- United States

- /

- Insurance

- /

- NYSE:FAF

How Investors Are Reacting To First American Financial (FAF) as National Home Price Appreciation Slows

Reviewed by Sasha Jovanovic

- First American Data & Analytics, a division of First American Financial Corporation, recently released its September 2025 Home Price Index report showing ten consecutive months of slowing annual home price appreciation nationally, with house prices now below their peak and notable regional differences emerging.

- The report highlights that while areas like New York-Jersey City-White Plains are still seeing price growth, other regions such as Los Angeles, San Diego, Dallas, and Houston experienced year-over-year home price declines, reflecting shifting affordability and inventory dynamics across local markets.

- With the national housing market cooling and certain major metros seeing price declines, we’ll explore what this means for First American Financial’s long-term outlook and investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

First American Financial Investment Narrative Recap

To be a shareholder in First American Financial, you need to believe that the long-term rebound in home purchase volumes and continued investment in technology will offset shorter-term volatility tied to real estate cycles. The latest Home Price Index report, showing ten straight months of slowing home price appreciation and regional declines, reinforces a key risk, persistent affordability challenges, which could limit near-term transaction volumes. This news does not materially change the company’s most important catalyst or risk at this stage.

Of the company’s recent updates, the upcoming third quarter earnings release, following the October 23 conference call, is the most relevant in context with today’s market news. Quarterly performance is likely to reflect ongoing softness in residential revenues due to affordability pressures, making near-term results an important gauge for investors watching both short-term catalysts and risk factors.

Yet, even as commercial volumes offer a buffer, investors should remain attentive to emerging regulatory shifts that could ...

Read the full narrative on First American Financial (it's free!)

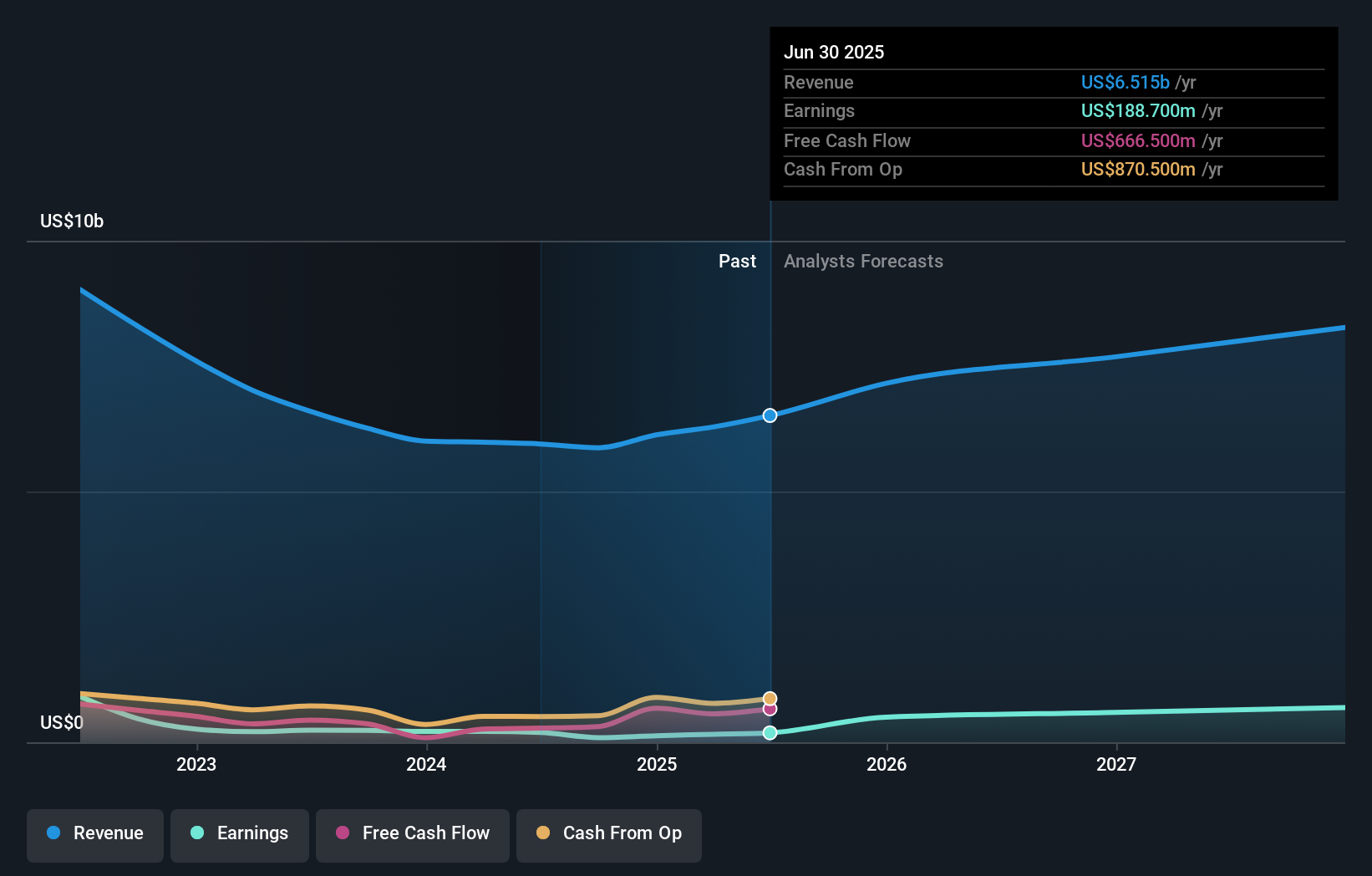

First American Financial is projected to reach $8.7 billion in revenue and $888.8 million in earnings by 2028. Achieving this requires 10.2% annual revenue growth and an earnings increase of $700.1 million from the current $188.7 million.

Uncover how First American Financial's forecasts yield a $77.00 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for First American Financial range from as low as US$16.26 to as high as US$77 per share. With transaction volumes facing pressure from affordability constraints, you can see how differently market participants assess the outlook and are encouraged to weigh several perspectives.

Explore 3 other fair value estimates on First American Financial - why the stock might be worth as much as 30% more than the current price!

Build Your Own First American Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First American Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free First American Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First American Financial's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FAF

First American Financial

Through its subsidiaries, provides financial services.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives