- United States

- /

- Insurance

- /

- NYSE:AXS

AXIS Capital Holdings Limited (NYSE:AXS) Screens Well But There Might Be A Catch

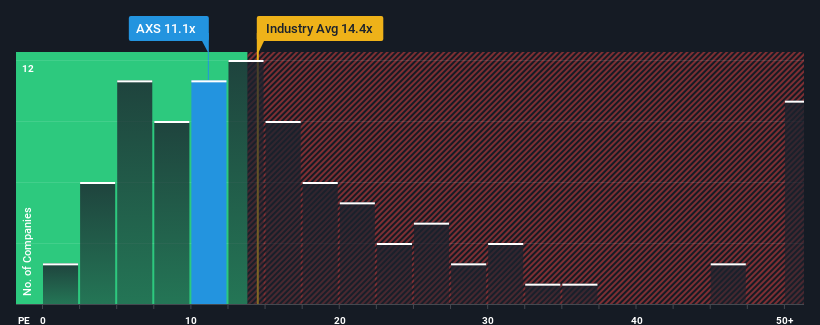

With a price-to-earnings (or "P/E") ratio of 11.1x AXIS Capital Holdings Limited (NYSE:AXS) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 34x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, AXIS Capital Holdings has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for AXIS Capital Holdings

Is There Any Growth For AXIS Capital Holdings?

There's an inherent assumption that a company should underperform the market for P/E ratios like AXIS Capital Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 83% gain to the company's bottom line. Pleasingly, EPS has also lifted 135% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 19% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially higher than the 10% per year growth forecast for the broader market.

With this information, we find it odd that AXIS Capital Holdings is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From AXIS Capital Holdings' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of AXIS Capital Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for AXIS Capital Holdings with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AXS

AXIS Capital Holdings

Through its subsidiaries, provides various specialty insurance and reinsurance products in Bermuda, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.