- United States

- /

- Insurance

- /

- NYSE:GL

Is Globe Life Poised for More Growth After Strong 30% Rally?

Reviewed by Bailey Pemberton

Thinking about what to do with Globe Life stock? You are definitely not alone. Friends and clients keep asking whether it is the right time to get in, stay patient, or take some profits. Globe Life’s price has had its share of twists lately, most notably a dip of 4.8% in the last week and 2.1% across the past month. Yet, look a little further back and things get more interesting. The stock’s up a strong 22.6% so far this year and an impressive 30.2% over the last twelve months. That kind of jump is hard to ignore, and the long-term climb of 75.4% over five years speaks volumes, especially in a market where investors are searching for solid, steady performers.

Some of what is driving these moves can be tied to broader market sentiment about life insurance and financial stability. The company has weathered recent industry trends with confidence, and there is a growing sense that major players like Globe Life could see lower risk premiums as economic uncertainty eases. But with shares rallying so much, are they still worth picking up? Or is all the easy upside behind us?

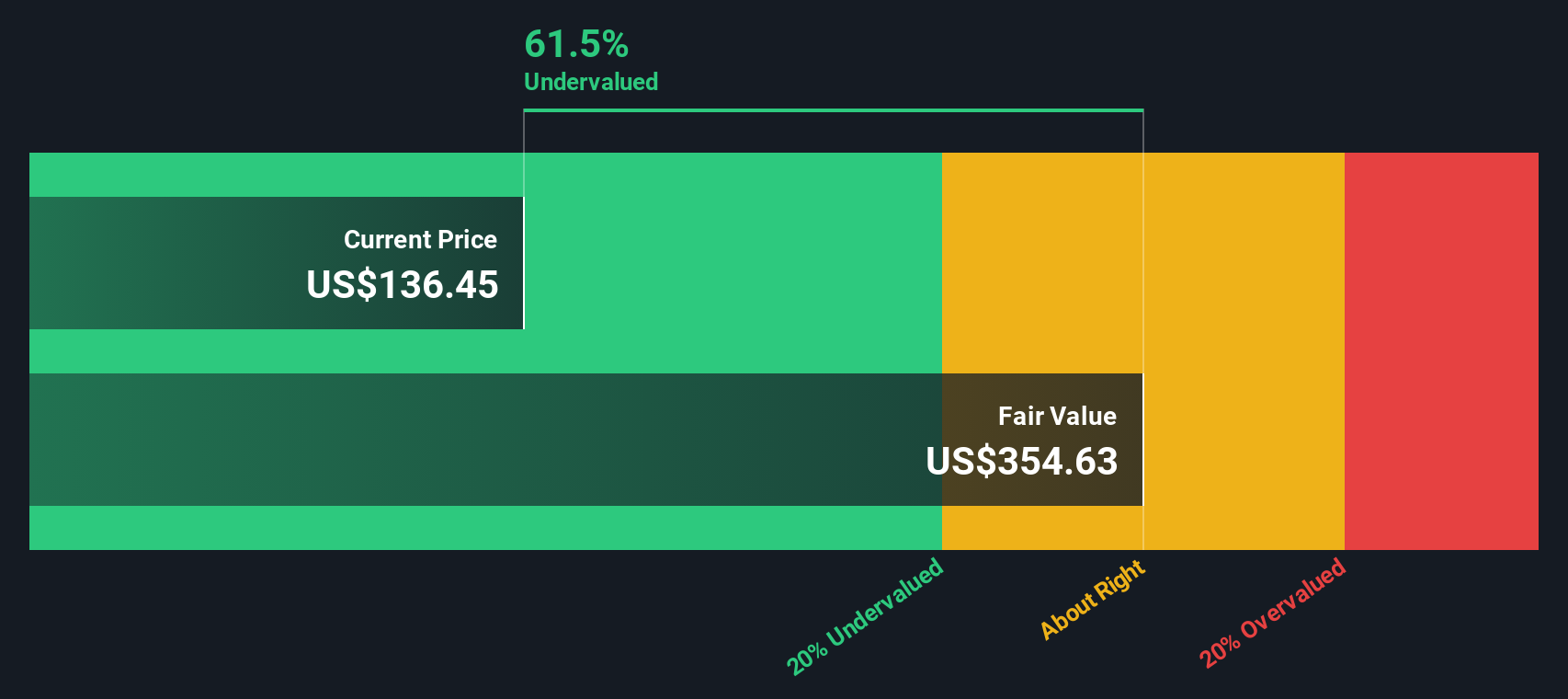

Here is where it gets interesting. Based on our valuation score, Globe Life checks 5 out of 6 key boxes for being undervalued, which is not something you see every day for a stock with this kind of track record. Let’s break down what those valuation checks look like, and then consider a way to look at valuation that is even more insightful than standard metrics alone.

Approach 1: Globe Life Excess Returns Analysis

The Excess Returns valuation model focuses on a company’s ability to generate profits above the minimum return required by its investors, known as the cost of equity. This approach highlights the value created by Globe Life by comparing its returns on invested capital to what shareholders expect, and by projecting stable earnings and book value potential into the future.

For Globe Life, the key numbers tell a compelling story:

- Book Value: $66.89 per share

- Stable EPS: $15.82 per share (Source: Weighted future Return on Equity estimates from 4 analysts.)

- Cost of Equity: $5.49 per share

- Excess Return: $10.33 per share

- Average Return on Equity: 19.69%

- Stable Book Value: $80.34 per share (Source: Weighted future Book Value estimates from 6 analysts.)

Globe Life’s sustained ability to earn a return well above its cost of equity signals real value creation and supports a robust intrinsic value. The Excess Returns model estimates the fair value at $355.95 per share, which suggests the stock is currently 61.3% undervalued compared to recent share prices.

Result: UNDERVALUED

Our Excess Returns analysis suggests Globe Life is undervalued by 61.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

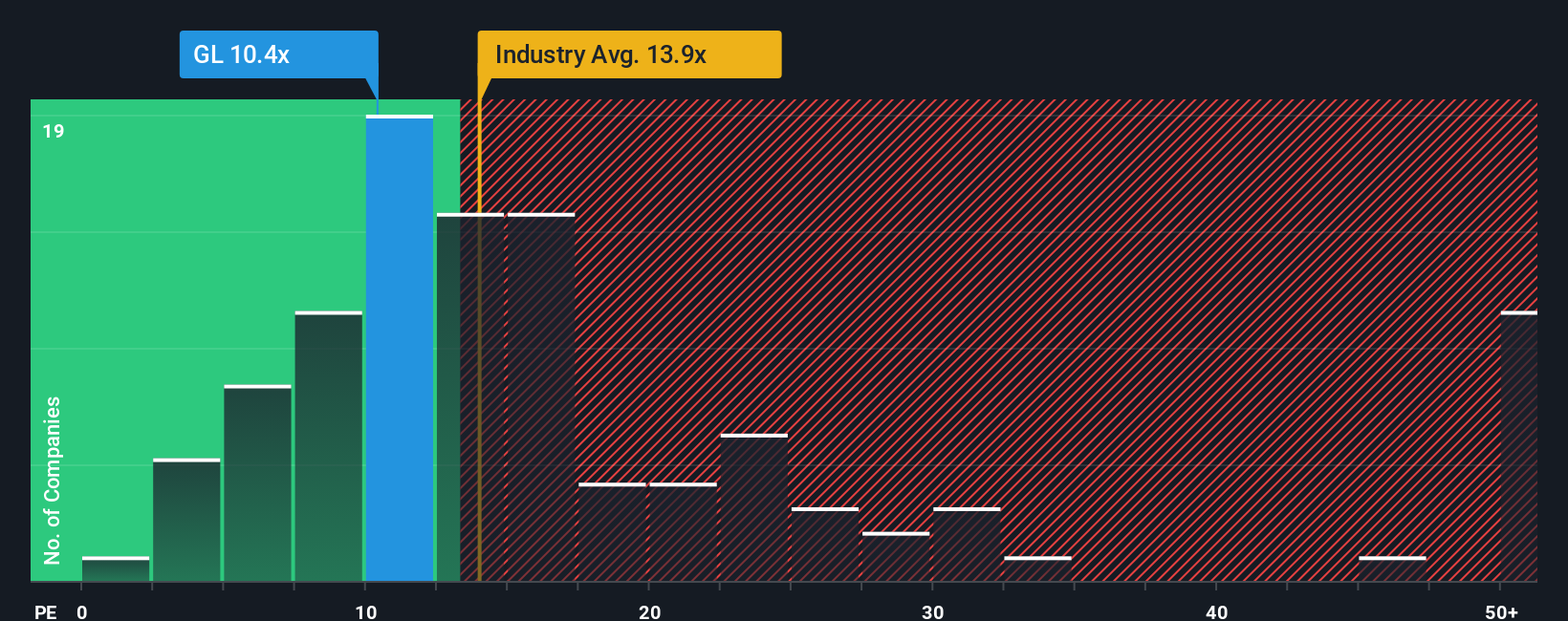

Approach 2: Globe Life Price vs Earnings

For profitable companies like Globe Life, the price-to-earnings (PE) ratio is a classic and effective way to assess valuation. That is because the PE ratio compares the market's valuation of a company directly to its actual earnings, giving investors a quick sense of how much they are paying for each dollar of profit.

A company’s “normal” or “fair” PE ratio will depend on expectations for its growth and how risky its earnings are. Higher growth and more stable profits typically justify a higher PE, while slow growth or unpredictable results should come at a discount. It pays to compare Globe Life’s numbers to several different benchmarks for a more complete picture.

Right now, Globe Life trades at a PE of 10.5x. This is comfortably below both the industry average of 14.2x and the peer average of 11.4x, suggesting the stock is relatively cheap on this measure. However, the true standout is Simply Wall St’s proprietary “Fair Ratio,” which for Globe Life currently sits at 12.8x. This Fair Ratio offers a more tailored benchmark than a raw industry or peer average, because it incorporates various factors unique to the company, such as its expected earnings trajectory, profit margins, size, and risk profile.

With Globe Life’s PE at 10.5x and a Fair Ratio of 12.8x, there is a solid gap implying Globe Life is undervalued based on the earnings multiple that fits its risk and growth outlook best.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Globe Life Narrative

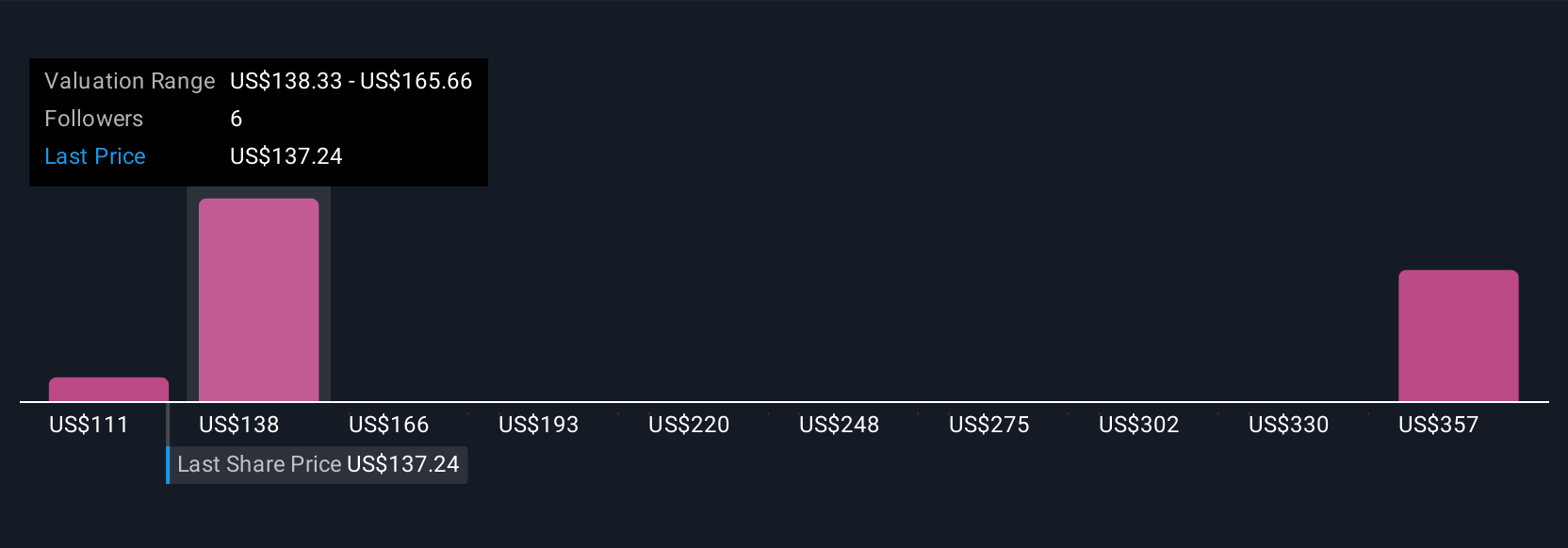

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, where you see it heading, what could change, and what you believe about its future. Instead of relying purely on numbers, Narratives let you share your outlook by plugging in your own estimates for Globe Life’s future revenue, earnings, and margins. This approach turns your beliefs into a fair value you can track and adjust over time.

Because a Narrative ties the company’s unique story to a financial forecast and then to a fair value, it creates a powerful bridge between facts and perspective. On Simply Wall St’s Community page, millions of investors already use Narratives to compare their fair value against the current share price and decide when to act. All updates are dynamic as markets, earnings, or news change.

For example, one Globe Life Narrative features a bullish view with a fair value of $188, driven by high confidence in digital automation and agent growth. Another Narrative takes a cautious stance with a lower fair value of $145, due to economic or regulatory concerns. Narratives put your investment decisions in context and give you a clear, actionable way to see how your assumptions stack up against real-world changes.

Do you think there's more to the story for Globe Life? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GL

Globe Life

Through its subsidiaries, provides various life and supplemental health insurance products, and annuities to lower middle- and middle-income families in the United States.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives