revenue Growth Might Change the Case for Investing in Hamilton Insurance Group (HG)

Reviewed by Sasha Jovanovic

- Hamilton Insurance Group recently announced that Mike Mulray will become Chief Underwriting Officer at Hamilton Select, its US excess and surplus lines insurer, effective October 20, 2025; Mulray brings over 25 years of underwriting experience from firms such as Everest and General Electric Company.

- This leadership change comes as the company reports exceptional revenue growth, increased market penetration, and improved combined ratio, which together highlight ongoing progress in scaling its specialty insurance and reinsurance platforms.

- We'll explore how the appointment of an experienced Chief Underwriting Officer may shape Hamilton Insurance Group's investment story and future outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Hamilton Insurance Group Investment Narrative Recap

To own shares in Hamilton Insurance Group, investors need to believe the company can balance its rapid specialty insurance growth with disciplined underwriting and expense control, despite ongoing sector volatility and pricing pressure. The recent appointment of Mike Mulray as Chief Underwriting Officer at Hamilton Select aligns with this goal but is unlikely to have a material near-term impact on the most important catalyst, the pace of premium growth driven by current market conditions, or on the immediate risk of margin compression from competitive pricing and elevated costs.

The recent addition of Russ Buckley as Group Chief Risk Officer stands out as particularly relevant. As Hamilton Insurance Group moves to strengthen both underwriting and risk oversight, these appointments may support improved loss ratio management going forward, a key area for sustaining earnings growth as premium expansion is expected to slow and market competition intensifies.

However, investors should be aware that, in contrast, persistently high acquisition and expense ratios could...

Read the full narrative on Hamilton Insurance Group (it's free!)

Hamilton Insurance Group's outlook anticipates $3.1 billion in revenue and $536.4 million in earnings by 2028. This assumes a 5.6% annual revenue growth rate and a $155.9 million increase in earnings from the current level of $380.5 million.

Uncover how Hamilton Insurance Group's forecasts yield a $26.43 fair value, a 8% upside to its current price.

Exploring Other Perspectives

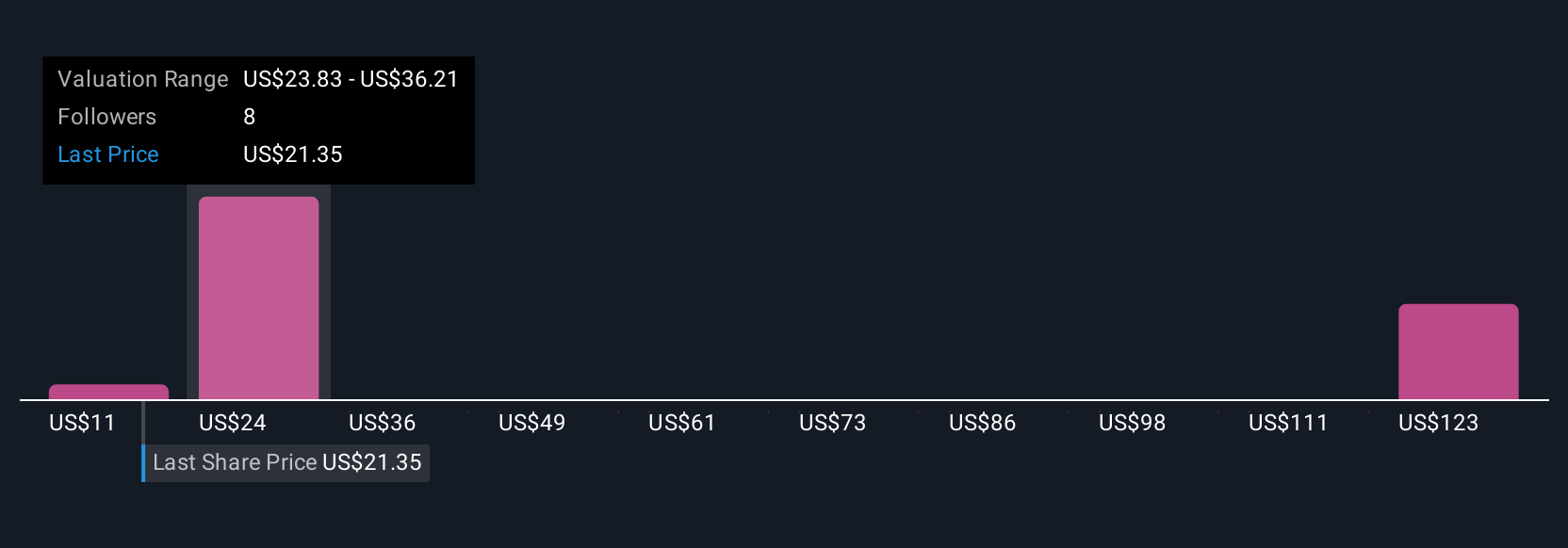

Five fair value estimates from the Simply Wall St Community span a wide US$11.44 to US$120.38 range. While many see value potential, margin compression risk from competitive pricing remains a concern that could impact long term profitability, so it’s worth exploring several viewpoints before deciding.

Explore 5 other fair value estimates on Hamilton Insurance Group - why the stock might be worth over 4x more than the current price!

Build Your Own Hamilton Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hamilton Insurance Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hamilton Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hamilton Insurance Group's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HG

Hamilton Insurance Group

Through its subsidiaries, operates as specialty insurance and reinsurance company in Bermuda and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives