- United States

- /

- Insurance

- /

- NYSE:GL

We Ran A Stock Scan For Earnings Growth And Globe Life (NYSE:GL) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Globe Life (NYSE:GL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Globe Life Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Globe Life has managed to grow EPS by 18% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming. EPS growth figures have also been helped by share buybacks, showing the market that the company is in a position of financial strength, allowing it to return capital to shareholders.

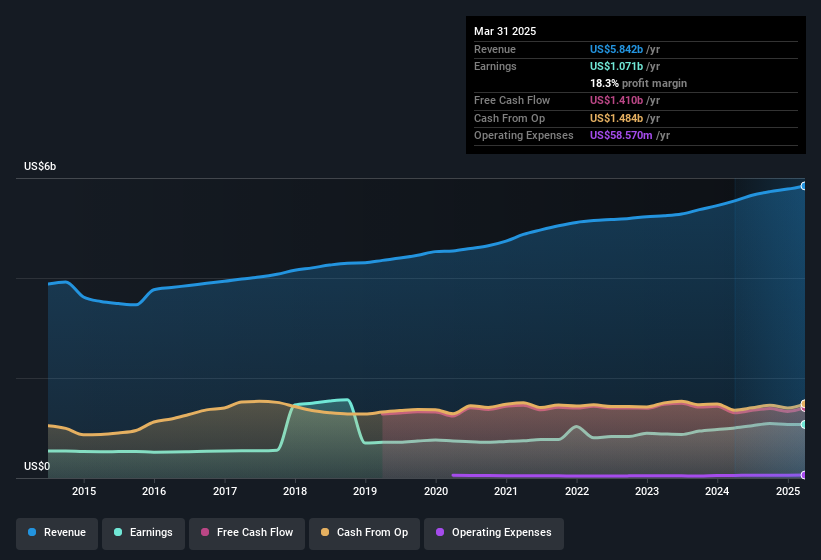

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Globe Life achieved similar EBIT margins to last year, revenue grew by a solid 5.4% to US$5.8b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

See our latest analysis for Globe Life

Fortunately, we've got access to analyst forecasts of Globe Life's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Globe Life Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite some Globe Life insiders disposing of some shares, we note that there was US$146k more in buying interest among those who know the company best Although some people may hesitate due to the share sales, the fact that insiders bought more than they sold, is a positive thing to note. It is also worth noting that it was Independent Director Mary Thigpen who made the biggest single purchase, worth US$271k, paying US$90.20 per share.

On top of the insider buying, it's good to see that Globe Life insiders have a valuable investment in the business. With a whopping US$75m worth of shares as a group, insiders have plenty riding on the company's success. This would indicate that the goals of shareholders and management are one and the same.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Frank Svoboda is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Globe Life, with market caps over US$8.0b, is about US$14m.

Globe Life's CEO took home a total compensation package worth US$8.7m in the year leading up to December 2024. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Globe Life Worth Keeping An Eye On?

For growth investors, Globe Life's raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. Before you take the next step you should know about the 1 warning sign for Globe Life that we have uncovered.

The good news is that Globe Life is not the only stock with insider buying. Here's a list of small cap, undervalued companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GL

Globe Life

Through its subsidiaries, provides various life and supplemental health insurance products, and annuities to lower middle- and middle-income families in the United States.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.