- United States

- /

- Insurance

- /

- NYSE:AON

Aon (AON): Net Margin Drops to 15.5%, Challenging Profitability Narrative

Reviewed by Simply Wall St

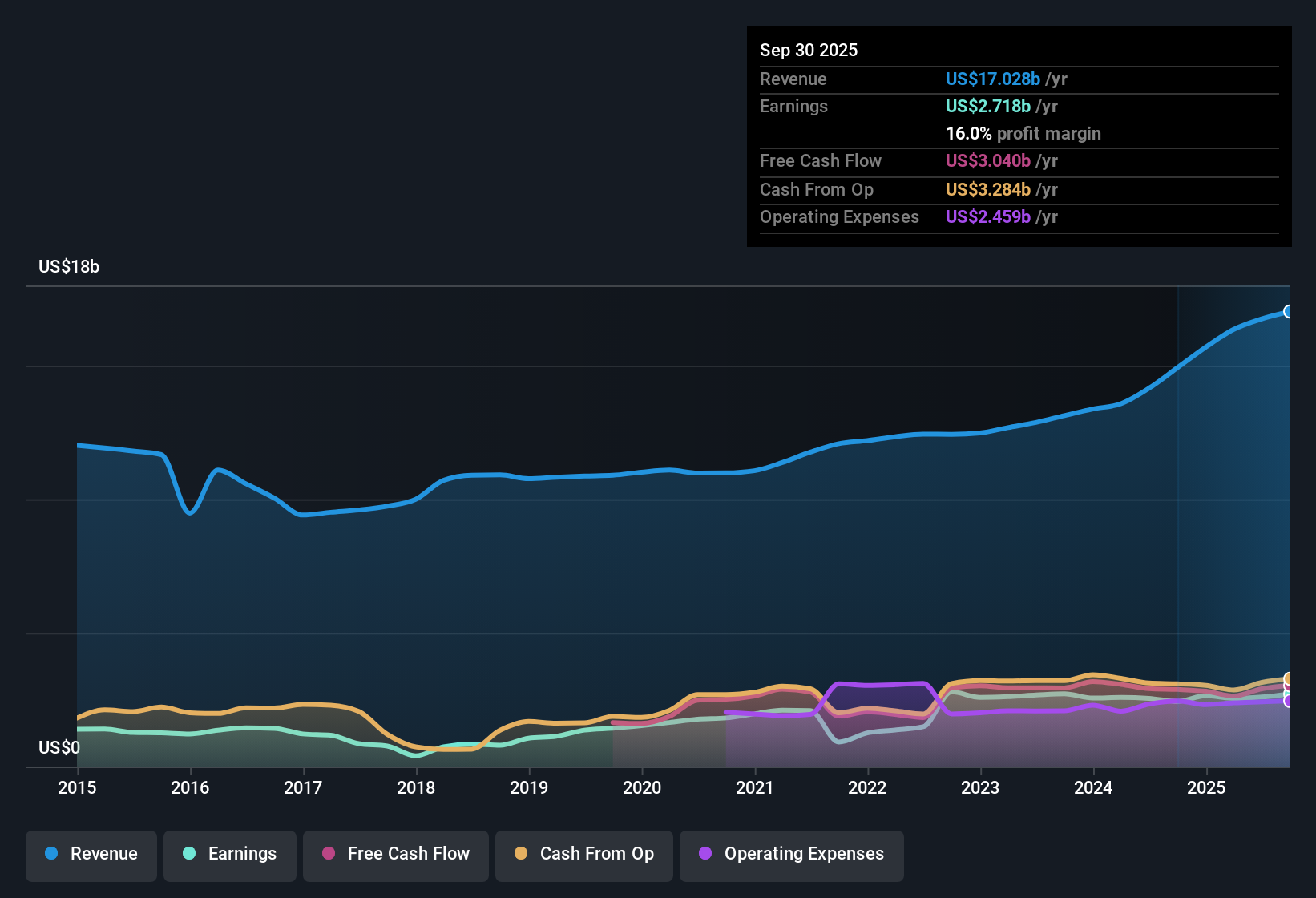

Aon (AON) continued its run of profit growth, reporting that earnings have climbed by 11.1% per year over the past five years. Looking ahead, the company expects earnings to rise at a slower pace of 10.7% annually, which trails both its own historical average and broader US market forecasts. Although revenue is projected to grow at 5% per year, this too lags behind the US market, and a dip in net profit margin to 15.5% from last year’s 18% highlights some pressure on profitability.

See our full analysis for Aon.Next up, we’ll see how these results measure up against the most widely followed narratives around Aon. Some themes could be reinforced, while others may be up for debate.

See what the community is saying about Aon

Profit Margin Targets Signal Recovery Ahead

- Analysts are projecting profit margins to rise from 15.5% today to 19.5% within three years, a gain that would bring Aon back toward its historical highs.

- According to the analysts' consensus view, Aon's operational improvements, including investments in Aon Business Services, the 3x3 Plan, and priority hiring, are expected to drive this margin rebound and support the sustainability of future earnings and free cash flow.

- The acquisition of NFP is cited as bringing in high-quality middle-market EBITDA, which should begin making a bigger impact as the year unfolds.

- The focus on new business and higher client retention is seen as a foundation for margin expansion, even as broader market conditions soften.

- Expect margin growth to remain a hot topic amid analyst optimism. See where the forecasts and reality converge in Aon's latest Consensus Narrative. 📊 Read the full Aon Consensus Narrative.

Leverage Rises as Debt Load Grows

- Aon's recent acquisition of NFP has contributed to a higher debt burden and increased interest costs, raising questions about the company's balance sheet flexibility.

- Analysts' consensus view calls out potential risks, noting that higher debt could pressure net margins and earnings growth if improved cash flows from acquisitions do not materialize as projected.

- Softer market conditions, such as property rates in the U.S. and Japan declining 5% to 20%, could compound the challenge by limiting revenue growth against higher interest obligations.

- Ongoing currency headwinds, with a stronger dollar impacting Q1 margins, add another layer of risk for Aon's bottom line.

Trading at a Discount to Analyst Targets

- With a current share price of $340.68, Aon is valued 18% below the analyst consensus price target of $416.44, despite boasting a high-quality earnings reputation.

- Analysts' consensus view emphasizes this discount, highlighting that Aon trades on a price-to-earnings ratio of 28.2x, more attractive than the peer average of 41.5x, though still above the wider US insurance industry’s 13.2x.

- This valuation gap suggests investors are factoring in both moderating growth expectations and Aon's track record of exceeding profitability goals.

- The forecast for shares outstanding to decline 0.3% per year could further bolster per-share earnings, supporting the case for a higher valuation if projections are achieved.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Aon on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these figures? Share your perspective and build your narrative in just a few minutes. Do it your way

A great starting point for your Aon research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Aon's profit margin recovery is expected, rising debt from recent acquisitions and higher interest expenses are adding pressure to its financial flexibility.

If you’d prefer businesses with lower leverage and robust financial foundations, use our solid balance sheet and fundamentals stocks screener (1984 results) to highlight companies built for resilience and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)