- United States

- /

- Insurance

- /

- NYSE:AON

Aon (NYSE:AON) Strengthens North American Leadership With Key Appointments

Reviewed by Simply Wall St

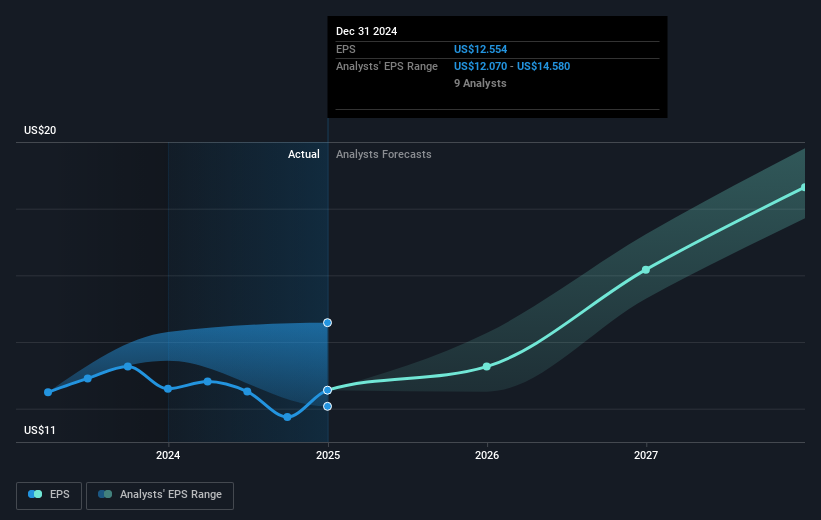

Aon (NYSE:AON) recently announced the appointment of new leaders, positioning Rob McDonough as CEO of Construction, Infrastructure, and Surety, North America, and Brian Hodges as Head of Surety, amidst a challenging market landscape. Over the last quarter, Aon's share price appreciated by 10%, a notable achievement amid broader market volatility and a 5% decline in major indexes due to heightened tariff concerns. The appointment of experienced leaders, alongside robust Q4 financial results showing increased sales and net income, bolstered investor confidence. The company's strategic focus on leadership enhancement, especially in North America, paired with confirmed earnings guidance for 2025, likely contributed to investor optimism. Moreover, Aon's aggressive share repurchase program and consistent dividend payouts may have further driven shareholder returns despite the turbulent economic backdrop characterized by tariff hikes and general market uncertainty.

Click here to discover the nuances of Aon with our detailed analytical report.

Aon's substantial five-year total return of 143.59% is a testament to its effective capital and operational strategies. During this period, the company reported a consistent annual earnings growth rate of 11.9%, reflecting its robust business model and strategic execution. Key contributors to this performance included seasoned leadership appointments and strategic acquisitions, such as the US$455 million purchase of Griffiths & Armour Ltd. Furthermore, Aon's focus on enhancing client solutions, including the launch of the Cyber Risk Analyzer, has bolstered its market reputation and operational capabilities.

In the last year alone, Aon's total shareholder return surpassed both the US market's 12.1% and the insurance industry's 19.4%, underlining its strong market positioning. Aon's commitment to shareholder returns was further exemplified by its aggressive repurchase of 533,235 shares valued at US$196.41 million during Q4 2024, alongside consistent dividend payments. These initiatives have played a significant role in sustaining investor interest and confidence over time.

- Get the full picture of Aon's valuation metrics and investment prospects—click to explore.

- Analyze the downside risks for Aon and understand their potential impact—click to learn more.

- Is Aon part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives