- United States

- /

- Insurance

- /

- NYSE:AJG

Arthur J. Gallagher (AJG): Revisiting Valuation After Mixed Momentum and Muted Short-Term Gains

Reviewed by Simply Wall St

Most Popular Narrative: 11.2% Undervalued

According to the most widely followed narrative, Arthur J. Gallagher is considered undervalued by 11.2%. The valuation is anchored on expectations of robust future earnings growth, rising margins, and the impact of ongoing expansion strategies.

"Broader adoption of digital tools, enhanced data analytics, and early-stage AI projects within the company's operations are producing measurable efficiency improvements and margin expansion. This is positioning net margins and overall profitability for continued long-term growth."

Want to know what’s fueling this bullish outlook? Underneath the surface are aggressive revenue projections, margin upgrades, and bold forecasts for future earnings, which go far beyond what industry averages suggest. Discover which specific numbers, assumptions, and financial hurdles are pushing the fair value higher in this narrative.

Result: Fair Value of $337.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, overreliance on acquisitions and sudden declines in property insurance rates could disrupt growth and challenge the optimism behind current analyst forecasts.

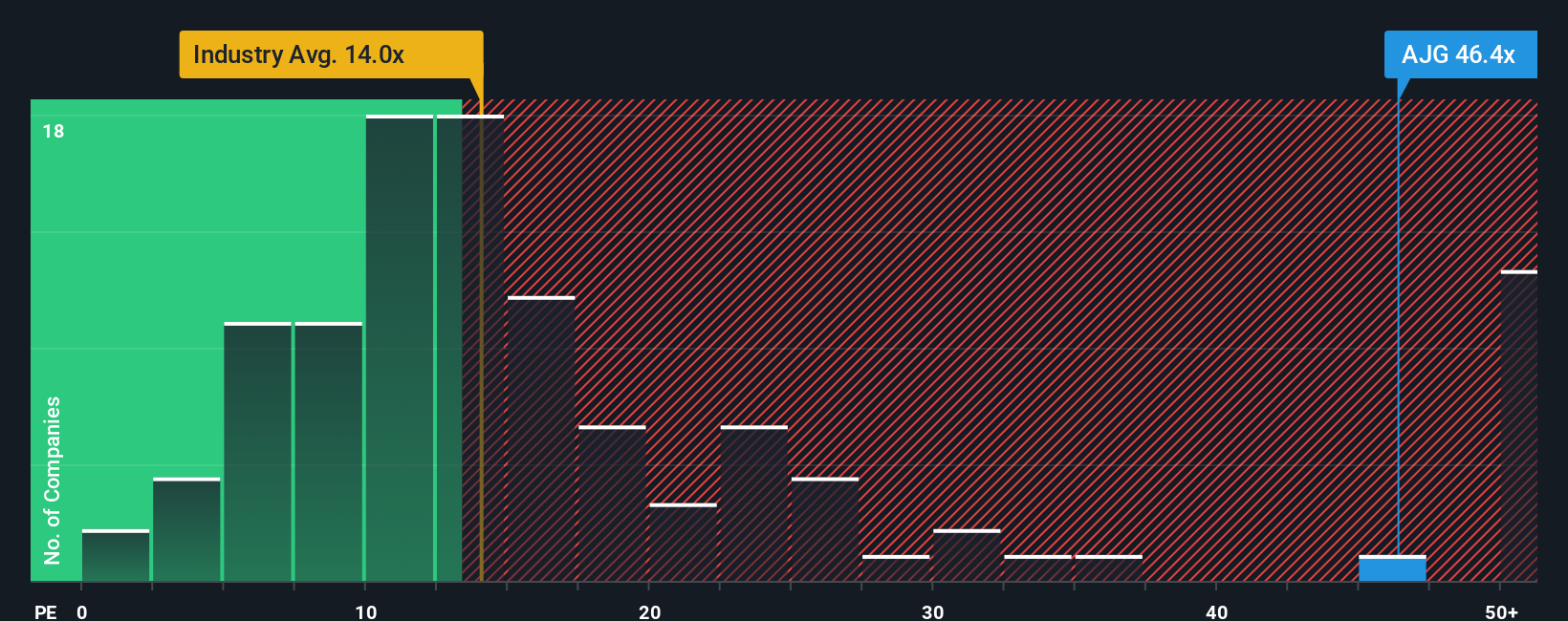

Find out about the key risks to this Arthur J. Gallagher narrative.Another View: Testing the Valuation with Earnings Multiples

While the previous analysis points to an undervalued scenario, looking at the company through the lens of its earnings multiple compared to the broader industry offers a different perspective. Some believe this method signals caution and challenges the optimistic assumptions. Which approach gives the truest sense of value?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Arthur J. Gallagher to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Arthur J. Gallagher Narrative

If the prevailing viewpoints do not quite match your investment style, consider diving into the data yourself. You can develop your own perspective in just a few minutes. Do it your way

A great starting point for your Arthur J. Gallagher research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock the full potential of your investment strategy by targeting companies and trends you might be missing. Take a closer look at these hand-picked opportunities designed to help you stay a step ahead.

- Supercharge your portfolio with companies leading the AI revolution by checking out AI penny stocks, making waves in intelligent automation and next-generation software.

- Secure steady income and long-term growth by searching for dividend stocks with yields > 3%, which consistently deliver reliable yields above 3% and reward investors year after year.

- Tap into value opportunities by browsing undervalued stocks based on cash flows, hidden gems that trade below their intrinsic worth and could offer strong upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)