- United States

- /

- Insurance

- /

- NYSE:CNO

CNO Financial Group Insiders Sold US$2.6m Of Shares Suggesting Hesitancy

The fact that multiple CNO Financial Group, Inc. (NYSE:CNO) insiders offloaded a considerable amount of shares over the past year could have raised some eyebrows amongst investors. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying versus knowing if they are selling, as the latter sends an ambiguous message. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

CNO Financial Group Insider Transactions Over The Last Year

Notably, that recent sale by Gary Bhojwani is the biggest insider sale of CNO Financial Group shares that we've seen in the last year. So it's clear an insider wanted to take some cash off the table, even slightly below the current price of US$41.22. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 5.6% of Gary Bhojwani's stake.

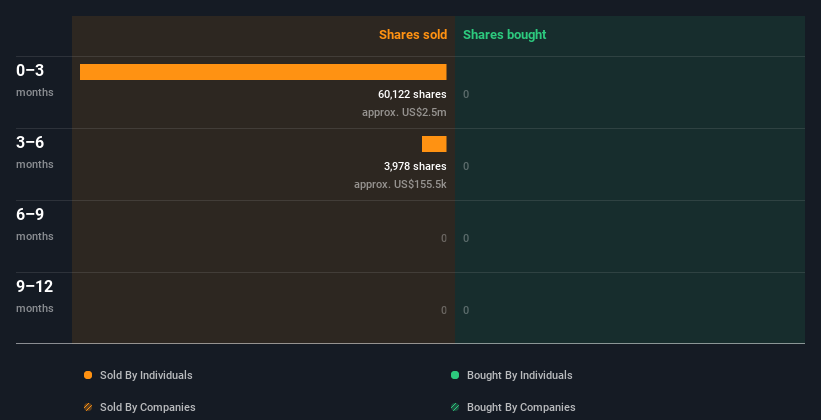

CNO Financial Group insiders didn't buy any shares over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Check out our latest analysis for CNO Financial Group

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Insiders At CNO Financial Group Have Sold Stock Recently

The last three months saw significant insider selling at CNO Financial Group. Specifically, CEO & Director Gary Bhojwani ditched US$2.5m worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the insiders think that the shares are a bargain.

Does CNO Financial Group Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. CNO Financial Group insiders own 2.7% of the company, currently worth about US$111m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

What Might The Insider Transactions At CNO Financial Group Tell Us?

An insider sold CNO Financial Group shares recently, but they didn't buy any. And there weren't any purchases to give us comfort, over the last year. But since CNO Financial Group is profitable and growing, we're not too worried by this. It is good to see high insider ownership, but the insider selling leaves us cautious. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing CNO Financial Group. When we did our research, we found 2 warning signs for CNO Financial Group (1 is significant!) that we believe deserve your full attention.

But note: CNO Financial Group may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CNO

CNO Financial Group

Through its subsidiaries, develops, markets, and administers health insurance, annuity, individual life insurance, insurance products, and financial services for middle-income pre-retiree and retired Americans in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives