The board of HCI Group, Inc. (NYSE:HCI) has announced that it will pay a dividend on the 15th of September, with investors receiving $0.40 per share. Based on this payment, the dividend yield on the company's stock will be 2.7%, which is an attractive boost to shareholder returns.

Check out our latest analysis for HCI Group

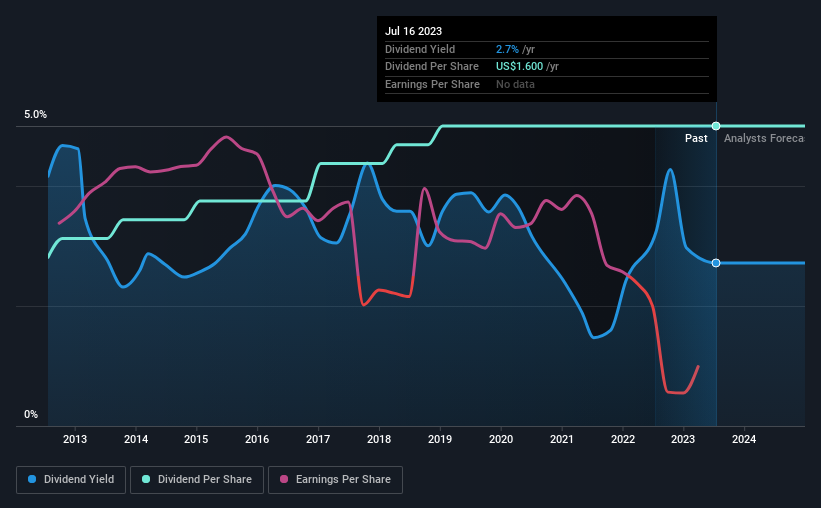

HCI Group Doesn't Earn Enough To Cover Its Payments

If the payments aren't sustainable, a high yield for a few years won't matter that much. HCI Group is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. This gives us some comfort about the level of the dividend payments.

Earnings per share is forecast to rise by 131.5% over the next year. If the dividend continues on its recent course, the payout ratio in 12 months could be 113%, which is a bit high and could start applying pressure to the balance sheet.

HCI Group Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of $0.90 in 2013 to the most recent total annual payment of $1.60. This works out to be a compound annual growth rate (CAGR) of approximately 5.9% a year over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Let's not jump to conclusions as things might not be as good as they appear on the surface. HCI Group's earnings per share has shrunk at 41% a year over the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Our Thoughts On HCI Group's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for HCI Group that you should be aware of before investing. Is HCI Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026