- United States

- /

- Insurance

- /

- NYSE:HCI

Did Exzeo’s NYSE Debut Just Shift HCI Group’s (HCI) Investment Narrative?

Reviewed by Sasha Jovanovic

- HCI Group recently announced that its majority-owned subsidiary, Exzeo Group, has launched an initial public offering in the US, offering 8 million shares and listing on the NYSE under the ticker "XZO" with HCI retaining majority ownership.

- This move marks a significant transition for HCI Group, as the IPO provides potential to unlock additional value and highlights the growing influence of insurance technology in the sector.

- We'll now explore how Exzeo's IPO and HCI's continued majority stake may influence the company's future growth and investor outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

HCI Group Investment Narrative Recap

To be a shareholder in HCI Group, you need to believe in its ability to leverage proprietary technology and insurance expertise for sustainable, profitable growth, especially as the company navigates the challenges of Florida market concentration and the shrinking Citizens depopulation pool. The Exzeo IPO presents a potential catalyst by unlocking capital and sharpening HCI’s tech profile, but the main near-term risk remains HCI’s reliance on a finite set of policy takeouts. The IPO itself doesn't materially alter this risk; HCI's exposure to Florida continues to be a central focus for investors.

Of HCI's recent announcements, the March 2025 restructure separating the insurance and technology divisions is closely linked to the Exzeo IPO. This move directly supports the catalyst of realizing value through the growth of Exzeo, potentially enticing new investor interest and providing capital for further insurance expansion, all while keeping the company’s core technology assets under majority control.

On the other hand, investors should be aware that if the pool of profitable Citizens Insurance policies continues shrinking at its current pace...

Read the full narrative on HCI Group (it's free!)

HCI Group's narrative projects $1.1 billion revenue and $342.7 million earnings by 2028. This requires 13.5% yearly revenue growth and a $205.1 million earnings increase from $137.6 million today.

Uncover how HCI Group's forecasts yield a $202.50 fair value, a 7% upside to its current price.

Exploring Other Perspectives

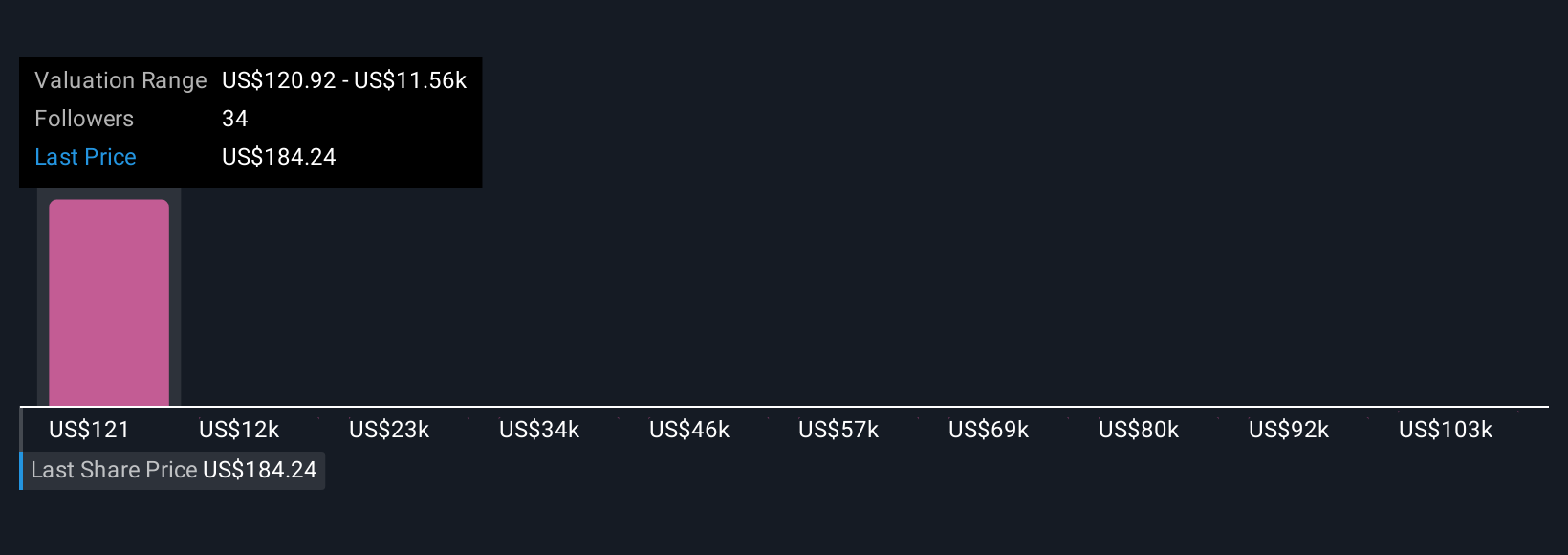

Simply Wall St Community members provided 7 fair value estimates for HCI Group ranging from US$120.92 to an outlier of US$114,561.05. With opinions this varied, and with technology-driven catalysts playing a bigger role following the Exzeo IPO, it pays to explore several viewpoints when considering HCI's future.

Explore 7 other fair value estimates on HCI Group - why the stock might be worth 36% less than the current price!

Build Your Own HCI Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HCI Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free HCI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCI Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives