- United States

- /

- Insurance

- /

- NYSE:CB

Chubb (CB) Reports Strong Quarterly Earnings and Completes US$4 Billion Buyback

Reviewed by Simply Wall St

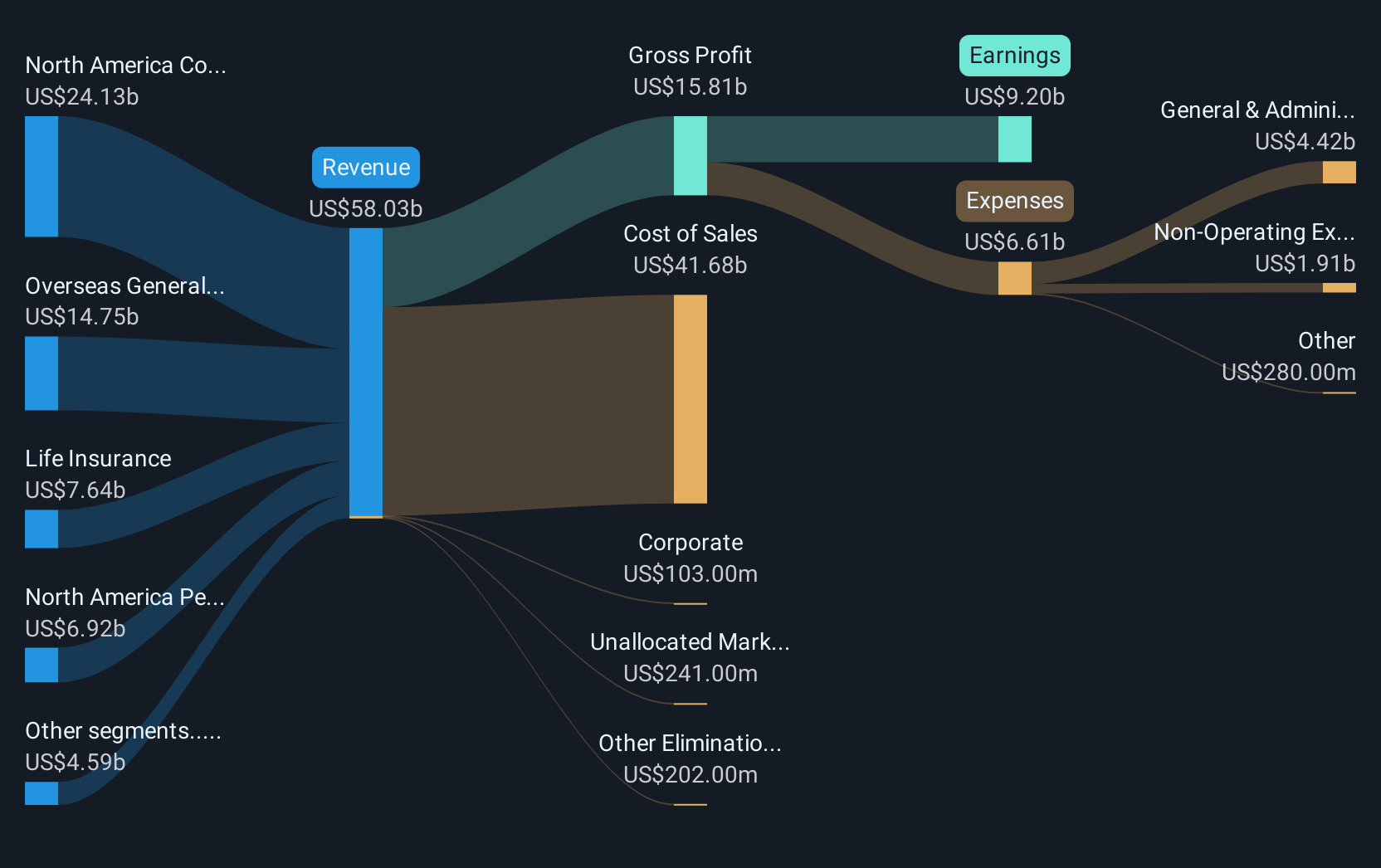

Chubb (CB) recently reported a strong increase in second-quarter net income, rising to USD 2,968 million from USD 2,230 million the previous year, alongside significant share repurchases as part of its ongoing buyback program. These moves highlight the company's commitment to shareholder value. Over the past week, Chubb's price increased by 1%, a performance slightly below the S&P 500's recent climb amid overall market optimism driven by positive trade deal news and robust technology sector earnings. While Chubb's developments may not have diverged significantly from the broader market trends, they certainly added supportive weight to its performance.

We've identified 1 warning sign for Chubb that you should be aware of.

The recent news surrounding Chubb's increased net income and ongoing share buybacks underscores its focus on enhancing shareholder value. These developments, coupled with the share price movement, suggest a positive trajectory, although the short-term gain of 1% lags slightly behind the S&P 500's rise. Looking back, Chubb's total shareholder return over the past five years is 129.34%, illustrating substantial growth and reaffirming investor confidence despite its 1-year underperformance compared to the US Insurance industry and market.

Chubb's acquisition efforts in Thailand and Vietnam, aimed at boosting revenue and global diversification, align well with its focus on disciplined pricing and operational efficiency. Despite a 3.3% expected annual revenue decline over the next three years, technological investments and an anticipated increase in profit margins to 21.8% could drive future earnings growth to US$10.6 billion by May 2028. The recent share price of US$278.73 remains below the analyst consensus price target of US$302.26, suggesting potential for upward movement as these strategic initiatives unfold. Relative performance and growth expectations will guide investors' perspectives on Chubb's valuation and future prospects.

Review our growth performance report to gain insights into Chubb's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CB

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives