- United States

- /

- Insurance

- /

- NYSE:AON

Aon (AON): Assessing Valuation After New AI Efficiency Push and Workforce Shift to Lower-Cost Regions

Reviewed by Simply Wall St

Aon (AON) is back in focus after fresh commentary around its AI initiatives and workforce shift to lower cost regions, moves that could quietly reshape margins and long term earnings power.

See our latest analysis for Aon.

Despite the buzz around AI and leadership changes, Aon’s 1 year total shareholder return is down, and the 90 day share price return of negative 6.71 percent suggests momentum has softened, even as its 3 year total shareholder return of 15.68 percent and 5 year total shareholder return of 75.94 percent still point to a resilient long term compounding story.

If Aon’s efficiency push has you rethinking where durable growth could come from next, it might be worth exploring Is Aon financially strong enough to weather the next crisis? as well as fast growing stocks with high insider ownership for fresh ideas.

With Aon’s shares lagging over the past year despite solid earnings growth, AI driven margin ambitions, and a double digit discount to analyst targets, investors may be wondering whether this weakness represents a buying opportunity or whether the market is already pricing in future upside.

Most Popular Narrative: 13.8% Undervalued

With Aon last closing at $345.20 against a most popular fair value view of roughly $400.50, the narrative is leaning toward meaningful upside if its long term plan delivers.

Aon's 3x3 Plan and the deployment of Risk Analyzers have increased new business and improved client retention, strengthening the foundation for ongoing revenue growth and margin expansion.

Want to see what powers that confidence? The narrative leans on steadily rising revenues, fatter margins, and a punchy earnings multiple that rivals high conviction compounders. Curious which forecasts really move the needle on that fair value calculation? Read on to unpack the full story behind the numbers.

Result: Fair Value of $400.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained macro volatility and a softer commercial risk pricing cycle could easily cap revenue growth and challenge the premium multiple that this narrative assumes.

Find out about the key risks to this Aon narrative.

Another Way to Look at Value

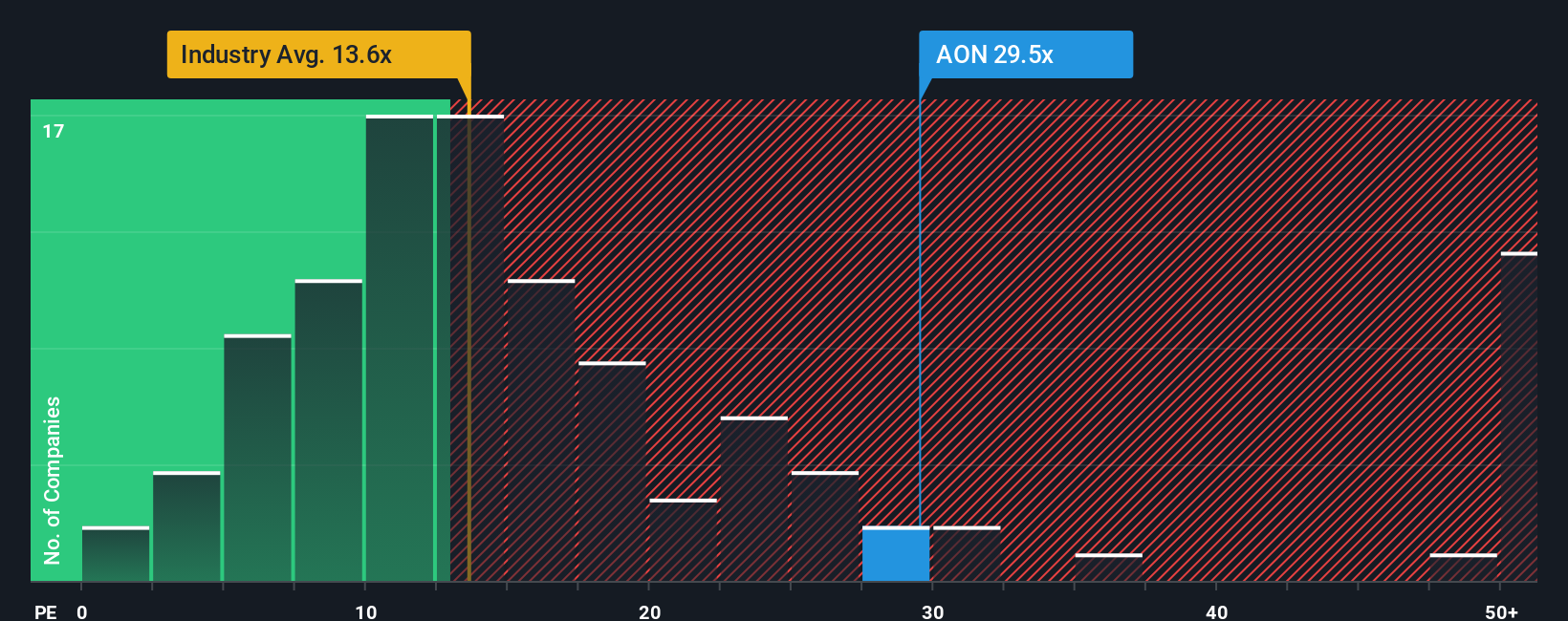

On earnings, the picture looks very different. Aon trades on about 27.3 times earnings, more than double the US Insurance industry at 12.8 times, peers at 25.4 times, and well above a fair ratio of 15.7 times. This points to meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aon Narrative

If you see the story differently, or want to test the assumptions with your own analysis, you can build a custom view in minutes: Do it your way.

A great starting point for your Aon research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Once you have a view on Aon, do not stop there. Use the Simply Wall Street Screener to uncover your next smart, long term opportunity today.

- Capture potential mispricings early by reviewing these 908 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Position yourself for structural growth trends by assessing these 30 healthcare AI stocks transforming diagnostics, treatment pathways, and operational efficiency.

- Tap into frontier innovation and volatility potential by examining these 81 cryptocurrency and blockchain stocks shaping the future of digital finance and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)