- United States

- /

- Insurance

- /

- NYSE:FAF

A Fresh Look at First American Financial’s (FAF) Valuation as Market Sentiment Shifts

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 15.1% Undervalued

According to the most widely followed narrative, First American Financial is currently undervalued by around 15%. This perspective is built around a detailed projection of future growth and profitability.

"The anticipated normalization and eventual rebound in U.S. home purchase volumes, driven by demographic tailwinds as Millennials and Gen Z enter prime homebuying years, positions First American to benefit from increased transaction activity. This underpins future revenue growth and operating leverage."

What is fueling this valuation? There is a bold prediction of a major transformation ahead, shaped by shifting demand and operational breakthroughs. Want to discover what aggressive growth assumptions and profit turnaround are hiding underneath the surface of this analysis? Find out what numbers could transform the investment case and see if the future stacks up to the narrative.

Result: Fair Value of $77.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent home affordability challenges or a sudden reversal in commercial strength could disrupt the optimistic outlook for First American Financial's future growth.

Find out about the key risks to this First American Financial narrative.Another View: Market-Based Valuation Sends a Different Signal

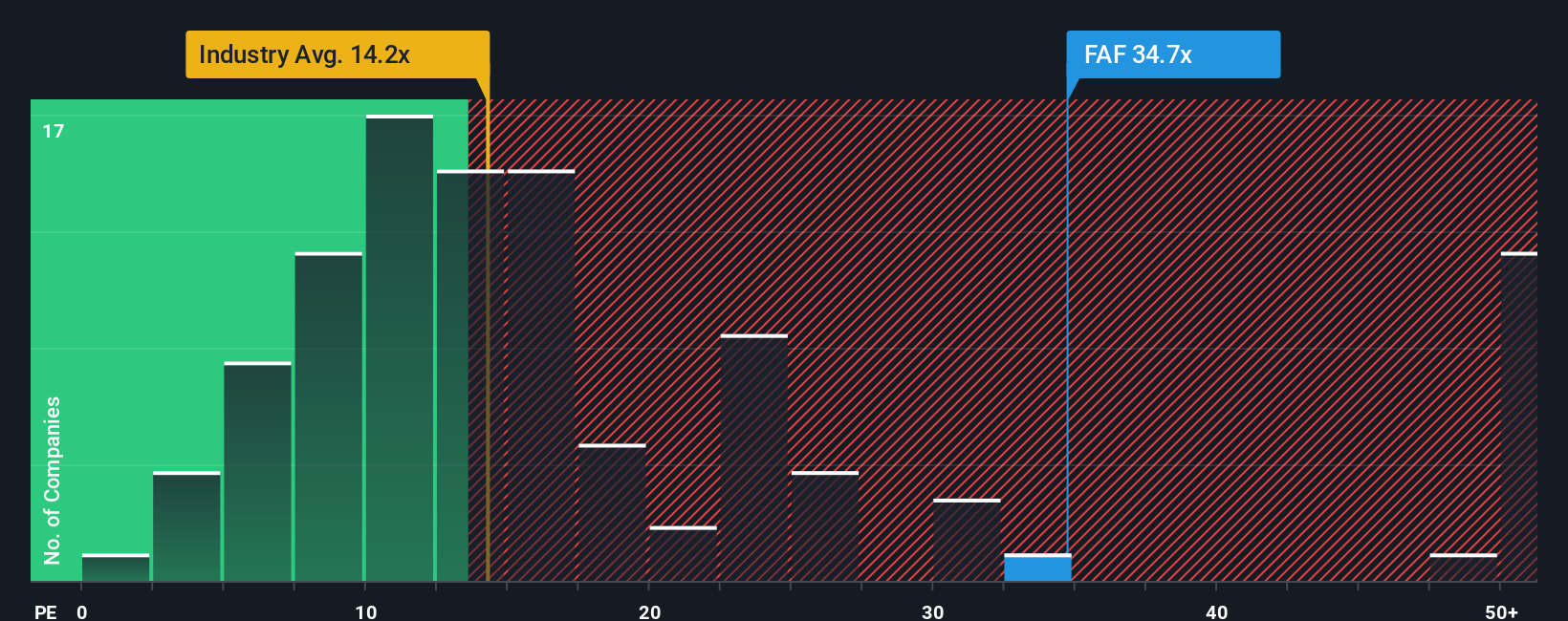

While analyst price targets suggest upside, a look at how shares are priced compared to industry norms paints a more expensive picture. This approach flags First American Financial as overvalued by typical measures. Which story matches reality?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding First American Financial to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own First American Financial Narrative

If you believe there is more to the story or prefer to uncover your own insights, you can build a narrative from scratch in just a few minutes. Do it your way

A great starting point for your First American Financial research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Turn your curiosity into action by searching for investments that align with tomorrow’s hottest themes. Don’t let opportunities pass you by while others get ahead.

- Unlock new potential for your portfolio by tracking companies setting the pace in cutting-edge artificial intelligence with AI penny stocks.

- Boost your income strategy by targeting shares with reliable yields using dividend stocks with yields > 3%.

- Find overlooked value by uncovering businesses trading below their intrinsic worth with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FAF

First American Financial

Through its subsidiaries, provides financial services.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives