- United States

- /

- Insurance

- /

- NYSE:FNF

Fidelity National Financial (FNF): Exploring Valuation After Recent 4% Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Fidelity National Financial.

Fidelity National Financial’s recent 4% dip this month follows a stretch where its share price has moved sideways, even as the insurance sector faces mixed market sentiment and steady business results. While the one-year total shareholder return is slightly negative, the long run tells a different story. Over the past three years and five years, total shareholder returns have been 73% and 136% respectively, underscoring the company’s enduring value for long-term investors.

If you’re curious what other opportunities experienced investors are scouting right now, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading about 17% below their estimated intrinsic value and nearly 24% under the average analyst price target, some investors are asking whether Fidelity National Financial is undervalued or if the market is already factoring in future growth.

Most Popular Narrative: 19.7% Undervalued

Fidelity National Financial's most popular narrative suggests the fair value is nearly 20% above the last close price. The story behind this calculation centers on transformative business catalysts and bold future projections, while also highlighting the gap between analyst targets and the current market value.

Ongoing digital investment, including enhanced security, technology, and recruitment in tech-focused roles, is expected to streamline transaction processes and drive operational efficiencies. These initiatives may result in lower long-term costs and eventual net margin expansion once these up-front expenses normalize.

Want to know what’s fueling this premium? This narrative is built on a runway of double-digit earnings growth, market-share grabs, and margin lift that few expect. The precise forecast and the magnitude of future profitability may catch you off guard. Dive in to see the quantitative leaps driving this valuation.

Result: Fair Value of $70.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market volatility or rising costs could weigh on transaction volumes and margins, which may challenge Fidelity National Financial’s upbeat valuation outlook.

Find out about the key risks to this Fidelity National Financial narrative.

Another View: Market Ratios Signal a Premium

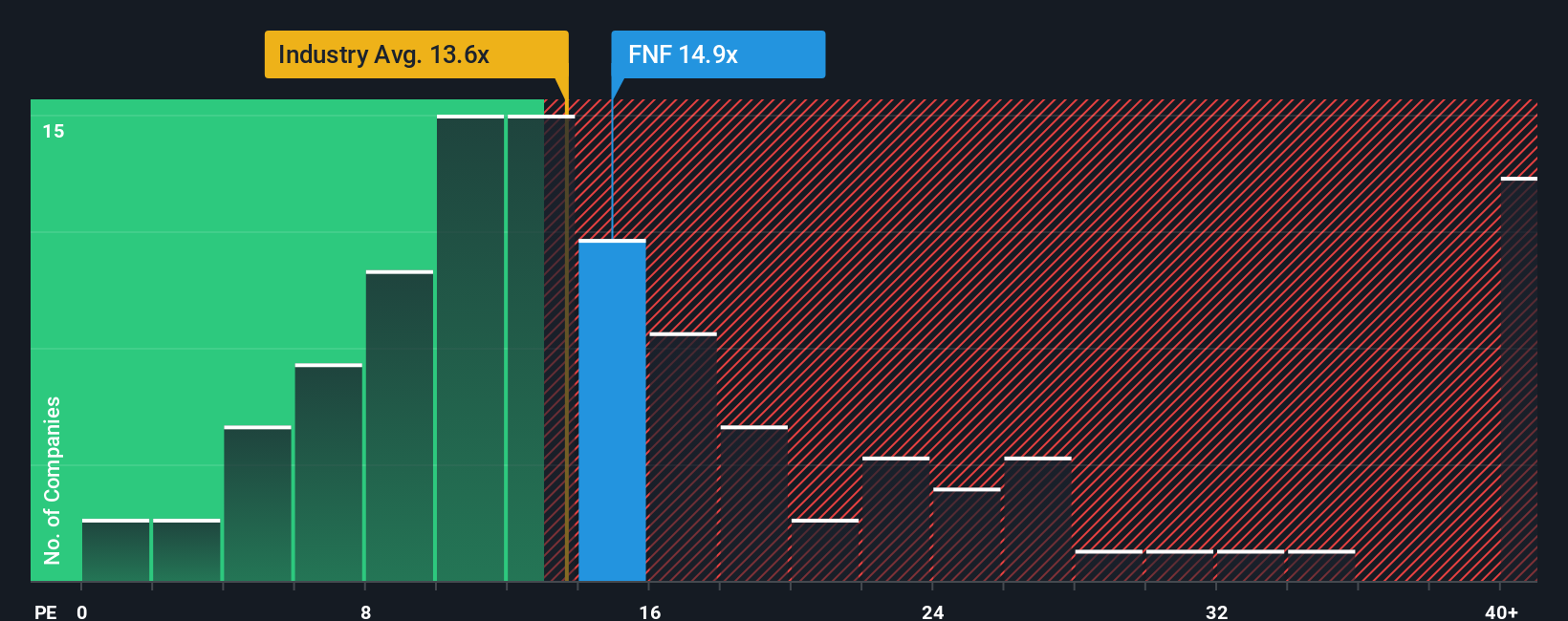

Looking from a different angle, Fidelity National Financial trades at a price-to-earnings ratio of 14.2 times, which is slightly above the insurance industry average of 14 and below the peer average of 16.7. However, the current ratio sits well below the estimated fair ratio of 21.3. This signals a possible valuation opportunity. Still, investors may wonder why the market might be hesitant.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fidelity National Financial Narrative

If you'd rather follow your own path or want to verify the numbers for yourself, you can easily piece together your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Fidelity National Financial.

Looking for More Ways to Grow Your Portfolio?

Don't miss your chance to uncover smart investment opportunities you might not have considered. The right idea can transform your returns, so why not grab it today?

- Seize the momentum of artificial intelligence by checking out these 26 AI penny stocks, where you’ll spot cutting-edge companies shaping tomorrow’s tech landscape.

- Unlock dividend income and long-term stability by reviewing these 17 dividend stocks with yields > 3%, featuring stocks offering yields above 3% for your portfolio.

- Catch undervalued gems with strong cash flows by starting with these 871 undervalued stocks based on cash flows and give your strategy a new edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FNF

Fidelity National Financial

Provides various insurance products in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives