- United States

- /

- Insurance

- /

- NYSE:FAF

A Look at First American Financial’s Valuation After Strong Q3 Earnings Beat and Turnaround

Reviewed by Simply Wall St

First American Financial (NYSE:FAF) delivered an impressive third-quarter earnings report, with both revenue and profit coming in well above expectations. The company’s results reversed last year’s losses and signaled renewed business momentum.

See our latest analysis for First American Financial.

Following the surprise third-quarter earnings beat, First American Financial’s momentum has shifted after a challenging year. The latest results helped drive a swift post-earnings bump in its share price, but the past 12 months tell a story of volatility, with a 1-year total shareholder return of -0.4%. Notably, long-term holders have still seen their investment grow, with a 47% total shareholder return over three years and nearly 60% over five years. This suggests that, while sentiment recently wavered, confidence in the company’s turnaround is growing.

If you’re exploring other opportunities beyond this rebound, it’s a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares bouncing after the latest earnings beat and analyst targets suggesting further upside, investors are left to wonder if First American Financial is still undervalued or if the market is already factoring in future growth. Is now the moment to buy, or has optimism been fully priced in?

Most Popular Narrative: 20.3% Undervalued

According to the most widely followed narrative, First American Financial's fair value estimate is $77, which stands well above its latest closing price of $61.40. This suggests meaningful upside potential and prompts investors to consider what may be fueling such optimism behind the consensus.

"Accelerating adoption and rollout of proprietary technology platforms such as Endpoint and Sequoia, aimed at automation of title and refinance transactions, are expected to unlock operational efficiencies and reduce processing costs, supporting higher net margins over the next 2-3 years."

What makes this valuation so punchy? The full narrative reveals a bold road map built on future efficiency gains and margin expansion, powered by technology and scale, with key earnings targets that could surprise even the most seasoned bulls. Curious what else is baked into these projections? Dive in for the specifics that justify this price.

Result: Fair Value of $77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain. Persistent home affordability issues and elevated mortgage rates pose risks that could pressure First American Financial's long-term growth narrative.

Find out about the key risks to this First American Financial narrative.

Another View: What Do The Multiples Say?

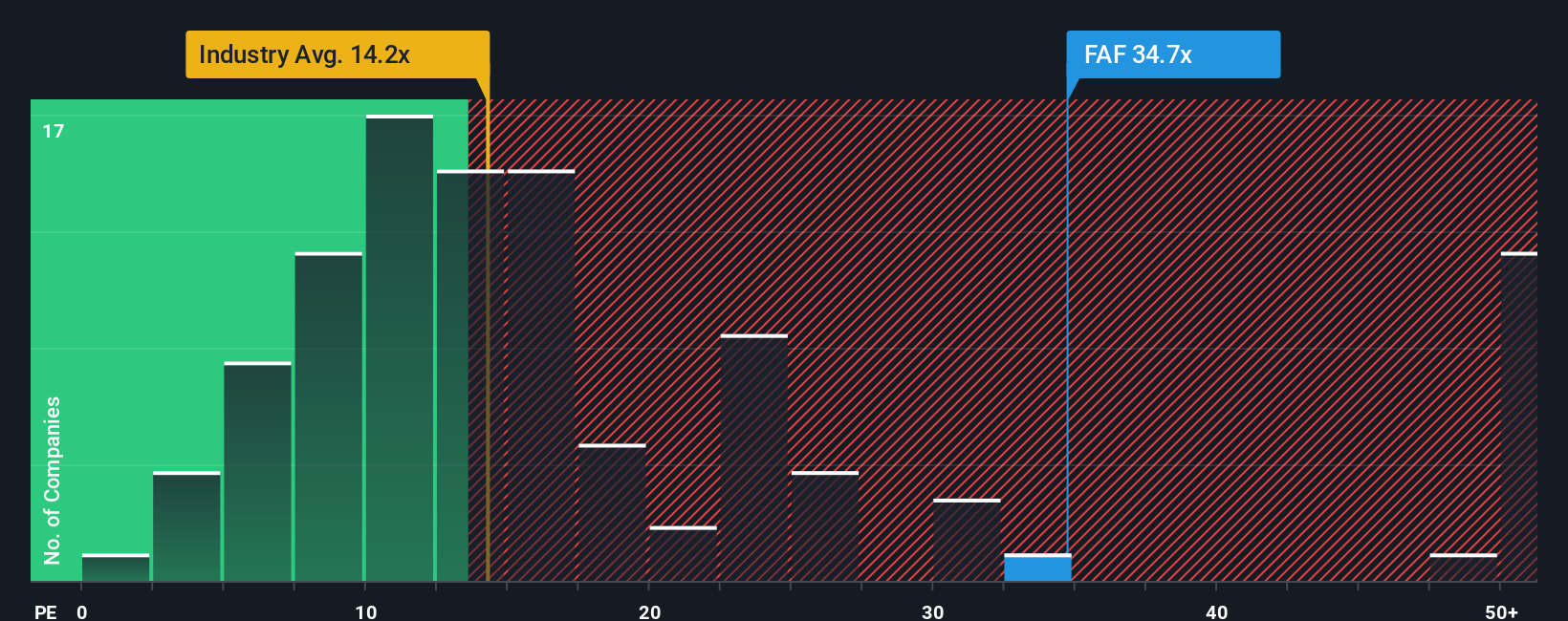

Looking at First American Financial through the lens of its price-to-earnings ratio, the picture is less optimistic. At 33.1x, the company is trading notably higher than both its industry peers (11.8x) and the broader U.S. Insurance sector average (14x). Even when compared to its fair ratio of 27.5x, it appears somewhat expensive, suggesting investors are paying a premium for expected growth. This may imply valuation risk if future results disappoint, or there may be room for expectations to catch up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First American Financial Narrative

If you see things differently, or simply want to dive in and build your own view from the ground up, you can create a personalized narrative in just minutes. Do it your way

A great starting point for your First American Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to a single stock when so many compelling opportunities are waiting. With the right insights, you can stay ahead and position yourself for breakthroughs others might miss.

- Tap into long-term income potential with these 17 dividend stocks with yields > 3% and see which companies stand out for strong, consistent yields over 3%.

- Catch the next wave of innovation with these 26 AI penny stocks and position yourself in businesses that are transforming industries through artificial intelligence leadership.

- Jump on value plays before the crowd by targeting these 878 undervalued stocks based on cash flows to find options based on strong cash flows and market mispricings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FAF

First American Financial

Through its subsidiaries, provides financial services.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives